Mark Minervini Strategy | Think and Trade Like a Champion Part 2 | Trading Strategy

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jul 22, 2024

Mark Minervini Strategy

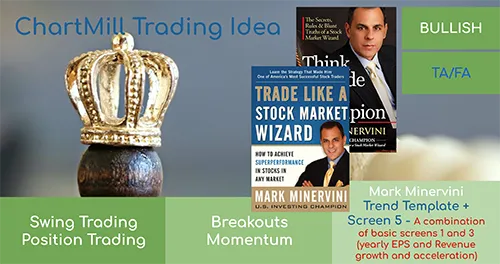

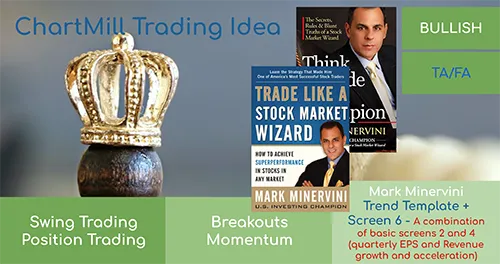

This article is a follow-up to Part 1 Think and Trade Like a Champion | Technical and Fundamental Filters.

In Part 1, we discussed the various technical and fundamental filters and provided some predefined screens you can use to find typical Minervini setups using ChartMill.

In this second part, we will continue with the actual strategy and provide answers to the following questions:

- What is the Volatility Contraction Pattern?

- Where and when does one open a position?

- Where do you place the initial stop-loss?

- From when do you move the stop-loss?

- When do you take profits?

- How big can a position be compared to your available trading capital?

- What is your max risk% on a new position (assuming your initial stop is hit)? ...

The info provided in this article is based on two Mark Minervini books, 'Trade Like a Stock Market Wizard' and 'Think and Trade Like a Champion'.

Important! Both of these articles on ChartMill are a good starting point but by no means replace the excellent books.

Not all concepts and terms are covered in this article. Therefore, it is highly recommended to read both books to fully understand and apply the concept and strategy.

Entering the Markets

The Volatility Contraction Pattern

One of the most important concepts in the book is the ‘Volatility Contraction Pattern’ (VCP). Its purpose is to determine as accurately as possible the price point at which a position may and can be taken while minimizing risk.

Simply explained - as the price moves into a consolidation pattern within its stage 2 - volatility should "dry up," so to speak. This becomes noticeable on the chart as the difference between successive swing highs and lows within the trading range becomes smaller.

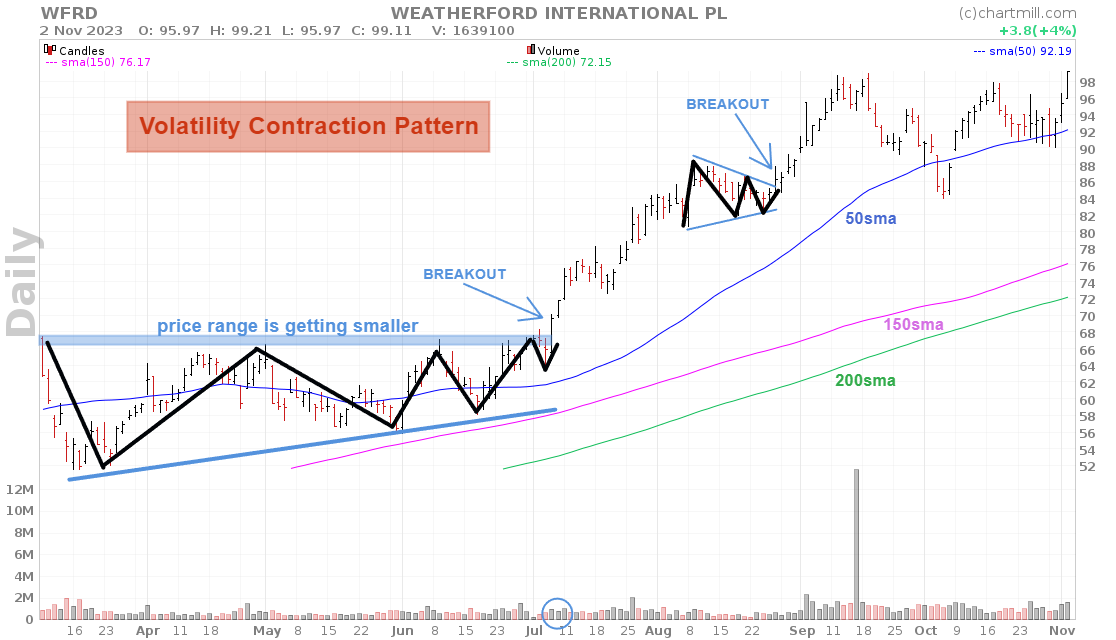

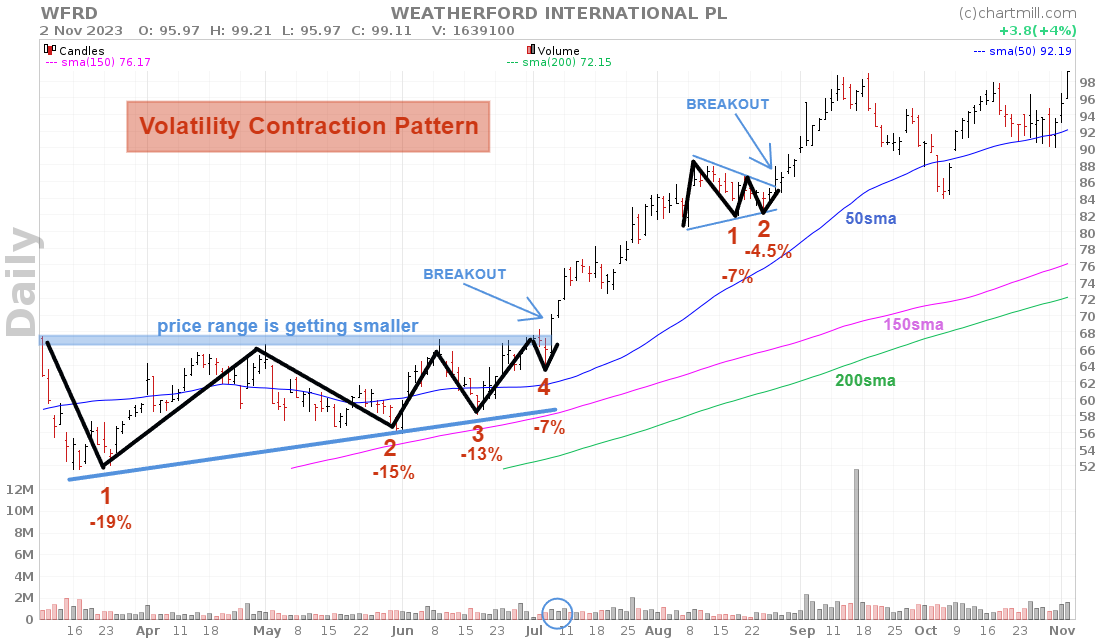

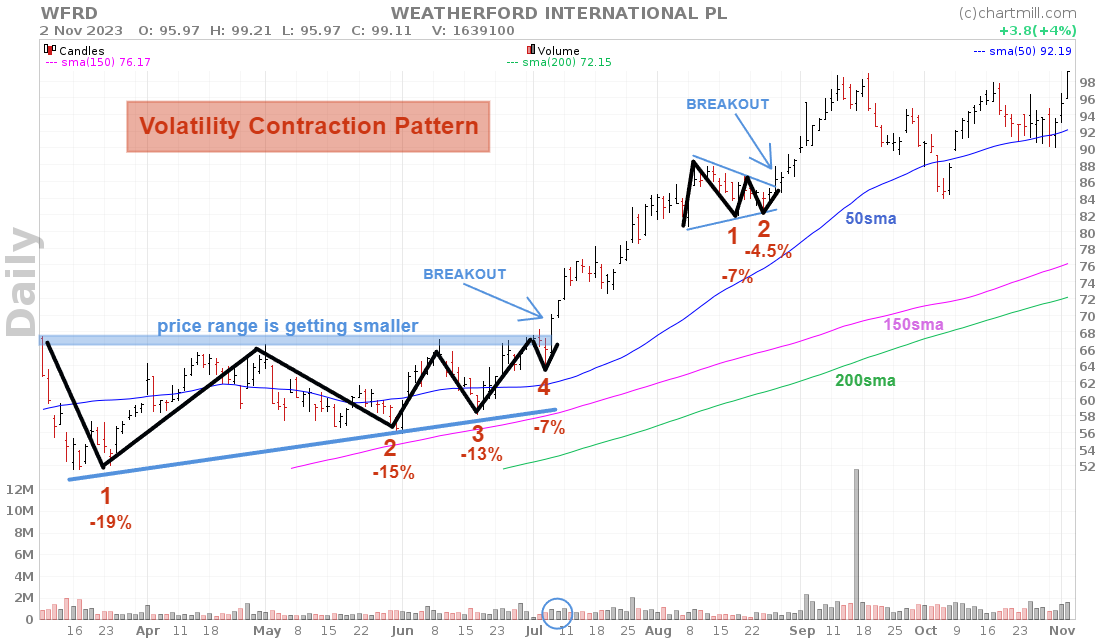

Below is an example in Weatherford stock (WFRD) with two VCP patterns visible on the chart.

Contraction counts

The number of contractions can vary but it is usually somewhere between 2 and 6.

The first contraction pattern in WFRD took almost 5 months before the final breakout occurred and it formed as an ascending triangle pattern.

The second pattern, in the form of a symmetrical triangle, was much shorter and lasted only about three weeks before the price broke out of the pattern.

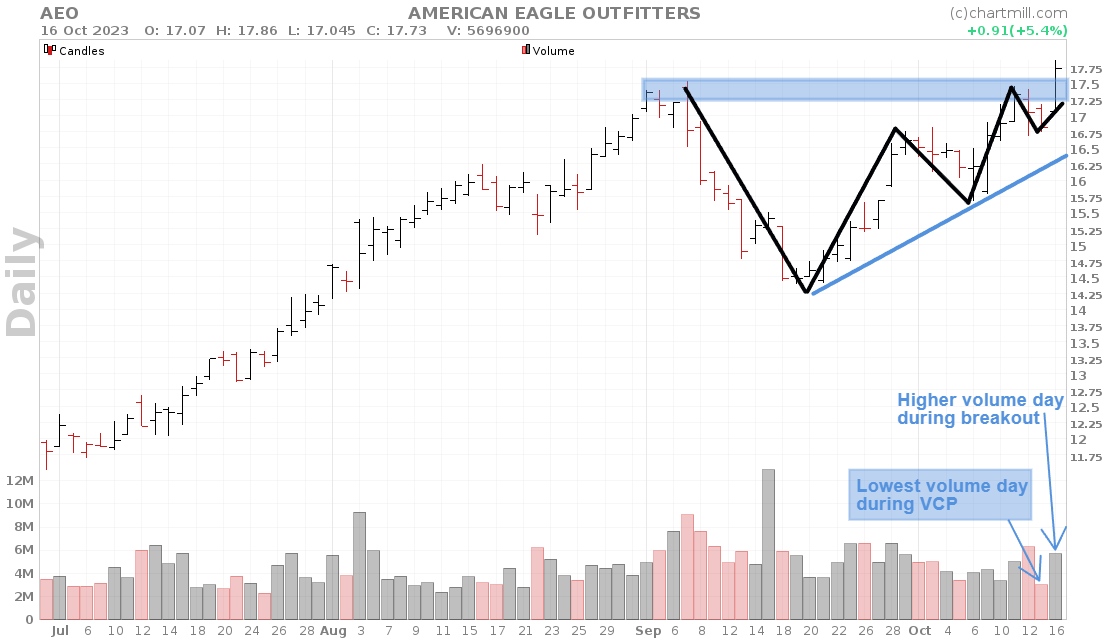

Volume in the VCP pattern

Volume plays a major role in interpreting the pattern. What is important is that the volume during down days is not significantly higher than the volume during up days and that towards the end the trading volume becomes noticeably lower.

Lower volumes during down days are an indication that supply is getting smaller and what is offered is accumulated quite quickly by institutional market participants. Sellers get outnumbered causing volume to fall and hence volatility....

Technical footprints

A technical footprint is a sequence of abbreviations used to quickly and accurately define several characteristics of a VCP.

The footprint consists of a number (number of weeks) for the period in which the VCP occurred, two numbers indicating the highest and lowest contraction, and finally, a number representing the amount of contractions that make up the VCP.

Applied to the two visible VCPs in terms of WFRD, we arrive at two technical footprints:

Footprint 1: "19W 19/7 4T"

19W = 19 weeks during which the VCP formed 19/7 = First (largest) and last (smallest) contraction 4T = number of contractions making up the VCP

Footprint 2: "3W 7/4.5 2T"

2W = 2 weeks 7/4.5 = First and last contraction 2T = a total of two contractions

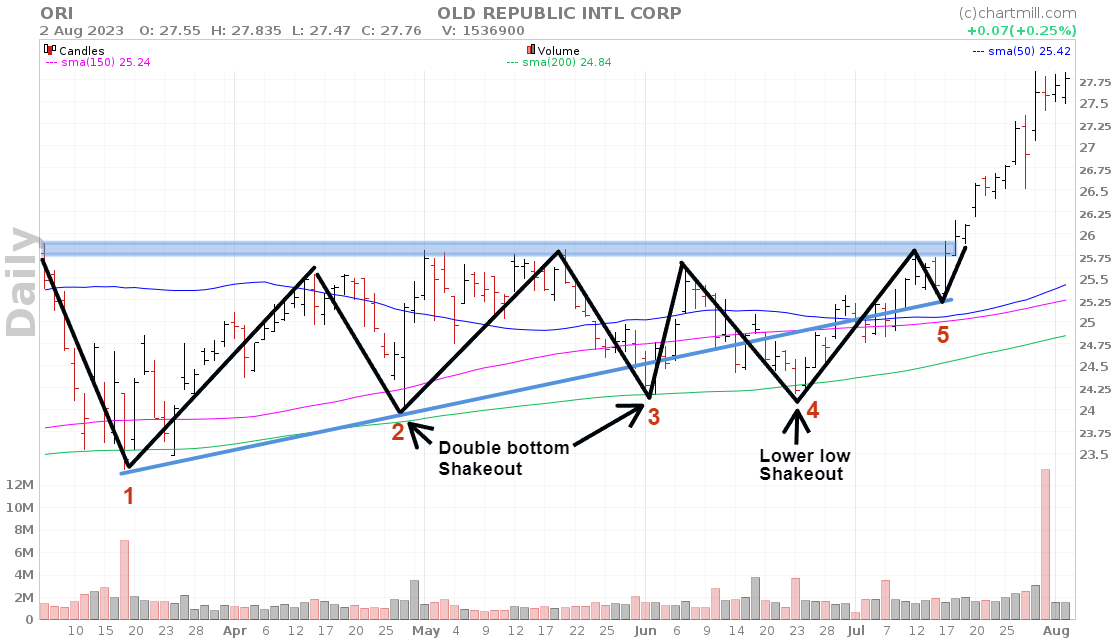

Shakeouts

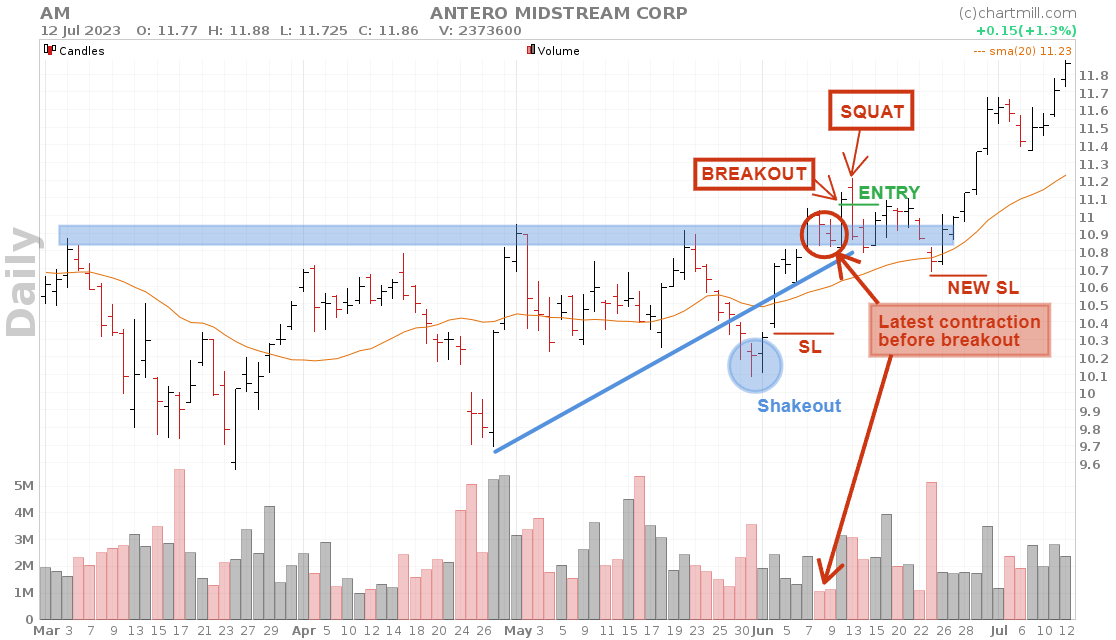

The examples above show the most ideal scenario. In many cases however, the setup will not present itself so perfectly. Thus, you will regularly encounter so-called "shakeouts”. What is meant by this is shown in the chart below:

As the pattern forms, the range in which the price moves becomes narrower (assuming we are talking about the perfect setup). Shakeouts occur when the price falls back below the most recent swing low in the VCP up to that point. This occurs in the chart above at point 4 where the price falls to just below point 3 and then recovers.

These are not exceptions. In fact, in reality, you will find far more of these setups than patterns where no shakeouts are visible at all.

The term 'shakeout' is not arbitrarily chosen... Many traders who bought near point 3, because of the double price bottom (formed by points 2 and 3), have their stop just below point 3. Initially, everything seemed to turn out well, but eventually, we got another price pullback, which triggered the stops located just below point 3. The earlier buyers are thus "shaken out" of the market.

Don't immediately remove a stock from your watchlist if you notice such a shakeout happening. These are false downward breakouts and if the price manages to recover from it rapidly, that is just a sign of strength. A VCP with several visible shakeouts therefore offers a greater chance of success.

Buying at the Pivot Point

The moment the stock breaks upward out of its most recent contraction is the time to take a position. It is the most optimal price point from a risk/reward standpoint.

The price action just before and during the pivot point is very important.

Lower than average volume just before the pivot point (ideally even 1 to 2 days of extremely low volume) followed by a sudden increase in volume during the actual breakout are the points that need attention.

3C Pattern

3C stands for "Cup Completion Cheat" and it is the earliest possible time you can take a position in a stock as a trader. Visually, this pattern looks like a cup-with-handle with the difference that there are two handles.

The first mini-handle is referred to as the "cheat" (because it feels somewhat like "cheating" according to the author).

This pattern will occur primarily during a general market correction.

The setup offers the advantage that you can take a position fairly early with a short stop-loss. If the position evolves favorably you can then extend the position as soon as the price breaks out above the second plateau (second handle).

Power Play

The Power Play is a High-Tight Bull Flag Pattern. It is the only pattern that may be approached purely from a technical perspective (without respecting fundamental conditions) precisely because it is so powerful.

First of all, it requires a lot of momentum because the pattern can only form after an initial very strong price increase. Furthermore, the setup does need to satisfy the volatility contraction parameters (narrowing price range with decreasing volume).

Conditions for a valid Power Play

-

Explosive price appreciation (+100%) with sharply increased volume within a time frame of about 8 weeks. Please note that stocks that are already late in their stage 2 phase do not qualify! The best setups are found with stocks that break out of their stage 1 vigorously.

-

This is followed by a period in which the price moves sideways within a narrow price range. The correction from the most recent top should be 20% to a maximum of 25% over 2 to 6 weeks.

-

Note that if the maximum correction is only 10%, there need not be any further price contraction because the correction itself is quite minimal.

False Breakouts (squats)

A false breakout occurs when the price breaks through resistance but falls back into the existing trading range the same day or the following day. Minervini uses the term squat for this.

No matter how good your analysis is, this will happen anyway. You can react very quickly by selling your position immediately (higher than your initial stop loss) but that is usually not the best option. Prices fluctuate and sentiment plays a major role. That is precisely what the initial stop loss is for.

Above all, keep an eye on the volume. If the decline is more or less 'controlled' and the volume remains relatively low, it is better to wait and maintain the original stop loss. Chances are that the price will eventually recover and continue to rise.

In the example below you can see the chart of the stock 'Antero Midstream Corp.' (AM). After the initial breakout on Oct. 10, the price fell back within the existing trading range on the next trading day.

However, the volume was slightly lower than the volume of the breakout candle. Initially, the stock moved sideways, its volume noticeably higher on bullish days.

The situation changed on the date of October 23 when the price fell quite firmly below the 20SMA (yellow ascending line). Pay particular attention to the volume that accompanied it. Such volume on a down day with a close below the 20SMA does provide a valid reason to tighten the existing stop-loss, on this occasion to just below the October 23 low. This is where we were lucky, the price recovered the following day and the rise continued.

But in case of a further decline, the position would have been stopped at a small loss.

Buy-Stop Limit Order

There are many ways to enter a position but the most appropriate order for this strategy is the “buy-stop limit order”. This is a combination of two orders, the “buy-stop market order” and a “limit order”

The buy-stop market part basically means that a market order becomes active as soon as the price reaches a certain price level.

The limit order allows you to set a maximum on the market price you are willing to pay. This protects you from unpleasant surprises... Suppose the market opens much higher (above your limit) then the set limit will prevent your market order from being executed.

More in-depth info can be found in this article; 'Which Order to Use when Buying Shares?'

Trading is a Business, the Importance of Risk Management

Losses are inevitable

Mark Minervini spends the last two chapters of his book "Trade Like a Stock Market Wizard" entirely on risk management and there is a good reason for doing so. No matter what strategy you use or how successful it is, if you don't control your risk you will fail sooner or later anyway.

With every new position you take, you must start with the question "What am I risking and what am I going to do to protect my capital to the maximum if things go wrong?". This is the only way to survive in the long run as a trader.

Avoiding big losers is key

Not all of your positions will be successful. Losses are inherently part of any strategy.

Loss positions, as such, are not a problem. Only how you deal with them can become a problem if you don't know how to control them.

There is only one important rule. Individual losses should always be kept small.

Five consecutive long positions where you get stopped out at your initial stop-loss are anything but fun, but it is not a tragedy if the individual loss per position is only 1% of your total trading account. After five losers you will be looking at a total loss of 5%.

However, if you took a 5% risk per position you will be looking at a loss of as much as 25% after those same five trades! Now that's a problem!

So focus on the size of your losers instead of constantly asking yourself how much you will earn with the winners.

You can start from a risk perspective in two ways:

Initial stop loss

Your initial stop loss is the most important order of all. It ensures that you draw a hard line to where you are willing to take risk. Once the price reaches that line, the position is irrevocably closed.

The size of the stop loss depends on your risk profile, but will normally range between 0.5 and 2.5%. For a first (test) position in a stock, it is best to start on the low side. When you notice that several initial positions quickly turn into profits and the probability of a new bull market increases, you can be more aggressive with your risk percentage.

A risk% of 0.5% on a trading account of $100,000 means that if your initial stop loss is hit, your loss should not exceed $500 (0.5% of $100,000).

If you use a risk percentage of 1.5%, your loss on that position will be $1,500.

A difference between 0.5% and 1.5% may not seem like much on paper but appearances can be deceptive... This becomes visible when you are confronted with a succession of loss positions. Suppose your initial stop loss is hit 6 times in a row:

6*0.5% = 3% loss on your total account

6*1.5% = 9% loss on your total account

That's a difference of a whopping 6% after just 6 trades!

Position Sizing

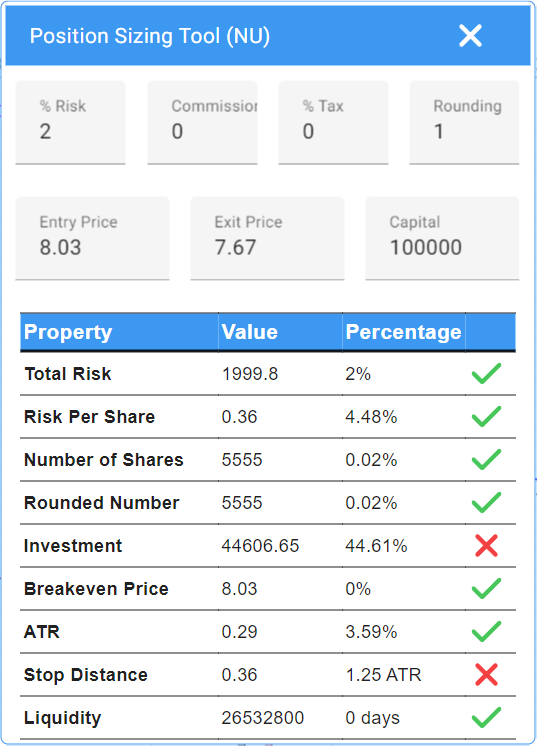

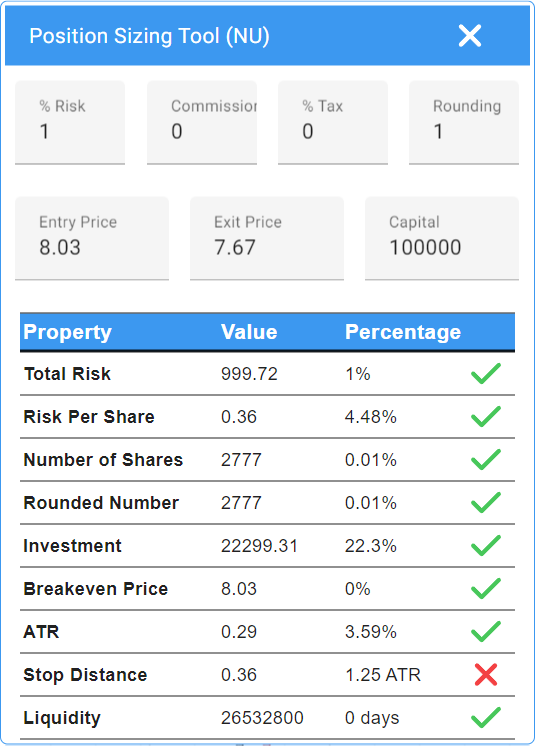

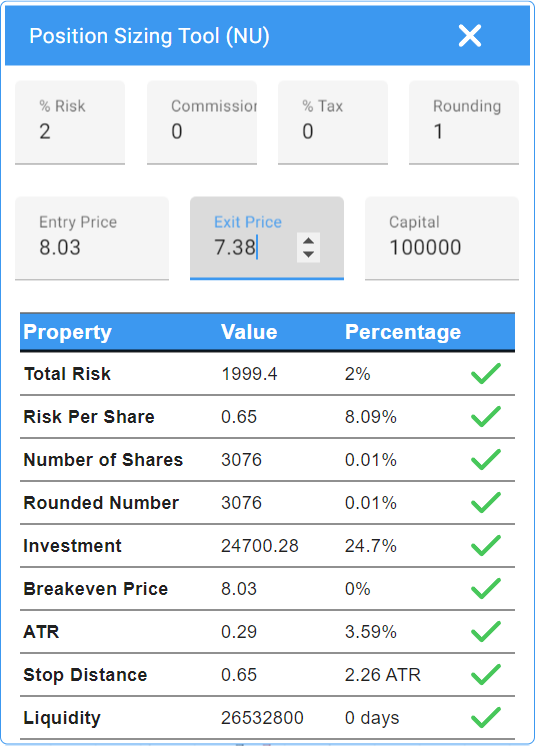

But it doesn't stop there. At least as important is the question "How many shares do I buy? Take a quick look at the setup below.

On the left is the daily chart, and on the right is the weekly chart of the ticker NU at the date of Oct. 18, 2023. This is a ticker that conforms to Mark Minervini's Trend Template. The fundamental criteria are not important for this particular example.

The weekly chart shows that the stock broke out of its stage 1 several months ago and is now forming a first base in its stage 2.

On the daily chart, we are looking at the formation of a 3C pattern (Cup Completion Cheat).

Suppose you want to go long as soon as the price moves above the cheat range. You set a stop market order at $8.03 with a limit of $8.08. The stop-loss is set at $7.67 (just below the cheat range). If the price hits your stop you want to risk a maximum of 2% of your total trading account (set at $100,000 in this example).

If we enter these parameters in our Stock Position Size Calculator we get the following data:

The risk is indeed limited to only $2,000 (2% of the total account size) but also consider the total amount invested. This setup requires a capital of over $44,000, which is about 44% of your entire trading account.

Now imagine that unexpected very bad news is announced about the company and the stock price opens 50% lower the next trading day.... This drops the total value of the investment from $44,606 to $22,303. That's an immediate loss on your total capital of more than 22%!

To avoid this, you can do two things:

Either lower the risk percentage to, say, 1%, in which case the investment lowers to $22,299. Or the stop loss can be placed further down ($7.38) lowering the total investment to $24,700.

In case the stop loss is set lower you also notice that the ATR warning disappears (visible if the stop loss is placed at less than 2 times the average daily range). You can read more about the Average True Range inthe following article 'Average True Range (ATR) Volatility Indicator'

The Stock Position Size Calculator gives a warning as soon as the invested capital in a single position exceeds 25% or ¼ of the total available trading capital. To be clear, that is a maximum.

When carefully entering new setups after a long-term downtrend, it is advisable to start smaller and, for example, start with half a position. In doing so, your investment in one position is thus limited to 12.5%. If you notice that your vision is correct you can gradually increase your order size to a full position.

Taking profits

Eventually, there comes a time when you take profits from the table. This can be done in many different ways but realize that no one way will allow you to always sell your position at the highest price.

There will always be positions where you sold too soon and others where you would have been better off cashing in profits a little earlier. It is vital that you follow a number of rules that allow you to trade according to a fixed framework.

First, a distinction should be made between selling during price strength or price weakness.

Selling during price weakness (when prices are falling)

Signs of price weakness after a rising trend include the size of the price drop and the volume involved.

For example, when the price shows the largest price decline since the beginning of the point at which you bought or (and) if the decline is accompanied by remarkably high volume, these are strong indications of weakness.

This is precisely what the stop loss is for. It will protect you if the price falls below the level at which you set your stop loss.

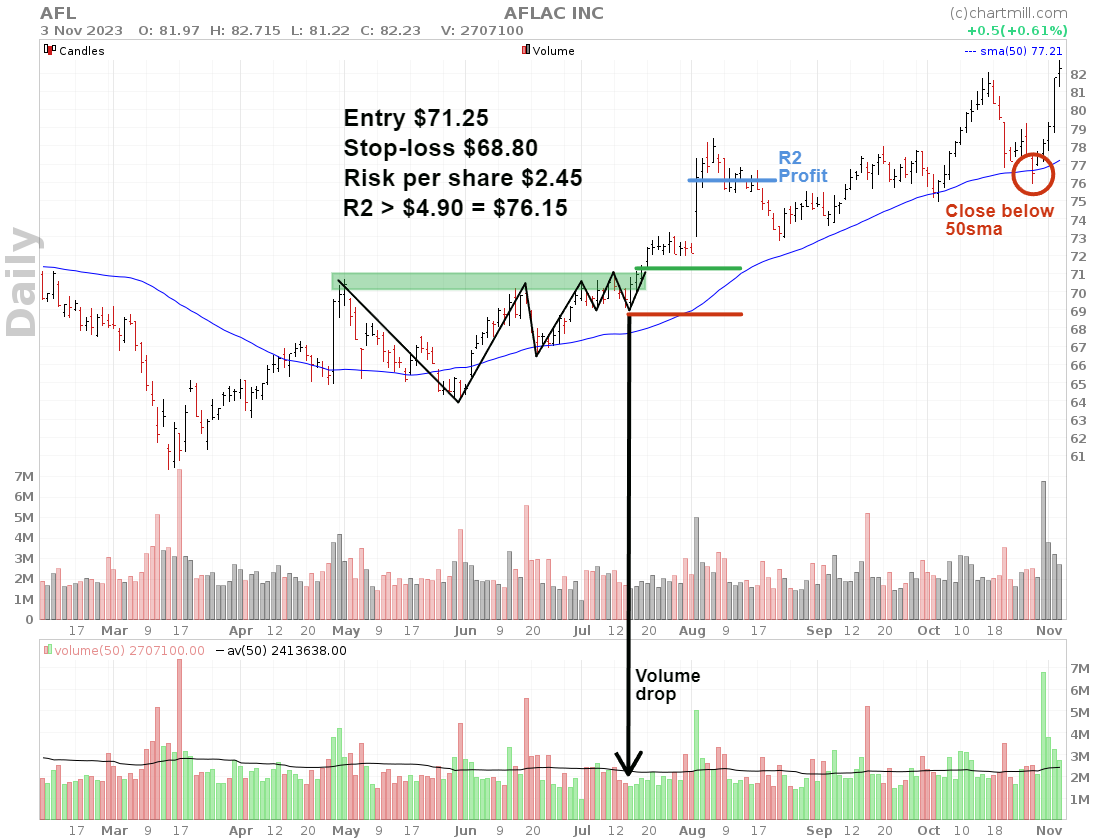

A fixed rule is that a position that shows a profit twice as high as the initial risk (a profit of 2R) should not turn into a loss. This is the so-called 'breakeven or better' rule. The stop is placed at breakeven from then on.

Whether you hold the entire position or sell half of it is personal. A useful guideline is - once the price has reached your breakeven price - to use the 50sma as a kind of trailing stop-loss.

As soon as the price closes below that average you sell (the rest of) the position or increase the stop loss to just below the low of that day. If the price opens or falls below the low the following day, the position is automatically sold.

Selling during price strength (when prices are rising)

Giving winners time and space to reach their full potential is one of the conditions for achieving exceptional results. The problem, however, is that you never know in advance how far the stock price will rise. A 100% price gain is impressive, but chances are you will find it much less impressive if it turns out after you have sold the stock, that the price has risen by many more hundreds of percent.

Selling into strength is therefore only advisable if you suspect a real "price extreme" situation. This occurs when the price has overshot so hard that it deviates to an extreme degree from the intrinsic value of the stock, even taking into account very optimistic prospects.

This increases the likelihood of a rapid and aggressive pullback. It pays to try to recognize such price extremes early on and anticipate them by securing profits.

First and foremost, the most important thing is to determine what upward phase the stock is in. A temporary price extreme resulting from an initial price breakout from stage 1 to stage 2 is not the time when you should sell during price strength. After all, the chances of this being a true Power Play are considerable.

However, the chart below shows a completely different situation:

-

MSTR shares are showing a real climax run after forming a fourth consecutive base in the same stage 2. In less than two weeks, the stock rose by a whopping 100% (from $650 to $1300).

-

In the period from January 22, 2021 ,to February 09, 2021, (13 trading days), the stock experienced 10 up days and only three down days (+75% up days).

-

During this surge several high volatility momentum gaps are visible and there is a real buyers' frenzy.

-

The largest up day on February 09 (+22%) is immediately followed by the largest down day (-23%). Both days also show the highest volume.

-

The biggest down day opens lower than the previous day's close (gap down). During the decline that follows, further exhaustion gaps are visible.

The volume on the down days after the largest down day on January 10, is much higher than the volume during the intervening up days.

The book also cites the P/E ratio as a kind of indication of a price extreme. When this ratio has roughly doubled since the time you bought your initial position, due to the very strong price increase, that is an additional indication of a price extreme.

No two situations are identical and making this kind of analysis based on an already known price trend is very easy. But at least it makes you think when faced with a similar situation, where a stock that has already risen quite a bit suddenly shows signs of a price extreme with a typical climax run.

That doesn't necessarily mean you should sell in a rush but armed with this knowledge, maybe it's the perfect time to protect those quick and easy profits in large part by raising your stop-loss quite aggressively?

One option in this case could have been to at least raise the stop-loss from the penultimate trading day before the final top (Jan. 08) to just below that day's low.

The day after that, on January 09 (when the top was formed) you could have done the same thing (raise stop-loss again to just below that day's low) and you would have finally exited around $1065 on January 10.

Progressive Exposure

Progressive exposure involves scaling in and out of positions based on current market conditions. In favorable market conditions, exposure is increased by taking larger positions. More information can be found in this separate article "Mastering Market Dynamics: The Benefits of Progressive Exposure"

Final Considerations

Trading Journal

Mark Minervini is a big proponent of keeping a trading journal. It gives you insight into several key elements that ensure you maintain consistency in your trading.

A good trading journal doesn't have to be super detailed. It does need to answer the following questions:

- What is the average size of your losers and winners?

- How many of your trades do you close successfully?

- What is your largest loss and profit position?

- How does the size of your losers compare to your winners?

- On average, how long do you hold a position?

This data is invaluable because such data gives an insight into what results you can expect in the long run, based on the results you have already achieved before. It goes without saying that the more data you collect, the more reliable the results will be.

His book "Think and Trade Like a Champion" devotes an entire chapter to it.

Picking bottoms

Trying to predict tops and bottoms is the best way to see your capital evaporate at a rapid pace. Saying that a price bottom "will be reached by now" because the price has already fallen 80% (from $100 to $20) is nonsense. Few people seem to realize that if in the following days, weeks or months the price drops further from $20 to $5, that is another drop of 75%!

It is much easier AND more effective to focus on stocks that are already rising because that way you are trading in the direction of the existing price trend.

Diversification

Diversification across sectors and industries is seen as the holy grail to spread your risk as effectively as possible but it offers little to no protection in the event of an overall market decline.

This is because it makes little difference what type of stocks you own if stock market sentiment becomes truly negative. During a true bear market, all stocks plummet.

At best, specific sectors may fall slightly less but all stocks undergo the negative sentiment, including so-called "quality" stocks. These are the stocks of companies that have excelled for several consecutive years with solid earnings and impressive margins and also have a decent pile of cash to be well-armed against a temporary economic downturn.

With a long-term horizon, these are undoubtedly the best stocks to own, but as a trader, you are not so much focused on the very long term but mainly want to take advantage of momentum. That requires that you will sometimes be heavily invested in one or a few sectors because that is where the strongest performers are.

Managing your risk is done by paying attention to the size of your positions and the risk associated with each individual position according to your available trading capital.

Trade Safe!

Kristoff De Turck

Co-founder - ChartMill

Disclaimer - This is not financial advice. Our content is intended to be used and must be used for information and education purposes only. Please read our disclaimer and terms and conditions to understand our obligations.