Fundamental and technical analysis : A brief summary

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

Fundamental and Technical Analysis : A brief summary

Fundamental and technical analysis are concepts that are undoubtedly familiar to those who invest themselves. Both methods are used to analyze companies/shares with the intention of deciding what and/or when something is considered as a good idea to buy or sell.

However, the two methods are vastly different and each has its pros and cons. To fully understand what the two forms of analysis entail, you should read the articles below that provide more info.

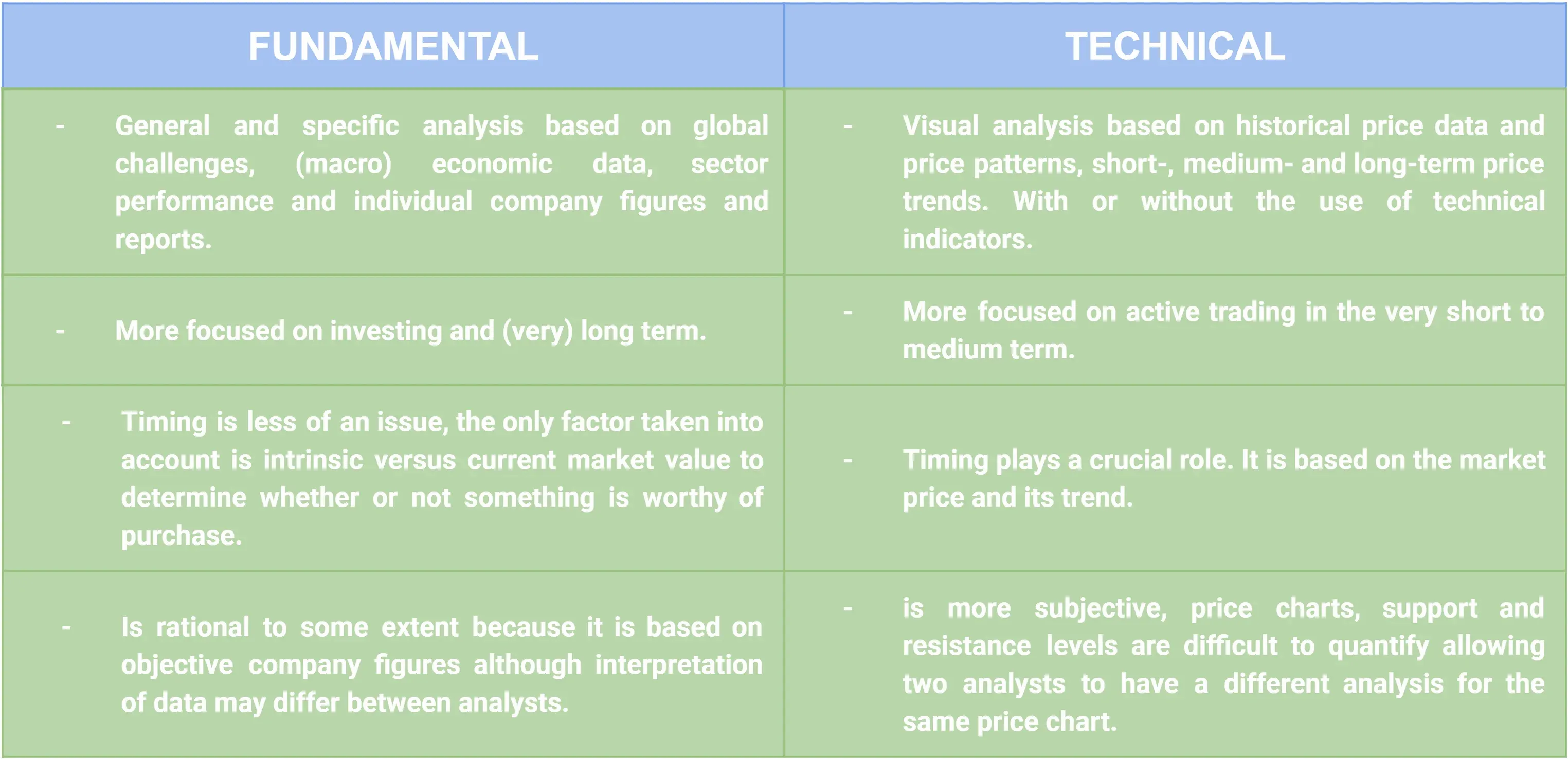

Main differences between FA and TA

Which is better?

For as long as the two models have existed, there have been proponents and opponents. Granted, the differences are great when the two are compared. A fundamental analyst looks for elements that tell him that the current value of the company is lower than the real value. As soon as he or she has come to that conclusion the company is considered to be worth buying. Contrary to the technical analyst who is convinced that all this information has already been incorporated in the price development. Only the price trend determines whether a stock is doing well or not. Where and when to buy or sell is mainly a matter of 'timing'.

Because every investor is unique, it is impossible to say what works best for you. But perhaps the best option is a combination of both ways?

For example, imagine a company which is considered very cheap on the basis of fundamental analysis. However, from a technical point of view that same company is not worth buying because the price trend is currently caught in a downward price cycle. Especially when the general market sentiment is negative, companies which are fundamentally sound can nevertheless be dragged along in a general market decline. In this way the fundamental investor risks buying far too early. Subsequently, a lot of patience will be needed before the position in the stock will yield a profit. Applying a few elementary rules from technical analysis can easily overcome this.

However, the opposite is also true.

Suppose that a technical analyst sees two charts of companies in the same sector where the price breaks out above a resistance level and both companies are equally worthy of buying according to the visual analysis. Fundamental analysis can then be an added value to see if both companies are quoting above or below their intrinsic value. The outcome can be an additional parameter to decide which of the two companies to trade.

Don't forget...

Whatever form of analysis you prefer, never forget that the analysis itself is only one part of a complete trading strategy. How much you invest and at what risk are other components which are at least equally important if you want to become and stay successful in the long term. This article series may be a good starting point to learn more about position sizing and risk management.