Martin Zweig Stock Screener: growth at reasonable price (GARP)

By Aldwin Keppens - reviewed by Kristoff De Turck

Last update: Jul 22, 2024

In the book Winning on Wall Street, Martin Zweig, an American investor, described the rules of his investment strategy, which we will discuss in detail in this article.

The investment strategy of Zweig uses both fundamental analysis and technical analysis. The goal is finding growth stocks while not ignoring the valuation of the stock. Fundamental criteria are used to determine which stocks meet the requirements, technical criteria combined with general market direction analysis determine when the stock should be bought.

The strategy is a position trading system, which means positions are typically held for several months to years, but one of the author's rules is to let profits run and take losses quickly.

Growth stocks, market direction, technical analysis and exit rules are things we also see in the CANSLIM methodology. However, taking into account the valuation of the stock is a key differentiator from other growth systems. Looking for growth stocks while taking into account valuation is also known as a Growth at Reasonable Price (GARP) strategy.

We also would like to recognize this article on the Zweig Strategy, which gives some additional background, but also lays out the rules for the screener very cleanly. We used these rules for our implementation and will discuss them below.

Market Timing

Using a market timing model as part of the rules is quite typical if not inherent for any position trading or growth stock system. When the system is not buy and hold but involves cutting losses and trailing stop losses to protect profits, it is quite evident that the system will work better when the market is in an uptrend.

In bear markets it is just better to stay in cash and wait for things to improve before you start taking new positions (even if there are stocks available which meet your criteria).

Market timing models come in many forms and can become complex quickly, but a simple one may do as well: if you inspect the ChartMill Trend Indicator on the weekly charts of SPY,QQQ and IWM you may get an overal idea on the current market situation.

Be sure to regularly check our market monitor page where we monitor both the major US index ETFs and the various sectors, along with multiple breadth indicators.

Martin Zweig Stock Screener Criteria

You can find our Martin Zweig: Growth at Reasonable Price screen implementation in our screen library. Below we will discuss the rules one by one as well as propose alternatives you could try.

Established and stable earnings and sales growth.

Zweig wanted to see consistent and established profit and revenue growth, meaning a proven track-record for at least the past five years. The following filters ensure this:

- 5 Year EPS growth CAGR > 15%: On average, during the last 5 years the EPS has grown with at least 15%.

- 5 Year Revenue growth CAGR > 0.5 * EPS CAGR: With this rule, Zweig makes sure that we are not just seeing an increasing EPS by for instance cost cutting measures. In the end it will always be sales increases which will drive long term earnings growth.

- EPS growth last year (TTM) > 0: Zweig requires at least 4 of the last 5 years to have shown positive growth. The main reason for this is to validate that the minimum of 15% yearly average is achieved by nice and stable growth. The screener does not allow to validate this at this point in time, so we are checking the last Y2Y growth to be positive. The growth for the other years should be checked manually in the financials of the stock.

Earnings and Sales growth momentum

The rules below ensure positive momentum in the established earnings and sales growth by requiring the most recent report (Q2Q growth) to top the historical averages:

- Q2Q revenue growth >= 5 Year Revenue growth CAGR: The last quarter's Q2Q revenue growth should be above the 5 year growth rate

- Q2Q revenue growth >= Revenue growth last year (TTM): The last quarter's Q2Q revenue growth should be above the revenue growth over the last 12 months

- Q2Q EPS growth >= 5 Year EPS growth CAGR: The last quarter's Q2Q EPS growth should be above the 5 year growth rate

- Q2Q EPS growth >= EPS growth last year (TTM): The last quarter's Q2Q EPS growth should be above the EPS growth over the last 12 months

- EPS growth last year (TTM)>=0%:The EPS growth over the last 12 months should be positive

- Revenue growth last year (TTM) >= 0%:The revenue growth over the last 12 months should be positive

Additional tip: "The ChartMill High Growth Momentum Rating Score"

At Reasonable Price

The author does not wants to avoid stocks at unreasonable Price/Earnings multiples.

- P/E ratio between 5 and 48: Zweig wants to avoid companies with a P/E ratio below 5 as this usually indicates something is wrong. On the high side he never wanted to pay more than twice the market average. The market average fluctuates, but it is not available as a property in the screener. For this reason we picked 48 as a maximum, but you can easily adjust this to the double of the current market average.

Healthy debt situation

Zweig uses the Debt-Equity ratio to ensure no excessive debt was used to finance the growth. We used the filter:

- Debt/Equity Industry Rank Above 50: this ensures the company has a better debt/equity ratio than at least 50% of the industry peers.

Price momentum

Zweig also requires price momentum. This is measured by filtering for those stocks which perform better than the index in the most recent 6 and 12 month periods. As these are dynamic numbers and are not available in the screener to filter against, we included the rule:

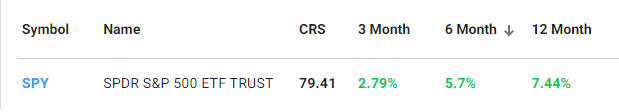

- ChartMill Relative Strength > 70: Using Relative Strength we ensure the stocks in the list outperform 70% of the universe of stocks. We note here that the S&P index itself has a relative strength of around 70 (at the time of writing).

But, you can very easily look up the exact 6 and 12 month performance of the SPY ETF and add filters on minimum 6 and 12 month performance to the screen, while removing the relative strength filter:

Insider Transactions

Martin Zweig also appreciated a positive amount of insider buying. We did not include this filter by default as insider transactions are only available for US stocks. If you are only looking for US stocks, you can easily add the filter on the 'other' tab -> Owner (insiders) change% > 0

Additional tip: Quickly check out the latest insider transactions via this link.

Summary

The Martin Zweig Screen selects growth investments at reasonable price by using the filters above. To match the exact rules, you need to look up the average P/E in the S&P500, as well as the 6 and 12 month performance of the same index and fine tune some of the rules in the example screen. It should also be noted that the author advises to only buy when the overall market is behaving in a positive manner and losses should be taken when the position turns against you.