Fundamental Growth Filters

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Jul 22, 2024

In this article we will discuss the available fundamental filters related to the Growth of a stock. All these filters are available in our stock screener and can be found on the Growth tab.

EPS Growth

EPS Growth tells us something about the earnings growth a company is achieving. There are different intervals at which this filter can be used. For example, you can choose EPS Growth 1Y, which compares the earnings growth of the past 12 months with that of the previous 12 months. EPS Growth 5Y calculates the average annual growth for the past 5 full years.

Alternatively, EPS Growth next Y compares earnings growth for the current year with an estimate of earnings growth for next year. EPS Growth next 2Y goes one step further and compares current earnings growth over the next two years (estimates). EPS Growth Q2Q does not use full years but only quarters. It compares earnings in the last reported quarter with earnings in the same quarter in the previous year. (For example, Q1 17 is compared to Q1 2016).

Earnings growth per share is an important factor in accurately valuing a company. Suppose company A achieves earnings per share of 5 and company B achieves earnings per share of 7. At first glance, company B seems like a better option because of its higher earnings per share. But if the next year it turns out that the earnings per share for company A has increased from 5 to 6 and for company B from 7 to 8, the situation is a little more nuanced.... After all, the earnings growth for Company A is 20% while that for Company B is "only" +/- 14%.

Large-scale companies will realize a rather stable but slightly weaker profit growth, while the same profit growth will be rather more volatile for young (growth) companies.

Revenue growth

This concept really needs little explanation. It is about the revenue growth a company achieves. Again - as with EPS Growth - multiple intervals are possible, both in the past and in the future.

Earnings growth should always be interpreted in conjunction with sales growth. After all, increasing sales is the most important condition for higher profits. Higher profits without an improvement in sales are possible but that is anything but structural profit growth. Such profit growth is mainly achieved by paying closer attention to costs and reducing them where possible. There is absolutely nothing wrong with that in itself but the effect is not long-lasting.

EBIT-Growth

EBIT represents a company’s net income before accounting for income taxes and interest expenses. It allows us to analyze the performance of a company’s core operations without the influence of tax expenses and the costs of the capital structure. EBIT is useful when comparing companies with varying capital structures.

Again, you have the option of looking at past growth (1,3,5 years) or taking into account forecasts (1,2,3,5 years).

Read more detailed information about EBITDA and EBIT.

OCF and FCF Growth

OCF (Operating Cash Flow) represents the cash generated from a company’s core operations. It includes cash inflows and outflows directly related to the business’s day-to-day activities. OCF helps assess a company’s short-term liquidity. By analyzing OCF, you can ensure that the company has enough cash to cover expenses and keep operations running smoothly.

FCF (Free Cash Flow) represents the cash available after covering all operating expenses, capital expenditures, and working capital needs. FCF allows a company to invest in growth opportunities. Positive FCF supports capital expenditures (such as buying new equipment or expanding facilities).

Read more detailed information about Cashflow.

EPS/Revenue Acceleration

This filter checks for growth acceleration by comparing quarterly performance (e.g., Q4 2023 vs Q4 2022) with the Q3 2023 vs Q3 2022 performance. Up to 4 quarters and 3 full years can be compared in this way.

Read more detailed information about EPS/Revenue Acceleration

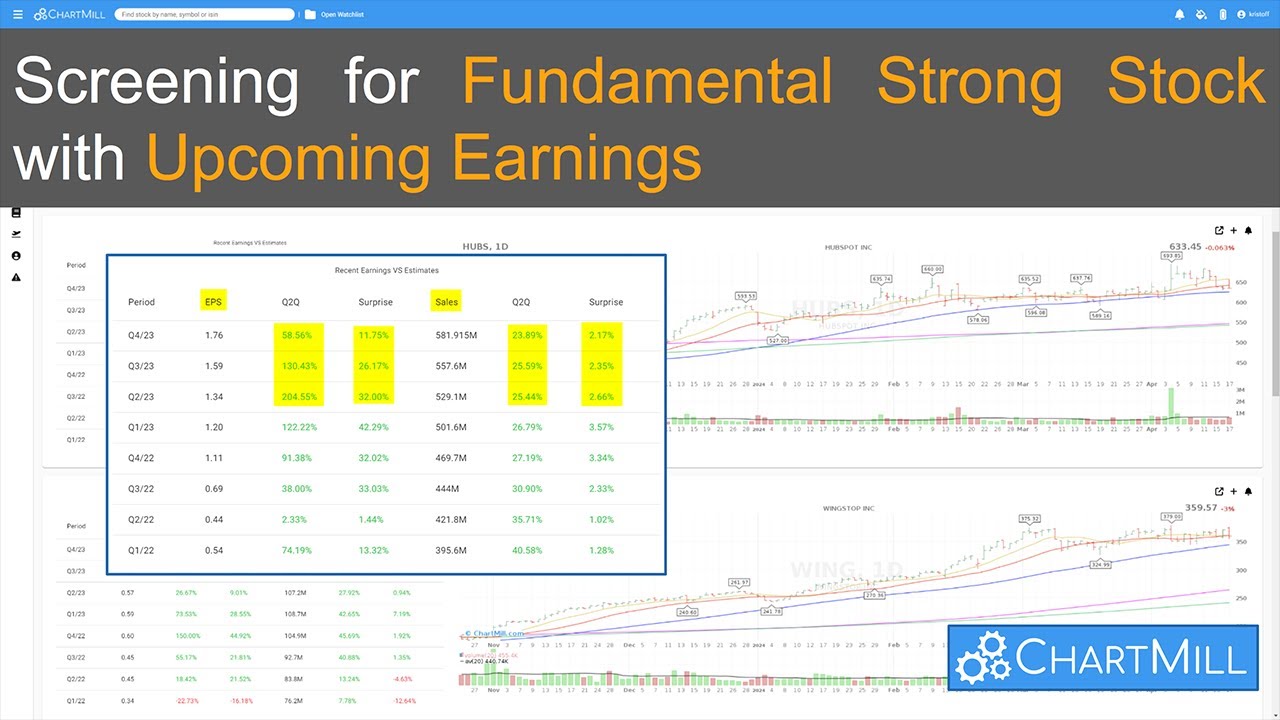

EPS/Revenue Surprises

An earnings surprise is a deviation from reported operating results, a significant difference between what was estimated in advance by analysts based on the financial data known about a company and the final publication of those figures. Such earnings surprises will almost always translate immediately into a corresponding and sudden price reaction with increased volatility.

Read more detailed information about EPS/Revenue Suprises

Related Articles

Fundamental Health Filters

In this article we will discuss the available fundamental filters related to the Financial Health of a stock. Read More...

Fundamental Valuation Filters

In this article we will discuss all the available fundamental filters related to the Valuation of a stock. Read more...

Fundamental Profitability Filters

In this article we will discuss all the available fundamental filters related to the Profitability of a stock. Read more...

Fundamental Dividend Filters

In this article we will discuss all the available fundamental filters related to the Dividend of a stock. Read more...