How To Find Support and Resistance?

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Dec 5, 2024

When it comes to designing successful trading strategies, support and resistance levels are among the most important elements in the field of technical analysis.

However, a good understanding of support and resistance is much more than just some lines drawn on a chart. Being able to discern specific price areas that determine price trends is critical to becoming consistently profitable.

So let’s explore how to find support and resistance levels, what they mean and why this technical tool should be in your toolbox.

Support And Resistance - The Basics

Support and resistance levels on a price chart are a visual representation of supply and demand. If supply and demand are in balance then the price will move more or less within a certain range.

The bottom of the bandwidth represents the floor price. This is the price at which there is strong demand for the stock in question; enough buyers are willing to purchase the stock at that price. This bottom price is referred to as ‘Support’.

The upper side is the top price and this is the price where demand stalls and supply increases because more sellers want to get rid of their pieces at this price. This top price is referred to as ‘Resistance’.

As long as supply and demand remain in balance, the known support and resistance levels will provide a barrier where there is a relatively low chance of the price dropping significantly below the bottom price or rising above the top price.

However, specific events can lead to a sudden change in supply and demand. For example, the company may announce positive news that suddenly increases demand much more, and the existing support and resistance levels are no longer valid.

Support: A price level, area, or zone where we expect an increased demand from buyers, thereby giving support to the price level and preventing the price from moving further downwards.

Resistance: A price level, area, or zone where we expect increased supply from sellers, thereby giving resistance to the price level and preventing the price to move further upwards.

Bear in mind that we are talking about a price level, area, or zone. Support or resistance is rarely at one specific price level. Many times, the price will move above and below a specific support or resistance level before choosing a final direction.

Understanding The ‘Self-Fulfilling Prophecy’ Concept

Market sentiment and market psychology play a very important role in strategies that use technical analysis. This is also the case for support and resistance zones.

Indeed, the mechanics of support and resistance levels - besides the classical explanation of supply and demand - are also largely related to the concept of the Self-Fulfilling Prophecy, derived from psychology and first introduced by sociologist Robert K. Merton in 1940.

It occurs when a belief or expectation leads to actions that effectively make the belief or expectation come true. In light of support and resistance levels, it occurs when enough investors believe that a particular price level is important and effectively buy or sell the stock as soon as the price approaches that particular level, regardless of other market factors.

As more and more investors act on that expectation, the more the identified support or resistance level is reinforced.

The Self-Fulfilling Prophecy concept allows active traders to take a position with a short stop-loss and thus observe how the market reacts.

How To Find Support And Resistance Levels?

Recognizing support and resistance levels in the stock market is possible using various technical analysis tools. We list some common methods below:

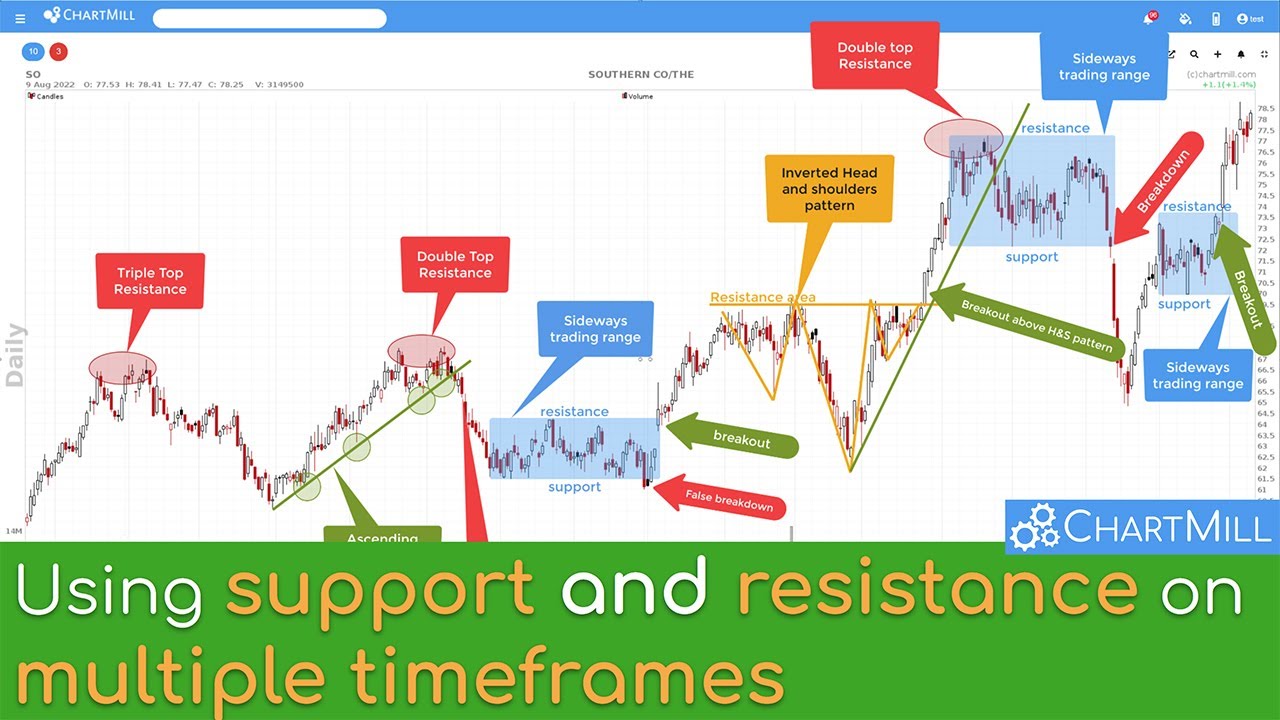

Horizontal Aligned Tops And Bottoms

Stocks form tops and bottoms. A bottom for instance is a local price formation where prices on both sides (earlier and later) are above the lowest price in the range. When multiple tops and/or bottoms are horizontally aligned on the chart, we can identify an area of support or resistance by drawing a horizontal line at this level.

Diagonal Aligned Tops And Bottoms

Tops and bottoms do not necessarily have to be horizontally aligned. They can also be seen in rising or falling price trends. When a stock forms higher bottoms and higher tops, we can draw a line connecting the different bottoms. This is called a rising trend line and it can serve as a support for the next higher bottom.

Moving Averages

Moving averages are dynamic trend lines that smooth out price fluctuations by averaging the price over some time. These are often used to identify support and resistance levels just because the price often bounces off the moving average line. Some commonly used averages are 20, 50, and 200SMA.

Fibonacci Retracement Levels

Fibonacci was an Italian mathematician. His Fibonacci sequence consists of a series of numbers where each number is the sum of the two preceding numbers: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55 and so on. The ratio of a number to its preceding one is always equal to 1.618 from the third number in the series onward. We call that number the golden ratio. It is denoted by the Greek letter φ (phi). The series is used by traders to identify potential support and resistance zones early on. It is based on the assumption that prices tend to take back some of their previous movement.

Volume Analysis

Volume is a very useful indicator for the early identification of support and resistance levels. High selling volume just before or at a resistance level confirms the presence of that resistance level. Just as high buying volume does for a support level.

Extra tip: higher than normal buying volume just before the price reaches an important resistance level can be an indication that the balance of supply and demand has been disturbed and a price breakout may follow through the resistance level up to that point.

Round Numbers

Multiple studies have shown that there is indeed a cluster effect as far as round numbers are concerned. These tend to act as psychological support, or resistance levels where investors use the round number as the basis for their entry, target or stop loss.

More information on technical indicators to recognize support and resistance can be found in our article "Support And Resistance Indicators: Which One To Choose?”

Key Elements To Keep In Mind When Using Support And Resistance Zones.

Confirmation (Number of touches)

The more times the support or resistance is hit, the clearer the trading range becomes in which the price moves. To qualify as a horizontal trading range there must be at least a double top (resistance) and double bottom (support).

The higher the number of times the support or resistance of the price channel is tested, the more interesting the setup becomes for breakout traders.

This is equally true for diagonal trading ranges.

Preceding Prive Move

The way the price evolves before a specific support or resistance level is hit should be watched closely. It can give important clues about the further course of the price once the support or resistance level is effectively reached.

A strong prior movement increases the probability that the support or resistance level will effectively be triggered and the price will change direction again at that level.

However, if the price has been trading close to the support or resistance level for some time and there is suddenly increased volume and momentum, there is a significant chance that we are facing an effective breakout above or below the resistance or support level.

Timeframe

In general, using higher timeframes leads to more reliable support and resistance levels. The reason is that a higher timeframe gives a broader view of the markets, automatically maintaining a longer-term view. In addition, volatility will be a lot less, making false breakouts above a resistance level or below a support level less frequent.

Multiple Timeframe Analysis

Anyway, it is recommended to consider multiple time frames in your analysis.

For example, suppose you take positions based on the daily chart on which you have indicated several support and resistance levels. Next, you also look at the weekly and monthly charts to see if there are any support or resistance levels that you may not have immediately noticed on the timeframe on which you are trading.

Such a top/down approach provides more consistent signals.

Past Support And Resistance Areas

The more recent the confirmation of a support or resistance line, the more significant the line is. Too often we see traders paying attention to a level with only a few tangents from sometimes years ago. Since these levels are long ago, they should no longer play such a significant role, because the stock will have new shareholders who do not remember these levels.

This is especially important for short-term traders. Seeking confirmation on higher time frames does make sense but it is of little use - for example, as a day trader - to want to take into account support and resistance zones from a distant past that might still be visible on a monthly chart.

Using Support And Resistance Levels When Opening A Position

In a trading strategy, support and resistance can be used in two different ways.

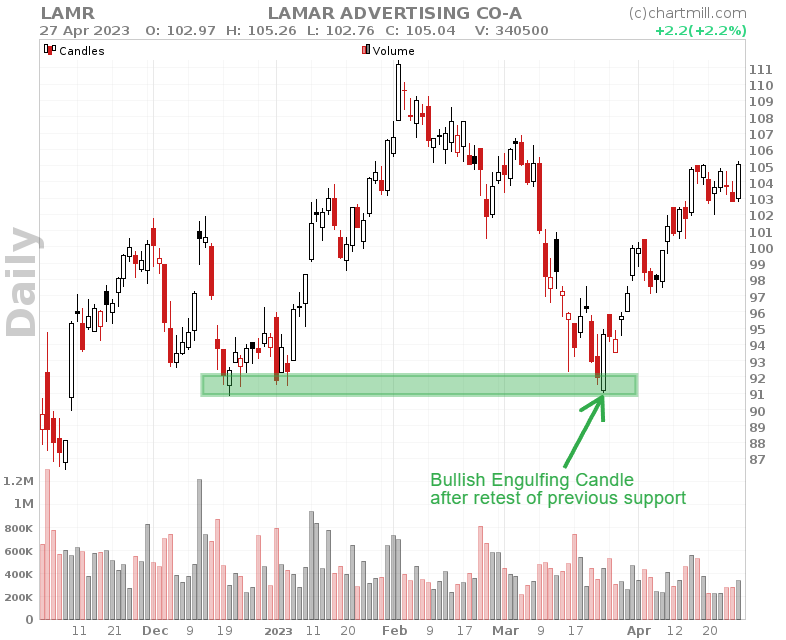

Rejection

In this case, a position is effectively taken on the assumption that the support or resistance level will cause the price to be pushed in the opposite direction again. The key here is to wait for a clear reversal pattern, merely taking an opposite position, speculating that the price will bounce off that particular price level is not a good idea and will lead to a lot of frustration.

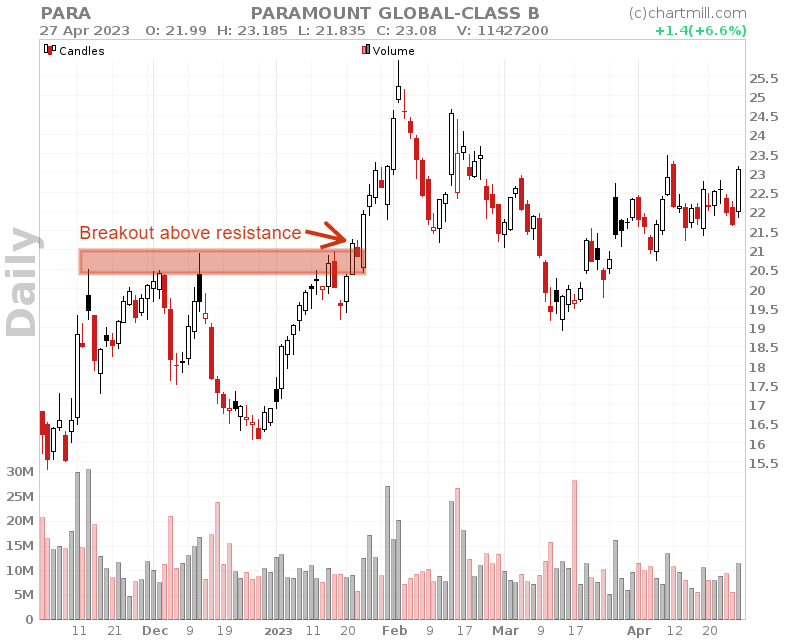

Breakthrough

This strategy requires more patience. The investor recognizes and acknowledges the specific level but will try to take a position the moment there is a clear breakout above the resistance level.

You can learn more about how to use support and resistance zones in a trading strategy in our article "Support and Resistance Stock Screener and Trading Strategies".

Using Support and Resistance Zones To Define Stop Losses

Just because support and resistance are used as levels where the price is more likely to change direction again, they are also well suited to be used as stop loss zones. In doing so, however, you need to pay attention to several things:

-

As discussed earlier, support and resistance are price zones rather than specific price levels. So use a somewhat wider margin and don't set your stop-loss too strictly (just below a support or above a resistance level).

-

Also, try to take into account other elements that additionally confirm the support or resistance level. For example, a rising moving average represents dynamic support. If it is just below the support zone, it is appropriate to place your stop loss both below the horizontal price support and below the rising moving average.

-

In case a round number is just below the identified support the same rule applies as for the moving average. Include it in your decision and place your stop-loss just below the round number.

What Happens When Resistance Becomes Support (and vice versa)?

A typical feature of support and resistance levels is their interaction in response to price changes. In this way, support becomes resistance and resistance becomes support. This may sound a bit confusing but the example below makes it clear.

A specific price level can act as resistance for a very long time but once the price has managed to break through the resistance you will notice in many cases that the previous resistance level will act as support. This is called a ‘retest of the breakout level’.

The same phenomenon also occurs when the price falls through a support level. A price recovery will then encounter resistance at the same price level that previously acted as support. [grafiek]

Automatic Recognition Of Support And Resistance Levels Using A Stock Screener

ChartMill is currently one of the few screeners equipped with an algorithmic support/resistance feature. It can detect specific support and resistance levels through user-set S&R filters.

The following parameters are available as filters:

- Length of the support/resistance zone (number of continuous periods that the support/resistance zone exists)

- Strength of the support/resistance zone (number of times the support/resistance zone has already been tested)

- Distance between the current price and the next support/resistance zone, expressed in %.

More details via our ‘Support and Resistance Stock Screener and Trading Strategies’ article.

FAQ

Do Support And Resistance Work?

It is important to point out that support and resistance zones by themselves do not guarantee success. But that is the case for any indicator. This is also true for fundamental investors. A low P/E ratio, for example, is not in itself sufficient to be sure that the price of a stock will rise.

However, because many traders see support and resistance levels as psychological barriers, they frequently use them to identify potential entry and exit points for trades as well as to set stop-loss and take-profit orders.

Just because support and resistance zones are strongly watched by a lot of market participants and trading decisions are based on them, the principle of Self-Fulfilling Prophecy can fully play its role.

Thus, they are useful for the more active investor, especially when used carefully (in conjunction with sound risk management and additional analysis techniques).

What Is The Best Timeframe For Support And Resistance?

Which is the best timeframe for using support and resistance levels depends largely on your trading style and objectives. Keep in mind that identified support and resistance zones on the higher timeframes have a higher degree of reliability than on the lower timeframes.

Scalpers and day traders will use lower time frames such as the 1-minute, 5-minute, or 15-minute chart.

Swing traders who hold their positions for days to weeks may focus on 1-hour or 4-hour charts or even a daily chart.

Position traders are more likely to concentrate on daily and weekly charts.

Whatever timeframe you use, it is important to always consider a higher timeframe as a reference and to confirm a certain level. For example, position traders can first consult the weekly chart to identify potential support and resistance levels and then analyze the daily chart to determine their exact entry.

How To Draw Horizontal Support And Resistance Levels?

Correctly interpreting and drawing horizontal support and resistance levels should be done as objectively as possible.

A few guidelines to that end:

- Start by looking for swing highs and swing lows. A swing high is characterized by a price top followed by a decline. A swing low is identified by a price bottom followed by a price increase.

- If you can connect at least two swing highs using a more or less horizontal line, you are dealing with a double top. This is the most basic form of resistance. Two swing lows that can be connected in this way signify a support level.

- The more swing lows or swing highs you can connect in this way the more significant that support or resistance becomes.

- Finally, also check the higher time frames to see if the support or resistance you recognize is also visible there. Support/resistance which is visible on multiple timeframes simultaneously increases the reliability of the level.

Keep in mind that drawing support and resistance levels is not an exact science and does not concern one specific price level but rather a price zone.