Dividend Screens - Decent Dividend Yield (minimum 3%), decent financial Health and Good Dividend Growth (between 10% and 20%)

This screen shows somewhat financially stable companies that pay reasonable dividends and maintain a good dividend growth%.

The ChartMill Dividend Rating

The ChartMill Dividend Rating evaluates the yield, reliability and sustainability of a dividend

How to find the best dividend stocks?

How to create a screener in ChartMill to find only those stocks that pay a very solid dividend and will most likely continue to do so in the near future.

What is Dividend Investing?

Dividend investing offers recurring income coming from dividend payments and in addition there is the potential capital appreciation from the stock. Dividend payments can be paid out as income or you can choose to reinvest these dividend payments to furth

Dividend Stock Versus Growth Stocks | Discover What Fits You Best

Choosing between dividend stocks and growth stocks is an important consideration for investors looking to build or diversify their portfolios. Both types of stocks offer unique advantages and carry different risks.

Evaluating stocks for Dividend Investing

Owning Dividend paying stocks gives you a passive income. Learn how evaluate the best dividend stocks.

Fundamental Dividend Filters

A description of the fundamental properties related to stocks dividends, like dividend yield, dividend growth and dividend payout.

Which Stocks to Pick when Inflation is Rising?

Which stocks to buy when inflation is rising strongly?

Best Dividend Stocks Screener

This screen uses the ChartMill predefined fundamental ratings to find high quality dividend stocks

Related Videos

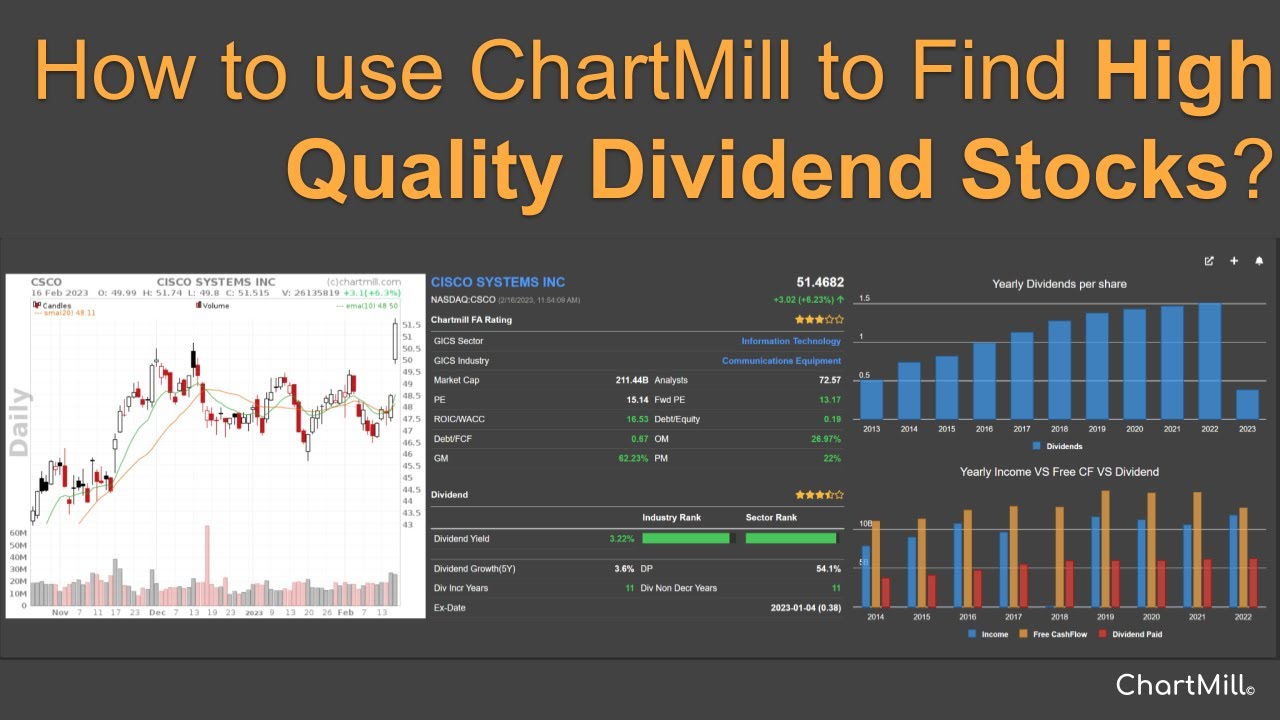

Finding Good Dividend Stock With Our New Dividend Filters

Investing in decent dividend stocks can be a great way to build long-term wealth and generate passive income. In this video, we'll explore some tips and techniques for finding high quality dividend stocks using the dividend screening filters in the ChartMill Stock Screener.

How to Find the Best Dividend Stocks using the ChartMill Stock Screener?

This video shows how to make a specific screening filter that looks for companies that have been paying a decent dividend for quite some time and are most likely to do so in the future. Beware, simply choosing companies that pay a very high dividend is not the way to generate a stable cash flow. Focus on companies with an irreproachable dividend track record (i.e. no interruptions) and where the dividend is growing steadily.

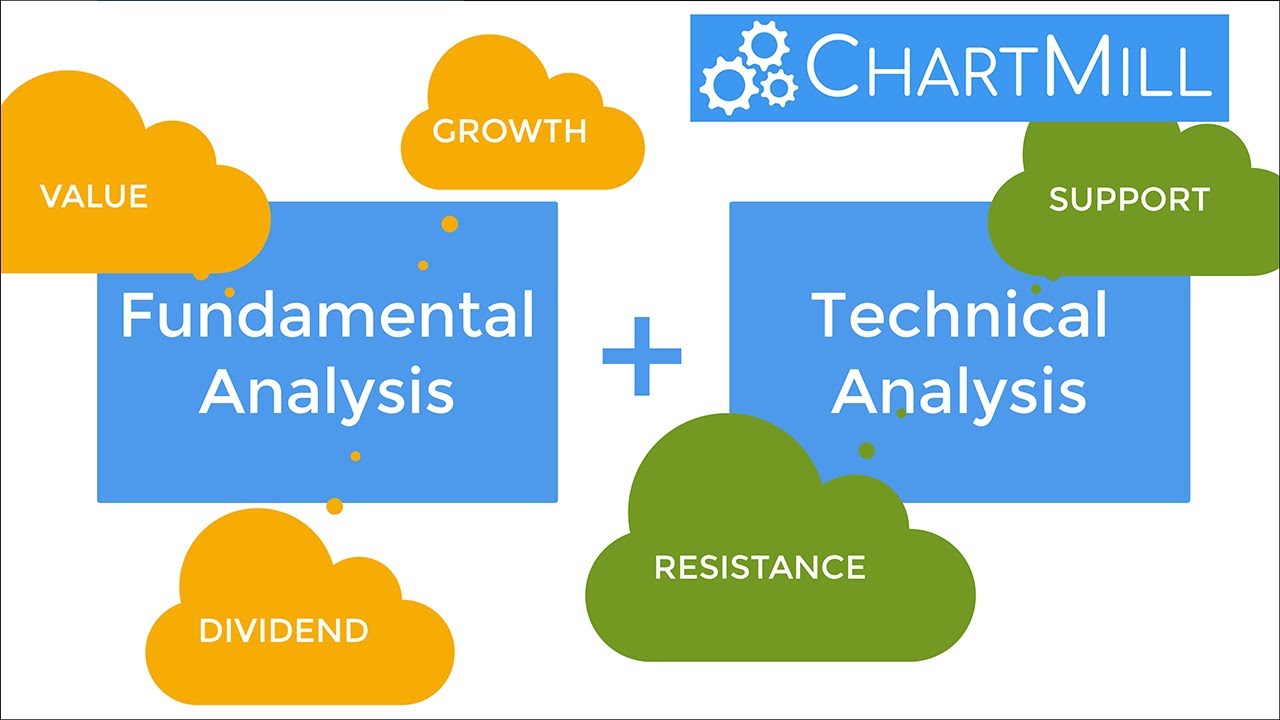

How to find financially sound Growth, Value or Dividend stocks that quote at key technical levels?

In this video you will learn: How to use ChartMill to find financially sound growth, value or dividend stocks using the predefined ChartMill Fundamental ratings And then use the technical screening capabilities to focus on stocks whose price currently coincides with a key technical price level, either support or resistance levels. The beauty of this is that we start from a fundamental perspective by first filtering on the basis of specific fundamental criteria. Within that selection, we then look specifically for price technical characteristics. In this way we combine fundamental with technical analysis.

Price: Above 10

To avoid low priced stocks

Health>=5

Only companies that are financially stable

Dividend Growth>=10% AND Dividend Growth<=20%

A good growth% that is sustainable

Average Volume: 50 SMA > 300K

Minimal liquidity

Dividend Yield>=3%

Minimum dividend yield%

FA table view

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.