Chartmill Channels

By Aldwin Keppens - reviewed by Kristoff De Turck

Last update: Apr 19, 2024

What are ChartMill Channels?

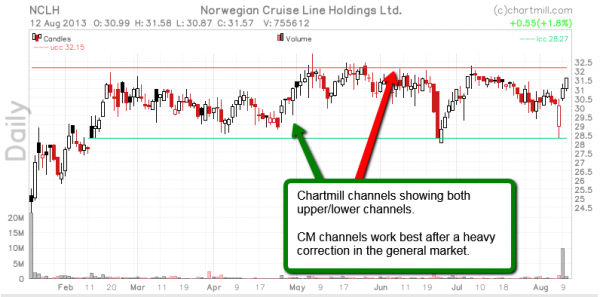

A Chartmill Channel is a horizontal channel wherein prices move sideways. The top side (red) is called the Upper Chartmill Channel (UCC), whereas the bottom side is called the Lower Chartmill Channel (LCC).

This channel doesn't - in contrary to the well known donchian channels - require extra parameters. Chartmill channels automatically calculate the most optimal value by looking for an optimum between "as long as possible" and "as small as possible". In that way, channels can be more objectively defined.

For an in depth description and calculation see this article, which was published in Traders Magazine

ChartMill Channel Usage

ChartMill Channels were primarily developed to detect sideways (accumulation) phases, from which a price breakout may occur. By maximizing length and minimizing height, Chartmill Channels help the hunt for stocks which are building up lots of energy before breaking out of a long accumulation phase.

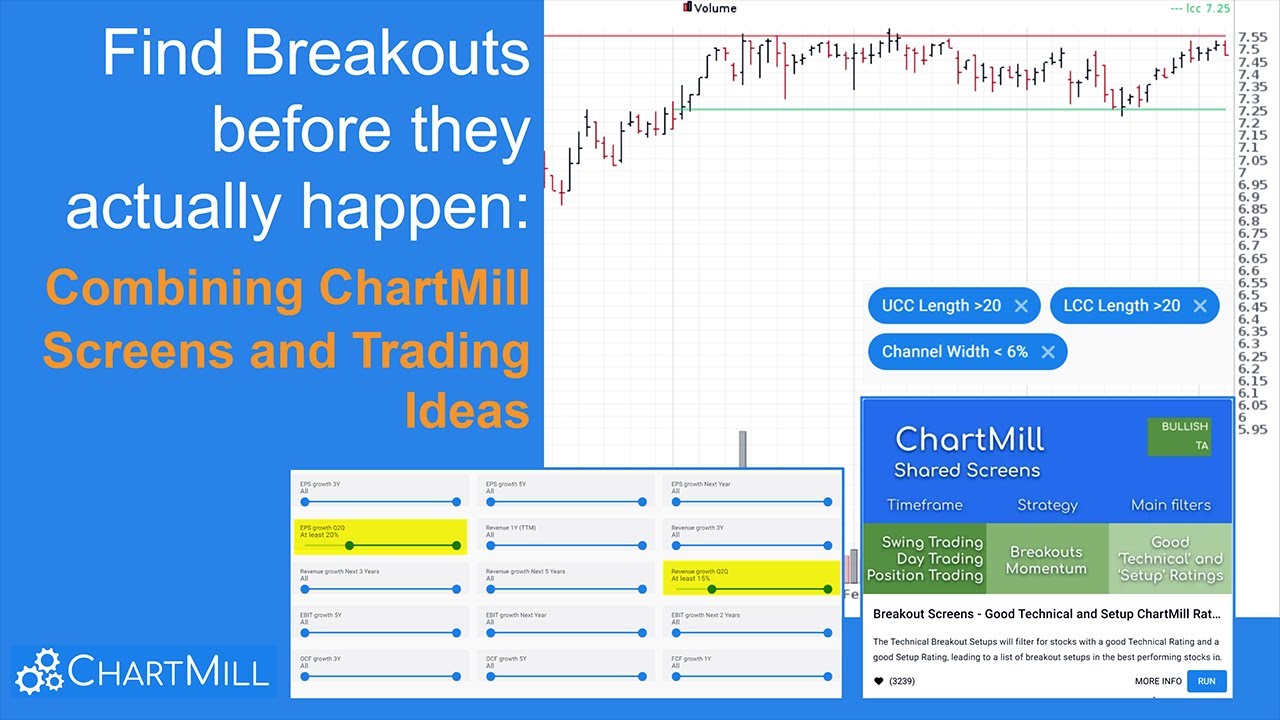

In the stock charts you can add the "ChartMill Channels" overlay indicator. In the stock screener you can find the filters related to ChartMill Channels on the "support/resistance" tab. You can enter search criteria related to the UCC, the LCC and the channel width.

Our trading ideas page contains several screens using ChartMill Channels. You can find a direct link to these screens right next to this article, in the "related screens" section.