Strong Growth Stocks with good Technical Setup Ratings

The Strong Growth Stock Technical Setups combines Technical and Fundamental analysis and will filter for technical breakout patterns in stocks which are growing strongly while having decent profitability and health.

Analyzer Intro

The analyzer module introduced

Martin Zweig Stock Screener: growth at reasonable price (GARP)

The criteria described by Martin Zweig find growth stocks at reasonable prices, also known at the GARP style. We will discuss the rules of the stock screener in this article.

Peter Lynch Investment Strategy in the stock screener

An overview of the investment rules and strategy by Peter Lynch as described in the book One Up On Wall Street and the implementation in the stock screener.

A CANSLIM stock screener – finding high growth market leaders

This article describes our CANSLIM base screen.

Dividend Stock Versus Growth Stocks | Discover What Fits You Best

Choosing between dividend stocks and growth stocks is an important consideration for investors looking to build or diversify their portfolios. Both types of stocks offer unique advantages and carry different risks.

Mark Minervini Strategy | Think and Trade Like a Champion Part 2 | Trading Strategy

Mark Minervini Strategy to Achieve Superperformance in Stocks in Any Market

Mark Minervini Strategy | Think and Trade Like a Champion Part 1 | Technical and Fundamental Filters

Mark Minervini, two-time U.S. Investing Champion, uses a strategy that combines both technical and fundamental analysis with tremendous attention to risk management as the key to long-term success.

The Zulu Principle by Jim Slater

Making Extraordinary Profits from Ordinary Shares

Fundamental Growth Filters

A description of the fundamental filters related to stock growth, like EPS and revenue growth.

Growth Investing Stock Screener Settings: find the best growth stocks

An overview of the best stock screener filters, settings and criteria for Growth Investing

What is Growth Investing?

Stocks that are expected to grow significantly faster than their sector peers and the overall market average are considered growth stocks. Investors who invest in growth stocks do so specifically because they expect the price of the stock to rise exponent

The ChartMill High Growth Momentum Rating

The ChartMill High Growth Momentum Rating evaluates different aspects of a high growth momentum stock and summarizes it into a single rating

Louis Navellier's Little Book That Makes You Rich – Screener Settings

A stock screener based on the rules and strategy described in the book "The little book that makes you rich", by Louis Navellier.

Fundamental Analysis Reports and Ratings

Fundamental analysis reports for growth, valuation, health, profitability and dividend.

Related Videos

Finding Trading Setups Using the Predefined ChartMill Screens

In this video I discuss a number of potentially interesting shares that were spotted with the predefined screens in our stock screening tool Chartmill. At the same time I show you how to manage your risk properly using the position sizing tool.

How to find financially sound Growth, Value or Dividend stocks that quote at key technical levels?

In this video you will learn: How to use ChartMill to find financially sound growth, value or dividend stocks using the predefined ChartMill Fundamental ratings And then use the technical screening capabilities to focus on stocks whose price currently coincides with a key technical price level, either support or resistance levels. The beauty of this is that we start from a fundamental perspective by first filtering on the basis of specific fundamental criteria. Within that selection, we then look specifically for price technical characteristics. In this way we combine fundamental with technical analysis.

Finding Growth Stocks Using Individual Screening Filters in ChartMill

Finding Growth Stocks Using Individual Screening Filters in ChartMill: In this video, I demonstrate how to use multiple fundamental, technical and volatility filters with the stock screener ChartMill in no time to find immediately useful setups in typical growth stocks.

Finding High Growth Market Leaders | a CANSLIM Trading Idea by ChartMill

Finding High Growth Market Leaders is a popular strategy. However, spotting these specific stocks is not easy. In this video, I show you how to quickly and accurately create a basic first list of stocks to consider using the O'Neill CANSLIM Trading Idea by ChartMill. The parameters used come from the book "How to Make Money in Stocks: A Winning System in Good Times and Bad" by William O'Neil. The book was first published in 1988 and has been revised repeatedly since then. In the book, fundamental criteria are used to determine which stocks meet the requirements, technical criteria combined with a general analysis of market direction further determine when to buy the stock.

Peter Lynch | One Up On Wall Street | Screening Stocks Like Peter Lynch

"One Up on Wall Street" is a highly regarded investment book written by Peter Lynch, a renowned investor and former fund manager. Published in 1989, the book provides valuable insights into Lynch's successful investment strategies and offers guidance on how to identify profitable investment opportunities.

How To Screen for Growth Stocks that have Earnings or Revenue Surprises

Growth stocks with strong quarterly earnings and revenue results are popular among swing traders, especially when the results are (much) better than what analysts expected. ChartMill allows you to specifically screen for stocks with such earnings or revenue surprises. In this video I show you exactly how to do that.

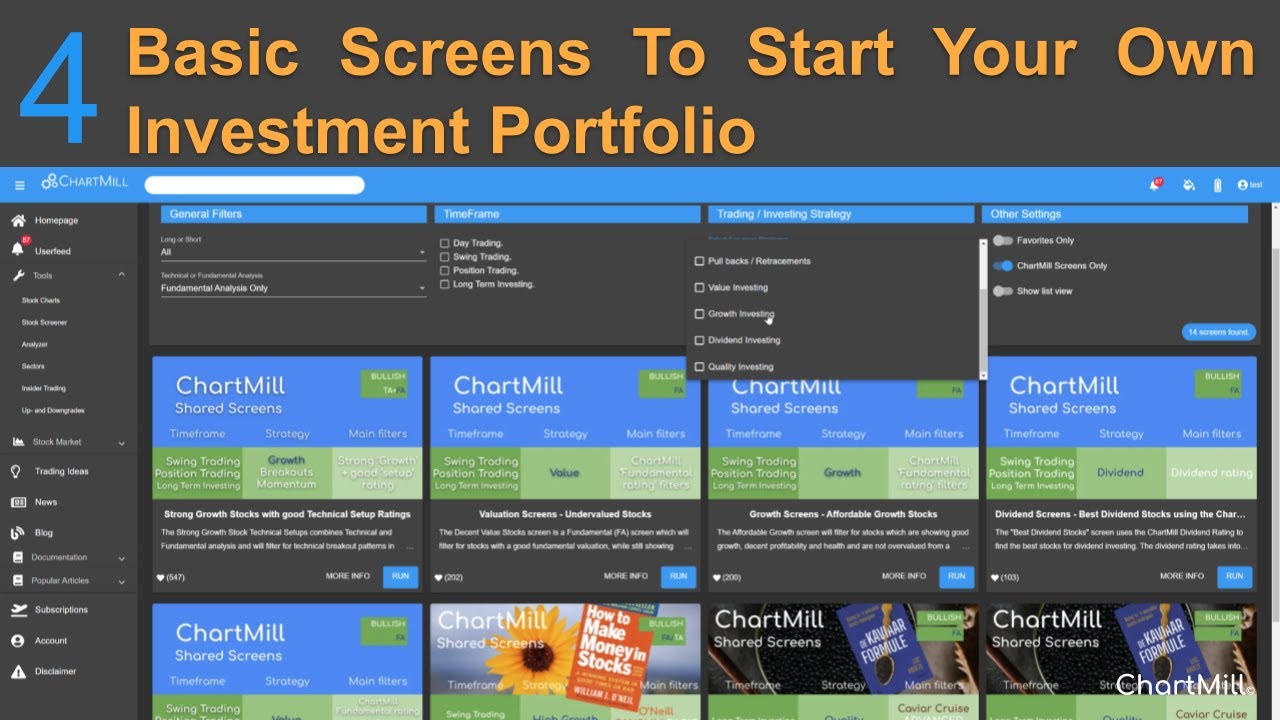

4 basic fundamental screens that will boost your search for the best stocks.

Investors come in different styles and sizes. In this article we take a look at four different fundamental screens that can serve as a basis for building your own investment portfolio with ChartMill. I'll explain what each style entails and what basic filters you can use in ChartMill to get a first basic selection.

A beginner's guide to growth investing: Reflections on "The little Book That Makes You Rich" by Louis Navellier.h

The Little Book That Makes You Rich is a beginners guide to investing in the stock market, with a focus on growth investing. The author, Louis Navellier, provides a framework for identifying and investing in high-growth companies, and offers insights on how to build a diversified portfolio. The book also includes information on market trends and strategies for managing risk. It is one of several books Navellier has written on investing and personal finance. ChartMill has translated the rules in the book into a trading idea that allows you to look for stocks that meet the selection criteria.

Spot the Next Big Winner: Introducing Our High Growth Momentum Filter

The High Growth Momentum Rating Filter This new filter is designed to help you identify stocks with outstanding growth potential by analyzing key performance indicators.

How to find GROWTH STOCKS that could become tomorrow's LEADERS?

Growth Stocks are expected to grow significantly faster than their sector peers and the overall market average. Investors who invest in growth stocks do so because they expect these companies to become the next industry leaders, allowing for large exponential price gains.

Chartmill Growth Rating: Rating >= 8

A ChartMill Fundamental Growth Rating of at least 8. This means the company shows strong growth.

Average Volume: 50 SMA > 500K

Minimum liquidity

Chartmill Profitability Rating: Rating >= 5

A ChartMill Fundamental Profitability Rating of at least 5. This means the company has decent Profitability metrics.

Chartmill Health Rating: Rating >= 5

A ChartMill Fundamental Health Rating of at least 5. This means the company is financially healthy.

Price: Above 20

A minimum price

Chartmill Setup Quality: SetupQ >= 7

A ChartMill Technical Setup Quality of at least 7. This means the stock shows a decent Technical setup pattern and allows a good entry and exit.

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.