Nvidia's November 20 Earnings Report: What to Expect

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Nov 20, 2024

Nvidia is set to release its much-anticipated third-quarter earnings report today, November 20 after market close. The tech giant, renowned for its industry-leading GPUs and dominant position in AI infrastructure, is expected to deliver another standout performance.

With the stock already up over 200% this year, all eyes are on how Nvidia continues to capitalize on the surging demand for AI solutions.

Key Highlights

-

Record-Breaking Revenue Growth: Wall Street analysts expect Nvidia's Q3 revenue to hit $33.59 billion, an 85% increase year-over-year, surpassing its prior $30 billion record in Q2. This growth is primarily fueled by surging demand for AI infrastructure, especially in data centers.

-

Skyrocketing Net Income: Nvidia’s net income is projected to reach $17.47 billion, nearly double the $9.24 billion it posted a year earlier. This highlights Nvidia's strong profitability as its sales scale rapidly.

-

Dominant Data Center Revenue: Nvidia’s data center business, the backbone of its AI success, is expected to achieve another record at $29.28 billion this quarter, up from $26.3 billion in Q2. Generative AI and accelerated computing are driving this growth, as global data centers overhaul their infrastructure with Nvidia’s solutions.

-

Blackwell AI Chip Launch: The Blackwell architecture, touted as a "complete game changer" by CEO Jensen Huang, is poised to significantly boost Nvidia's Q4 revenue. Investors will be closely watching updates on Blackwell shipments, expected to contribute several billion dollars in revenue in the January quarter.

-

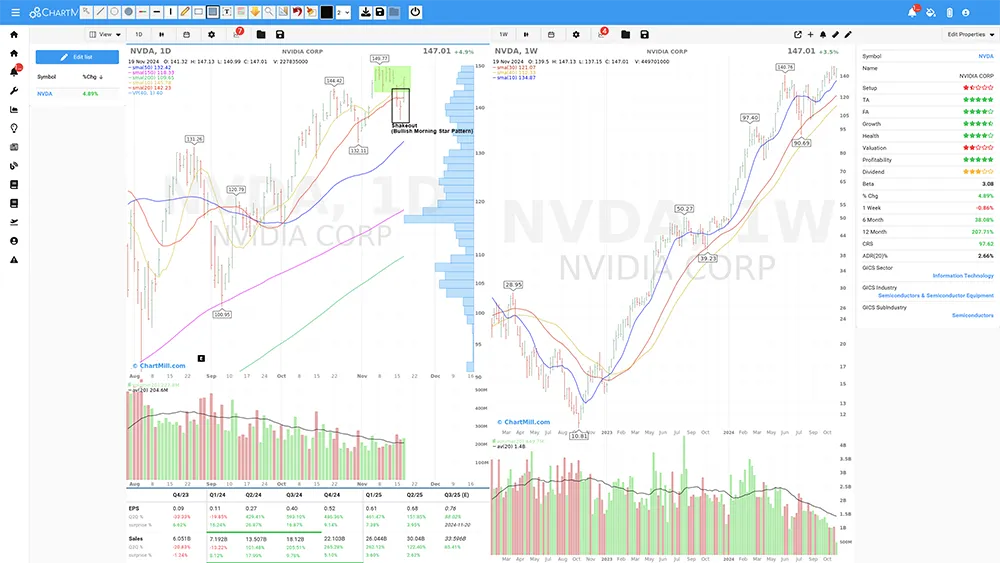

Stock Momentum and Valuation: Nvidia shares, which have nearly tripled this year, closed at $147.01 as of Thursday after market close. Morgan Stanley has raised its price target for Nvidia stock to $160, citing its strong data center growth and potential for long-term AI-driven expansion.

-

Supply Constraints: Despite high demand for Blackwell chips, analysts caution that supply constraints may temper Nvidia's near-term upside. However, significant upward revisions to its financial outlook are expected later in the fiscal year as production ramps up.

-

Margin Sustainability: Nvidia's gross margins remain a strong point, projected to stay in the mid-70% range. This reflects Nvidia's ability to profit efficiently even amidst high operational scale.

Chart

Conclusion

Nvidia’s upcoming earnings report is set to reaffirm its position as the AI industry’s leader, with soaring data center revenue and the launch of its Blackwell AI chips driving optimism.

Wall Street forecasts record Q3 results, including 85% revenue growth and nearly doubled net income. Investors should focus on updates about Blackwell shipments and any signs of supply chain improvements, as these factors will shape Nvidia's near-term and long-term performance.

With its stock surging and AI enthusiasm at an all-time high, Nvidia remains a critical player in the tech revolution.