Best Dividend Stocks Screener

By Aldwin Keppens - reviewed by Kristoff De Turck

Last update: Apr 19, 2024

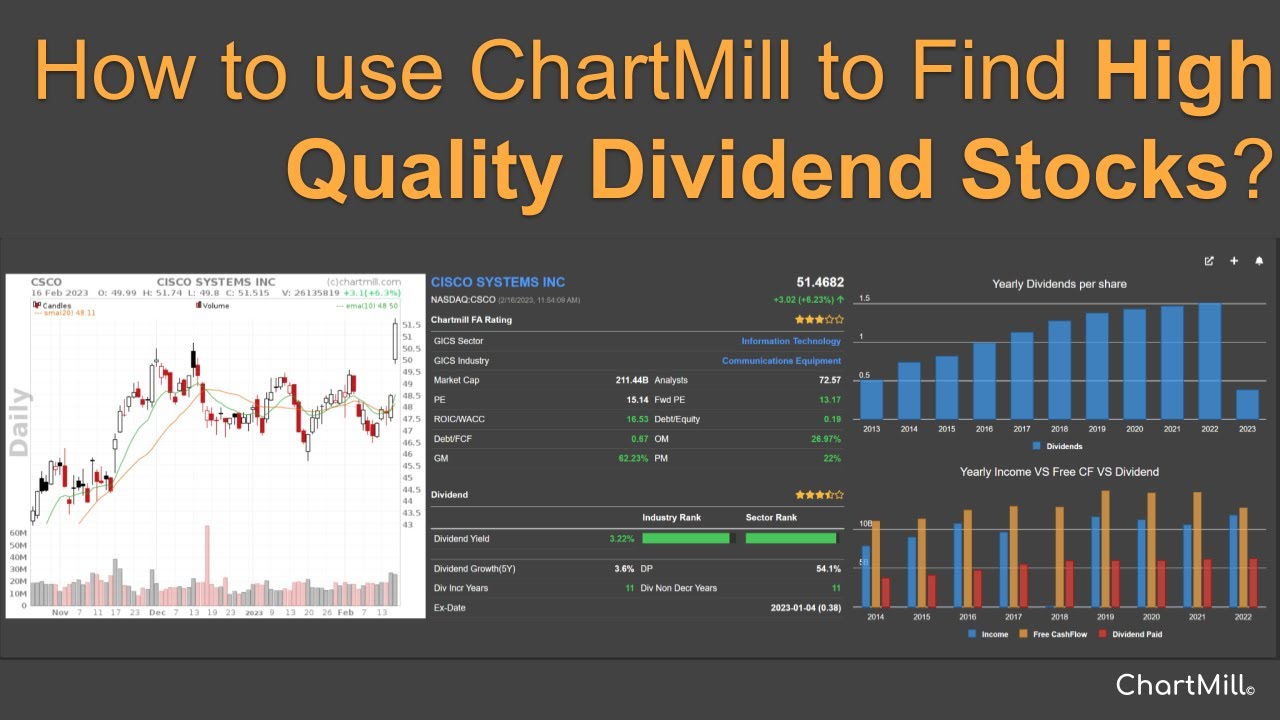

In this article we will discuss the Best Dividend Stocks screen. Our article on evaluating stocks for dividend investing contains some useful background.

Running the screen takes you to the fully configured stock screener page. It has the following filters set:

- Minimum Average Volume > 500K: only stocks with a higher daily volume will be part of our selection.

- Price above 10: we use this filter to avoid low priced and often more volatile stocks.

- ChartMill Health Rating >=5: we use the ChartMill Health Rating to make sure we have only healthy stocks. The health rating evaluates the solvability and liquidity of the company. We are not looking for the top class here, but also want to avoid companies with issues.

- ChartMill Profitability Rating >=5: we use the ChartMill Profitability Rating so filter for companies which are sufficiently profitable. Again top class is not required when we are looking for Dividend Stocks.

- ChartMill Dividend Rating >= 7: we use the ChartMill Dividend Rating to look for top class dividend stocks.

These are the default settings of the screen, but you can of course easily adjust the filters. You could for instance add "US Only" from the exchange filters to have only US stocks, or pick "S&P500 only" from the Index filter list to look at only stocks from the S&P500. Also a minimum market cap could be useful.

The Screen Results.

By default the screen will display the "FA table" view and the results are sorted by descending "ChartMill Dividend Rating".

The advantage of the view is that it is consise and give your a first quick overview, the disadvantage is that it does not give you all the information you need yet. But it can inspire you to add more filters. We see for instance that some of the results are not very appreciated by analysts, we could add an additional filter for a minimum Analyst score.

Evaluating the results.

Now we need to evaluate these results. A screener gives you a list of ideas, but it is up to you to go over the list and pick the best ones according to your needs. More information is available in either the "Fundamental" or "Fundamental Report" views. There are 2 options to go through the list:

- Clicking on the ticker will open the profile on the specific stock. Here you can find all information in different tabs.

- Changing the view of the screener output will give you the information directly. Here is a link to the same screen, sorted by dividend yield, using the fundamental view and the fundamental report as secondary view

A good strategy is to go over the list and make an initial judgement while adding things we want to investigate deeper to a watchlist. You can very easily do this by clicking the + sign which is always available.

Things to watch ....

- Check the evaluating stocks for dividend investing article.

- Always take into account current general and market conditions.

- A huge price decline is always suspicious. It makes the stock looks cheap and divend yield look high. It can be tricky, but it requires research and judegement to evaluate whether this is really a good buy or not. You should also take into account that analysts may not have updated their rating or future estimates yet, so it is best to develop a good understanding of what is going on.