What is Position Trading?

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

POSITION TRADING

Position traders are long-term investors. They are not concerned with the daily price fluctuations on the intraday chart. At most, the daily charts are used to open a position, trying to fine-tune the moment of entry. A number of basic techniques from technical analysis are used for this.

LONG TERM TREND IS KEY

This type of trading aims to profit from the long-term trends of a stock, index or derivative. As long as the main trend does not change the position will be held, this can take months or even years. It may be clear that this way of investing is very passive and therefore requires very little follow-up.

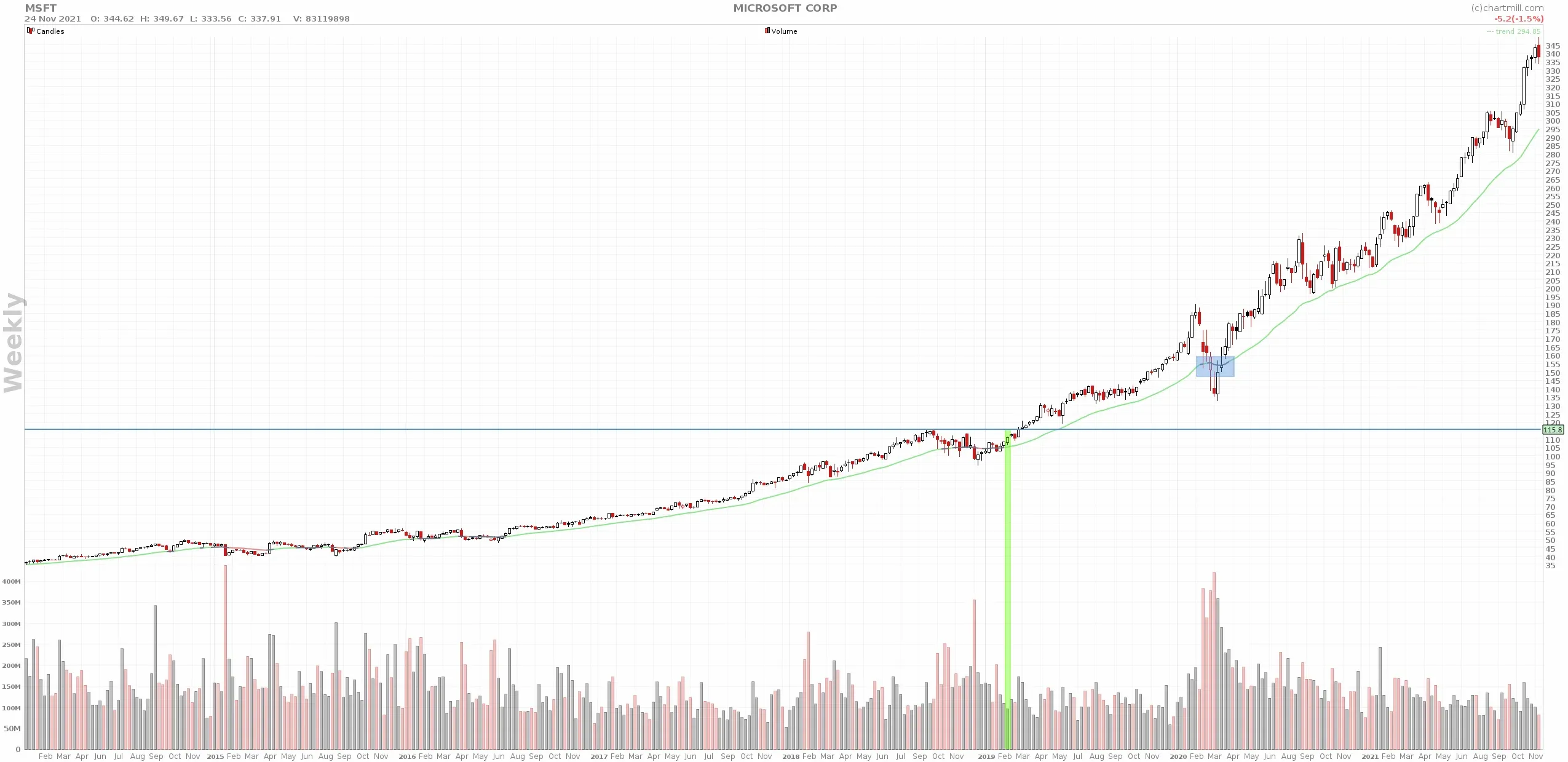

Weekly chart Microsoft - The breakout above the blue horizontal line (February 2019) initiated a bullish trend that continues to this day. The upward trend only experienced a brief neutral period between February and April 2021. At the beginning of 2019 the price was +/- $115, at the time of writing this article the price is trading near $350. That is an increase of more than 200%.... The line below the price is the ChartMill Trend Indicator.

SMA200

For determining the long-term trend, there are a lot of different methods. Undoubtedly one of the more popular ones is the SMA200. This long-term average is used by many traders as a basic moving average because it is widely used to determine the long-term trend of a stock. A price above the SMA200 indicates a positive trend, while a price below the SMA200 indicates a downward trend.

TECHNICAL OR FUNDAMENTAL ANALYSIS?

The core of the strategy may be based on technical or fundamental analysis or a combination of the two. Because the investment horizon is long, emerging or disappearing general trends in the world economy and general society are also taken into account.

ENTRY, STOPLOSS AND PROFIT TARGET

Entry

Investors who rely primarily on fundamental analysis will barely pay attention to timing. The stock will be bought from the moment the current value is assumed to be lower than the actual value.

For those who rather rely on technical analysis, they will base their purchase on technical patterns, indicators and support and resistance levels. In combination with prices that break out or temporarily show a slight decline, the exact entry can be determined.

Fastenal Corp. - Retracement entry

Fastenal Corp. - Retracement entry

LKQ Corp. - Breakout entry

LKQ Corp. - Breakout entry

Stoploss

Given the timeframe on which trading is done, the stoploss is broader in terms of position trading, as it must be placed in such a way that when it is hit it also effectively means that the prevailing trend has ended.

Profit Target

The main difference between daytrading and swing trading is the way a position is sold. With this strategy the intention is to hold the position as long as possible. So a trailing stoploss is used. There are a lot of alternatives possible. You can use a moving average, a stoploss based on swing points or based on a volatility indicator such as the Average True Range.

Below an example of an ATR-based stoploss (3ATR distance)

ADVANTAGES OF POSITION TRADING

- Passive form of investing which requires very little follow-up.

- Wider stoplosses so positions are much less likely to be stopped out by intraday price differences.

- Opportunity for huge profits because the potential for gains is unlimited.

- Low transaction costs because positions are held for a long time.

DISADVANTAGES OF POSITION TRADING

- The passive nature of this style of investment can also be a major disadvantage for those who prefer to buy and sell actively.

- The biggest disadvantage of passive investing is the fact that capital is stuck for a long time in the product in which you have invested. If, for example, you have 5 open positions with which you have invested 20% of your capital each time, there is nothing you can do but wait until one of the positions is stopped out. And that can take quite a while. In case the market moves strongly in your favor that's great, that's the purpose of this trading method. However, markets can (and will) also move sideways for quite some time. With the large stoploss which is typical for this way of trading, you will not be stopped out quickly. This can lead to frustration when you see other opportunities that you can therefore not exploit.

- Profits can rise very quickly, which is obviously not a disadvantage, but it is a tough challenge to let these profits actually run and not let them fall to the level of the following stoploss. Many people start out with the idea of staying in the market as long as possible but the temptation to cream off the profits when they have risen sharply often proves to be too great to resist...

WHO IS POSITION TRADING SUITABLE FOR?

Would you like to invest but have little time for it and/or just don't feel like spending a lot of time on it? Then this might be your ideal investment style. Just keep in mind that it can be quite a challenge to be in the market for so long, especially if the profits become relatively large and your stoploss is quite far.