Updates, ideas, insights and tips from the ChartMill Team

Breadth Cools Further as Indexes Stall at Resistance

Tuesday’s session kept the headline indexes relatively contained, but internal participation continued to soften. The S&P 500 and Nasdaq remain in short-term pullback mode below their fast moving averages, while small caps are busy retesting a key breakout zone. Longer-term trends are still constructive, yet the breadth “engine” is clearly running less efficiently than it did earlier in December.

Jobs Data Trips the Dow While AI Legislation Keeps Nasdaq Awake

A messy, shutdown-delayed jobs print pushed unemployment to a four-year high, oil slid to fresh multi-year lows, and energy stocks took the punch. Meanwhile, an AI-infrastructure permitting push in the House helped keep the Nasdaq afloat, though the market’s tolerance for debt-funded AI buildouts is clearly thinning.

Indexes Hold Near Highs, But Breadth Keeps Slipping

Major ETFs are still holding key support on the weekly timeframe, but participation under the surface continues to fade. Monday’s session showed a still-negative advance/decline split and a noticeable rise in “hard down” movers (>4%), while fewer stocks remain above short-term moving averages. The tape is not breaking yet, but it’s getting thinner.

Oracle’s AI Spending Hangover Meets a Cathie Wood Turbo-Boost

Monday’s tape felt like markets were pacing in the hallway before a doctor’s appointment: slightly red, slightly tense, and absolutely obsessed with the next data print. Oracle kept sliding on “more AI capex” anxiety, while Tesla ripped higher on Cathie Wood’s megaphone? plus a handful of single-stock soap operas stole the show.

Breadth Stumbles on Heavy Distribution, But the Foundation Holds

Friday delivered a clear “risk-off” breadth reset: decliners overwhelmed advancers and downside volatility picked up, on heavier-than-average volume. Yet beneath the one-day damage, participation across key moving-average measures and longer timeframes remains broadly constructive, suggesting more of a cooling phase than a trend break.

AI Hangover Hits the Tape: Broadcom’s Face-Plant Spooks the Whole Complex

A late-week mood swing around AI spending slammed tech and dragged the major indexes off record highs. Broadcom’s guidance nuance got punished, Oracle’s OpenAI data-center noise didn’t help, and suddenly “AI” felt less like a love story and more like a capex therapy session.

Small Caps Take the Lead as Breadth Holds Its Ground

Thursday’s session looked more like a controlled handoff than a reversal: IWM broke out convincingly, SPY kept grinding near the highs, and QQQ cooled off under resistance.

Oracle’s AI Reality Check—While the Dow Parties On

Oracle’s earnings miss punched the Nasdaq in the nose, but the broader market basically shrugged and rotated into “normal economy” winners, pushing the Dow and S&P 500 to fresh records. Under the hood, the message felt consistent: investors still love AI… they just want proof it pays.

Small Caps Lead as Breadth Re-Accelerates After Monday’s Shakeout

U.S. equities extended Tuesday’s rebound on Wednesday, with small caps taking the lead and breadth strengthening across most horizons. The damage from Monday’s sell-off is now largely repaired, and medium- to long-term participation remains firmly constructive, although SPY and QQQ still need decisive breakouts from their short-term ranges.

Fed Cut Ignites AI Power Trade While Oracle Trips the After-Hours Party

The Fed delivered a widely expected rate cut to 3.50–3.75%, stocks and Treasuries rallied, and the dollar slipped. AI-linked power play GE Vernova stole the show, while lawsuits hit major chipmakers and Oracle wiped away some of the post-Fed euphoria with a 6.5% after-hours slide.

Why GE Vernova Surged 16% in a Single Session

On Wednesday, shares of GE Vernova (NYSE: GEV) jumped roughly 16% in one trading session. That kind of move in a large, established industrial name doesn’t happen by accident...

Market Breadth Update: Small Caps Break Out as Rally Broadens Again

After Monday’s risk-off session, Tuesday brought a modest rebound with the Russell 2000 pushing into new high territory while SPY and QQQ hover just below resistance. Breadth metrics ticked back toward neutral-to-positive, keeping the medium-term uptrend intact even as rotation and short-term noise continue under the surface.

JPMorgan’s Cost Shock and Silver’s Moonshot: Wall Street Freezes Before the Fed

On the eve of a closely watched Fed rate cut, stocks barely moved, but under the surface, JPMorgan’s cost warning rattled the Dow, silver finally smashed through $60 an ounce, and Exxon doubled down on fossil-fuel cash flows. I walk through what actually mattered yesterday and what I’ll be watching when the Fed steps up to the mic tonight.

Market Breadth Softens Further as Indices Stall at Resistance

After Friday’s first signs of fatigue, Monday’s session brought another day of weak participation while the major U.S. indices hovered near record highs. Short- and medium-term breadth ticked lower again, but the majority of stocks still trade above key moving averages and new lows remain limited. The current breadth trend remains neutral with a slight positive bias, but the cushion is getting thinner.

Streaming Wars Go Hostile Just as Wall Street Braces for the Fed

Stocks slipped from record levels on Monday as investors shifted into “wait-and-see” mode ahead of Wednesday’s Fed decision. At the same time, Hollywood turned into a live-fire M&A battlefield, with Paramount Skydance crashing Netflix’s party for Warner Bros. Discovery and IBM writing a big AI-data check for Confluent.

Rally Pauses at the Highs as Breadth Stays Constructive

U.S. indices finished the week parked right under resistance with only a mild negative breadth day on Friday. Under the surface, participation remains broad and trend metrics are still strong, but the post-selloff rebound is clearly shifting from “surge” to “digestion,” especially in small caps.

Netflix’s $83 Billion Plot Twist Leaves Wall Street Calm but Cautious

Friday’s session ended in the green again, capping a quietly positive week for US equities. But under the surface, the market spent most of the day digesting three things: a cooler-but-not-too-cool inflation print, a small rebound in consumer sentiment, and Netflix’s jumbo bid for Warner Bros. Discovery that could reshape the streaming landscape for years.

Rally Pauses at Resistance as Breadth Stays Constructive

After a powerful breadth surge in the previous session, Thursday’s action cooled but remained net positive. Major indexes are pressing into resistance zones while most breadth gauges hold above the 50% line, pointing to a healthy uptrend that is starting to look extended rather than euphoric.

Thrifty Shoppers and a Metaverse Diet: Discount Chains Shine as Wall Street Waits on the Fed

Wall Street’s headline indices barely moved on Thursday, but under the surface the story was loud and clear: U.S. consumers are trading down hard, discount retailers are loving it, and Meta is finally putting its metaverse on a diet. All of this is playing out against a backdrop of ultra-low jobless claims, a weaker dollar and growing confidence that the Fed will cut rates next week.

Market Breadth: Bulls Regain Control as Small Caps Rejoin the Rally

After Monday’s wobble at resistance, Wednesday’s session delivered the broad-based follow-through that was missing on Tuesday. Advances outnumbered declines three to one, participation above key moving averages ticked higher again, and small caps (IWM) finally caught up with the large-cap indices. The intermediate trend in market breadth moves back into clearly positive territory, albeit with major indices still pressing against overhead resistance zones.

Weak Jobs, Strong Hopes: Wall Street Bets on Fed Cuts While AI Hype Hits a Speed Bump

A surprise drop in private-sector jobs pushed rate-cut expectations even higher and lifted stocks, even as fresh doubts about enterprise AI spending knocked Microsoft lower. Under the surface, chipmakers, retailers, and high-growth software names showed just how narrow and rotational this market still is.

Discover New Ways to Screen Stocks: ChartMill Adds Fresh Filters and Metrics

ChartMill’s stock screener just got more powerful. Explore new filters including EMAs, relative strength, revenue, Graham number, and more — perfect for traders and investors alike.

Testing the Waters: Three Short Swing Trade Setups

Three Short Swing Trade Setups Testing the downside with minimal exposure.

Introducing the Master Swing Trading Course: Built From Your Questions, Backed by 30+ Years of Experience

After months of work, we’re proud to release the Master Swing Trading Course - a 175-page deep dive designed from your feedback and our three decades of market experience.

NIKE Q4 FY2025 – Is the Swoosh Turning the Corner?

Nike beats low expectations, sparks a breakout, fundamental turnaround in progress?

FedEx: Better Numbers, Bleaker Outlook And a Founder Farewell

Despite a solid Q4, FedEx stock stumbles on soft guidance and macro headwinds.

How the Iran-US Crisis Could Shake Markets And Where Smart Traders Are Looking for Opportunity

Roku and Amazon Ads: A Game-Changer or a Fleeting Hype?

Roku’s new Amazon Ads deal could reshape CTV advertising, but can it drive real growth or is it just hype? Here's what investors need to know.

Oracle Just Soared 13% on Earnings — Too Hot to Touch, or Still a Buy?

Oracle just soared 13% after earnings — but is it too hot to chase, or still worth buying for long-term investors? Walter Shares breaks it down.

GitLab Just Crushed Earnings… and the Stock Crashed – Here’s Why I’m Buying

GitLab beats earnings, stock drops. Long-term investor Walter Shares explains why it’s a buying opportunity, not a red flag.

Are Uranium Stocks Worth Considering Today?

The energy market is on the move, and nuclear power, long shunned, is making a comeback. Should I be keeping an eye on uranium stocks? And maybe even: Is now the time to get in?

One Big Winner and the Power of Cutting Losses

One big winner can change your portfolio. Learn why risk management beats perfect setups in swing trading.

Trading Bull Flags, 5 Common Mistakes You Should Definitely Avoid!

Avoid costly trading errors. Learn the 5 most common mistakes traders make with bull flag patterns—and how to avoid them.

Palantir Reports Strong Q1 Results and Boosts 2025 Outlook Amid Soaring AI Demand

Palantir kicks off 2025 with strong Q1 earnings and raises its full-year forecast, but lofty valuation tempers investor enthusiasm.

Amazon Posts Strong Q1 Earnings, But Clouds Gather Over Trade Uncertainty

Amazon delivered strong Q1 2025 earnings with rising profits and record AWS margins, but looming U.S.-China trade tensions could impact future growth.

Apple Beats Expectations, But China Sales Weigh On Stock

Apple beat Q2 estimates, but China sales and soft guidance dragged the stock. AI, buybacks, and India production are key themes.

Netflix Surges After Delivering Robust Q1 Earnings, Raises Q2 Outlook

Netflix kicked off earnings season with impressive first-quarter results.

Marvell's (MRVL) Q4 Earnings: A Strong Quarter, But Investors Wanted More

Marvell Technology (MRVL) recently released its fourth-quarter earnings, and while the company delivered solid results, its stock took a significant hit.

Why the P/E Ratio Alone Isn’t Enough to Identify Value Stocks...

The price-to-earnings (P/E) ratio is one of the most widely used metrics for evaluating stocks, especially when looking for value investments. However, relying solely on this indicator can lead to misleading conclusions.

Snowflake (SNOW) stock news: Q4 Earnings Soars with Strong Earnings Beat, but Near-Term Headwinds Loom

Snowflake (SNOW) reported strong fourth-quarter earnings that surpassed Wall Street expectations

NVIDIA (NVDA) Q4 2025 Earnings Preview & Stock Analysis: AI Growth, Market Risks, and Key Technical Levels

On Friday, NVDA announces results for the fourth quarter of fiscal year 2025. What are investors watching for and what does the chart tell us?

Materialise Stock Crashes 35% – Buying Opportunity or Falling Knife?

Materialise (MTLS) plunged 35% after weak earnings, sparking debate among investors. Is this a long-term buying opportunity, or should traders wait for stability? A breakdown for both long-term investors and swing traders.

Introducing Our New and Improved Stock Profile Pages!

Discover ChartMill's new and improved stock profile pages! Get key financials, technical ratings, news, and insights—all in one place. Explore now!

ChartMill 2024 Highlights

As we step into 2025, it's the perfect moment to reflect on the groundbreaking features and enhancements that defined ChartMill in 2024.

Swing Trading Recap: Two Recent Trades

Swing trading is not just about identifying the right entry and exit points; it’s also about disciplined risk and position management.

Discover Short Interest Trading Ideas and Spot Potential Short Squeezes with ChartMill

We’ve just released a new article on short interest, short squeezes, and how to use ChartMill’s screening tools to identify potential high-pressure setups.

The Market Monitor: A Unique Feature in ChartMill

ChartMill stands out by offering a Market Monitor page, updated daily, which gives users a clear overview of the current market conditions.

Explore Our Latest Videos: Mastering Growth and Swing Trading with ChartMill

Hidden Insights: Using a Stock Screener to Decode Market Conditions

Let’s explore how stock screeners can serve as an indirect barometer for the health of the market.

Nvidia's November 20 Earnings Report: What to Expect

Nvidia is set to release its much-anticipated third-quarter earnings report today, November 20 after market close.

Introducing the New Full Screen Stock Charts in ChartMill

With Full Screen Stock Charts, you can open an expanded charting window and either enter individual tickers or load your saved watchlists directly.

Discover Hot IPO Breakouts with ChartMill's New Screen

We’ve developed a new screen in ChartMill to help you easily find IPOs from the past year that are on the verge of breaking out to new highs. These are the stocks showing strong demand, which can be a powerful signal for future growth.

How To Find The New Leaders When Stock Markets Are Correcting?

Focus on a bottom-up approach to find the strongest individual stocks that can become the new leaders of tomorrow.

Which Sectors, Industries and Stocks merit your full attention when interest rates fall?

Better-than-expected inflation data have increased the likelihood that the Federal Reserve will cut interest rates. This has shifted investor interest toward sectors that benefit more directly from lower borrowing costs, such as smaller, interest-sensitive growth companies.

New Features and updates from ChartMill – Taking Your Analysis to the Next Level!

Quickly discover these exciting new features and updates in your favorite stock screening platform!

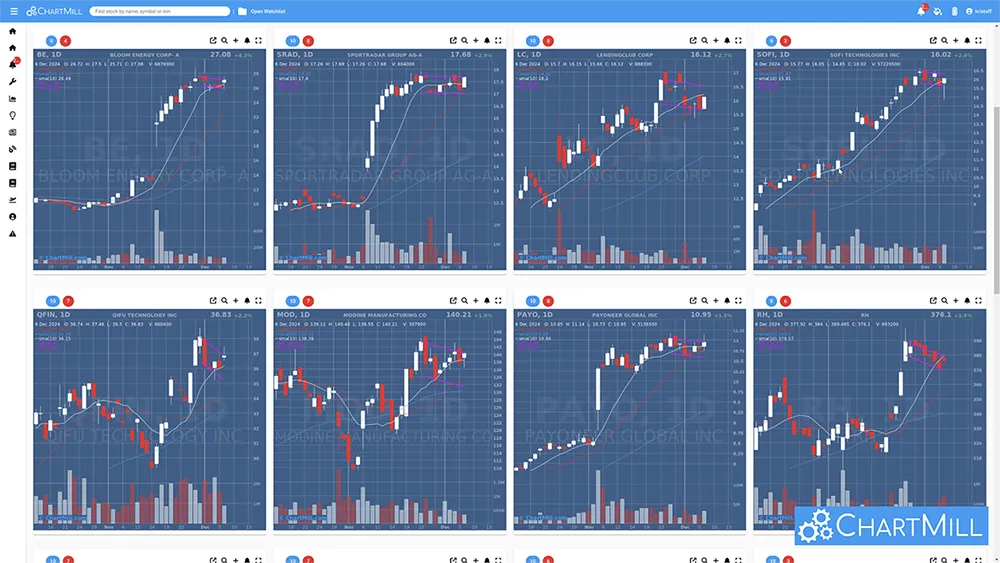

Screening The Best Setups Doesn't Have To Be Complicated!

You've read the right books, you recognize the importance of the prevailing trend and market sentiment, and you know that keeping losers small and keeping winners for as long as possible contributes significantly to the performance of your portfolio...