What is Technical Analysis?

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

TECHNICAL ANALYSIS

This form of analysis assumes that all the information that can influence the value of a company is already incorporated into the stock prices. The price is thus completely driven by supply and demand where the seller sells based on his arguments but at the same time the buyer buys based on his opposite view. This game of supply and demand leads to rising, falling or rather sideways price movements. From this, short-, medium- and long-term price developments are then derived, as well as specific recurring price patterns.

Price Developments

Price Patterns

Very important within the field of technical analysis is the concept of "support" and "resistance". Investor sentiment and psychology play a major role in technical analysis.

Support and Resistance

Contrary to popular belief, technical analysis does not have the ability to predict future prices. The main purpose of technical analysis is to identify price areas where you can take a position with relatively low risk. This may be a position that tries to follow the existing trend, or it may be that the price level represents a certain extreme where the position taken assumes a trend reversal.

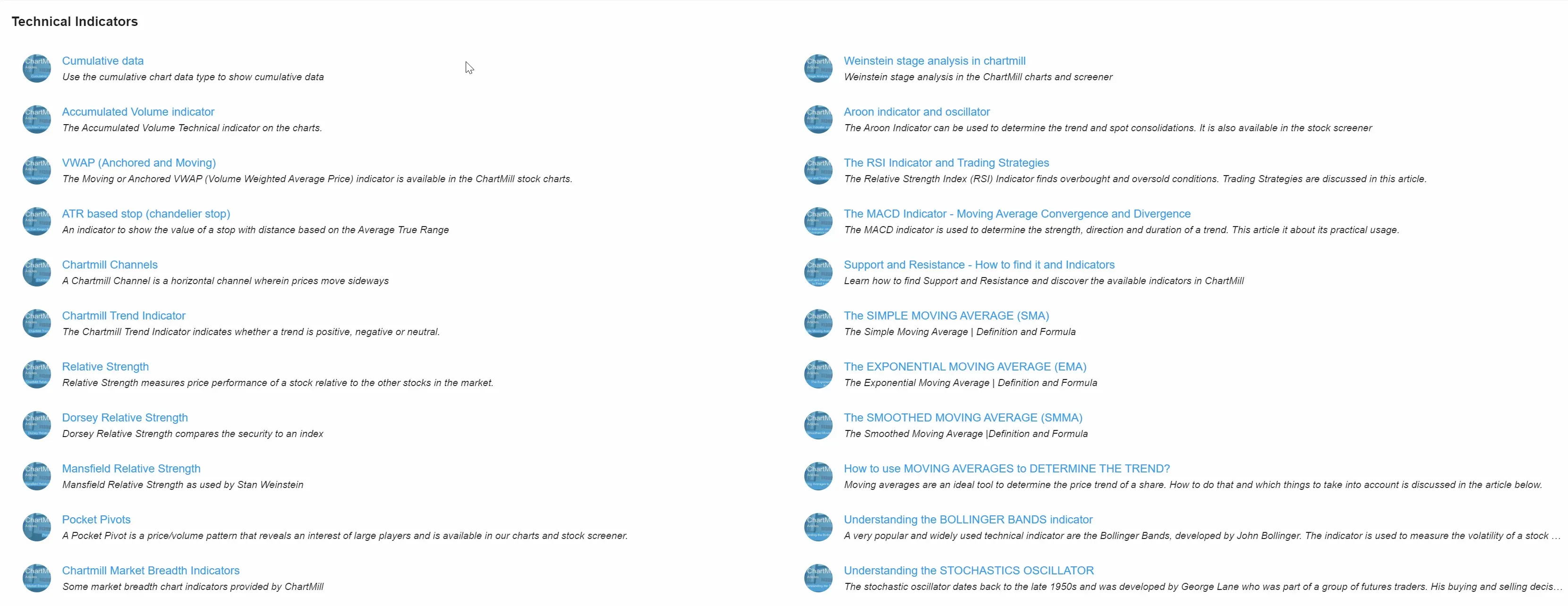

Within technical analysis there is a wide range of different technical indicators and oscillators available which, however, all have in common that they are based on the price development of the financial product to which they are applied. Those who use these indicators belong to the group of quantitative analysts.

Indicators are either "leading" or "lagging". In the first case, they try to say something about future price movement. Lagging indicators are used to confirm the existing trend.

An example of a leading indicator is donchian channels.

A simple moving average is a typical example of a lagging indicator.

Oscillators are also indicators, but they always show two extremes. If the indicator is in the upper extreme, it is overbought. On the other hand, if the indicator is in the other extreme, we are dealing with an oversold situation.

One of the best known and most popular oscillators is the MACD.

It is important to realize that indicators only have a "warning function" and can therefore only be used as additional information when interpreting the actual price chart. There is also a group of technical analysts who act purely on the basis of price patterns and visible trends on the charts. They use no or hardly any technical indicators but limit themselves to a purely visual analysis. This form of technical analysis is better known as the pure price action trading strategy.

Pros and Cons of Technical Analysis

Pros

- Technical analysis requires relatively little basic data, the only thing necessary is historical price data which is displayed visually on charts..

- The learning curve is much less steep than with fundamental analysis because the method is much more visual and direct. Recognizing a falling, rising or rather sideways trend is easy. Just like recognizing so-called support and resistance zones..

Cons

- A technical analysis performed by two different traders on the same price chart can be totally different. The method is therefore hardly quantifiable and highly subjective.

- The fact that certain price levels effectively work as support and resistance is, according to critics, purely related to the notion of 'self-fulfilling prophecy'. If enough people recognize a specific price level as support or resistance and act accordingly, it effectively becomes a level at which the price changes direction.

Chartmill offers you the possibility to filter on quite a lot of technical indicators and price patterns. In our documentation center you will additionally find many articles and videos in which we demonstrate how you can implement these indicators in your own trading strategies.

Technical analysis is just one method of determining whether or not a company is worthy of purchase. Fundamental analysis is an alternative way by which the fundamental investor tries to valorize the real intrinsic value of the company. In this article you can read how this is done (link to be added).

See how the two forms of analysis stand side by side in this summary article.