What is Dividend Investing?

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

WHAT ARE DIVIDEND STOCKS?

Dividend is a regular distribution of profits to the shareholders of a company. Usually a portion of the profit is paid out although it happens that dividends are also paid if the company has made a loss. How much the dividend is, whether it is paid in cash or shares and at what frequency it is paid, varies.

Investing in dividend stocks is popular with both novice and experienced investors because it provides passive income. In addition, companies that consistently pay dividends are usually large companies with a proven track record. This ensures that they can deliver stable growth, sustainable profits and a strong competitive position in the market.

HOW MUCH DIVIDEND IS BEING PAID?

How much the dividend amounts to is decided and approved at the shareholders' meeting. All common shares have an equal dividend value. Preferred stocks, however, can deviate from this.

- Dividend Yield: the yield is calculated by dividing the expected dividend by the current share price.

- Dividend Payout Ratio (DPR): DPR is a measure of how much of a company's net income is paid out to its shareholders as a percentage of the company's total earnings.

HOW IS THE DIVIDEND PAID?

There are two possible forms in which dividends are paid. Either the dividend is paid out in cash (cash dividend), or you receive a dividend in the form of new shares (stock dividend). To calculate the number of shares you will receive as a dividend, the average stock price and the trading volume are taken into account. It is also possible that the dividend consists of a combination of a cash and a stock part. For some dividends, you can choose which of the two you prefer.

WHEN IS THE DIVIDEND PAID?

To be sure that you are entitled to a dividend payment, it is best to take a number of different dates into account. These dates determine whether or not you are eligible for a dividend payment.

- Announcement date: this is the date on which the company announces how much dividend will be paid and on which date this will happen.

- Ex-dividend date: the date from which the stock is NOT entitled to a dividend payment. So keep in mind that you, as an investor, must hold the stock at least one day before the ex-dividend date. In general, this is also the day on which the price falls more or less in the same proportion as the value of the dividend.

- Dividend record date: this is the record date, the moment when it is determined which investors are entitled to the dividend. From this moment onwards, the stock will again be entitled to future dividends.

- Dividend payment date: the day the dividend is actually paid (or when the new shares are delivered in case of a stock dividend).

SUPERDIVIDEND?

Some companies may opt to pay out a high dividend once, this is called a 'superdividend'. This will mainly occur when, for example, a specific part of the company is sold or a related subsidiary is sold.

POSSIBLE STRATEGIES FOR DIVIDEND INVESTING

Focus on the highest possible Dividend Yield

With this strategy you only choose stocks that pay a very high dividend yield. However, this high yield comes with an additional risk, because if the company suddenly gets into difficulties and can no longer meet the high dividend payments, the yield may suddenly be much lower or there may even be no dividend paid at all. You may still own the shares but they are no longer suitable for your chosen strategy. If the share price has fallen sharply, you are trapped between the hammer and the anvil...

Focus on stocks with constant Dividend Growth

In this case, the quality of the company in which you invest is of great importance. This forms a buffer so that even in times when the economy is less successful, the company is still perfectly able to continue paying dividends. It goes without saying that the dividend yields of these companies are a lot lower than when focusing solely on the highest dividend yield.

TIP: US stocks that have been paying dividends continuously for more than 25 years and have increased their dividend time and again are called Dividend Aristocrats.

ADVANTAGES AND DISADVANTAGES OF DIVIDEND STOCKS

Advantages

- Generates a passive income (which may or may not be reinvested)

- Requires little follow-up, very similar to the Buy and Hold strategy

- Stable growth of your assets

- Less volatile than growth stocks

Disadvantages

- Never 100% certainty of dividend payment (especially if choosing stocks that offer a very high dividend yield)

- The prospect of significant capital gains is rather limited

- Capital is fixed for the long term, responding to new opportunities will usually have to be done with additional capital

HOW TO CHOOSE DIVIDEND STOCKS?

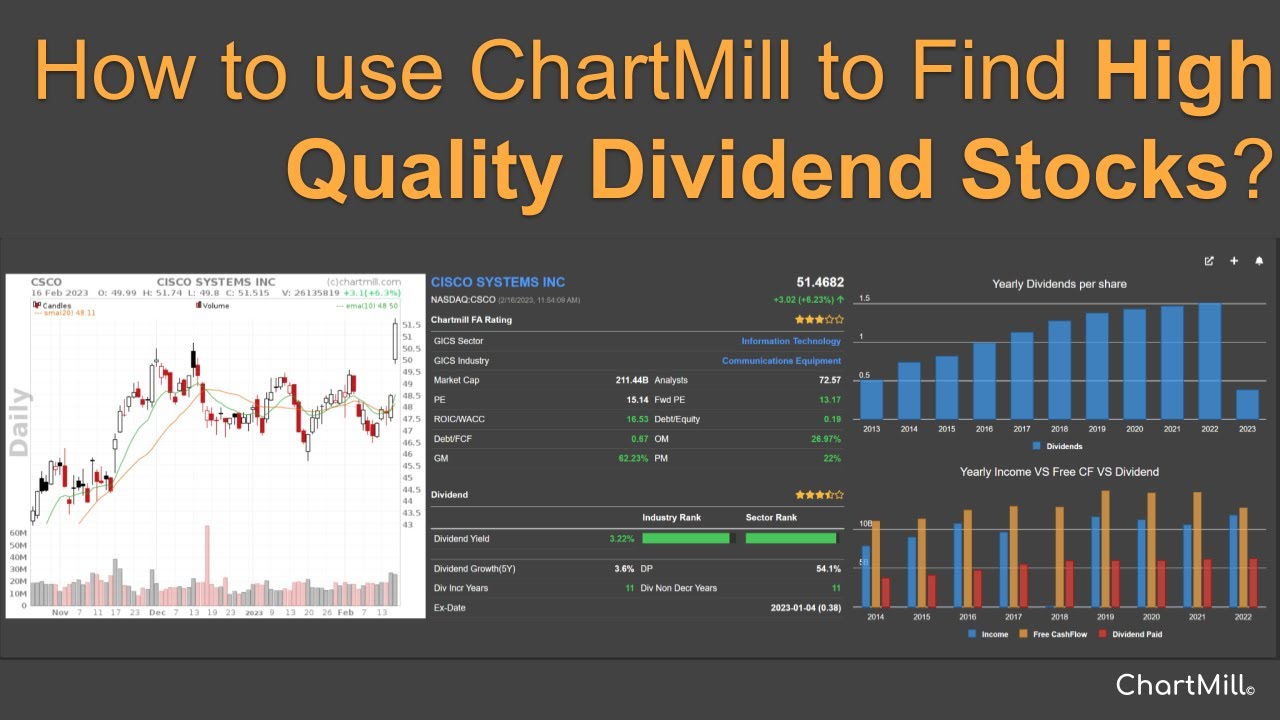

There are a number of important parameters to consider when investing in dividends. This article and video discusses them in more detail and shows you how we use ChartMill to arrive at a selection of quality dividend stocks.