Smarter Stock Selection by Combining Different Screening Filters

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Dec 7, 2024

If you’ve been searching for a way to narrow down high-potential stocks effectively, you’re in for a treat. ChartMill's screening tools allow you to combine powerful filters to create a precise strategy tailored to your needs.

This week, we shared a post on X that became rather popular, showcasing a simple yet effective way to screen for great retracement setups. Now, we’re breaking it all down in this blog post and a detailed video tutorial showing you the exact steps to replicate this screen!

What Makes This Screening Combination So Powerful?

These are the trading idea/screening filters used for this screen:

Mark Minervini Trend Template:

Helps you identify stocks in strong uptrends, following one of the most successful trading templates.

These technical conditions are the blueprint of Minervini's strategy. A stock that does not meet all the conditions irrevocably falls off the list of possible candidates. Even stocks with excellent fundamentals must meet these before they can be considered for trading.

Bull Flag Screen:

Automatically detects bull flag patterns—ideal for spotting continuation patterns in an uptrend. This specific filter screen (the total number of bull flag patterns recognized by our stock screener) is a great example of how a stock screener can provide insight intro broader market conditions.

More on that specific topic in this separate blog article; "Hidden Insights: Using a Stock Screener to Decode Market Conditions"

Relative Strength (RS):

Focus on market leaders by filtering for stocks with an RS score of 90 or higher. More on Relative Strength can be found in this article.

Average Daily Range (ADR):

Ensure sufficient volatility by including stocks with an ADR(20%) higher than 3. This is crucial because, without enough price fluctuation, profit-making opportunities are limited.

Although volatility is sometimes viewed negatively, it is essential for swing trading as it provides the chance to benefit from price increases. Stocks with the greatest volatility are often the most suitable for swing trading, as they present the highest potential for profit.

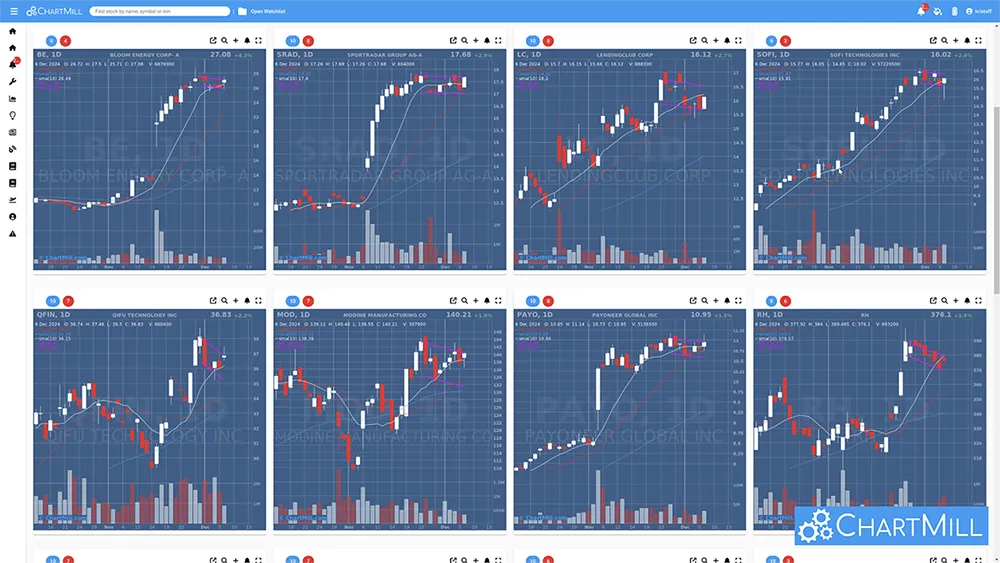

Some examples from this screen

Step-by-Step Video Guide

Our latest video tutorial walks you through the entire process of setting up this screen in ChartMill. You’ll learn how to apply each filter, adjust parameters, and show the results—all in just a few minutes.

Why Should You Try This Screen Today?

This combination is perfect for traders looking to catch strong momentum stocks with high relative strength and actionable patterns. Whether you’re a swing trader or short-term investor, this setup provides an edge in identifying top-performing stocks.