Retracement Screens - Using the Bullish Hammer Pattern

This screen searches for minor price retracements while a bullish hammer pattern is formed.

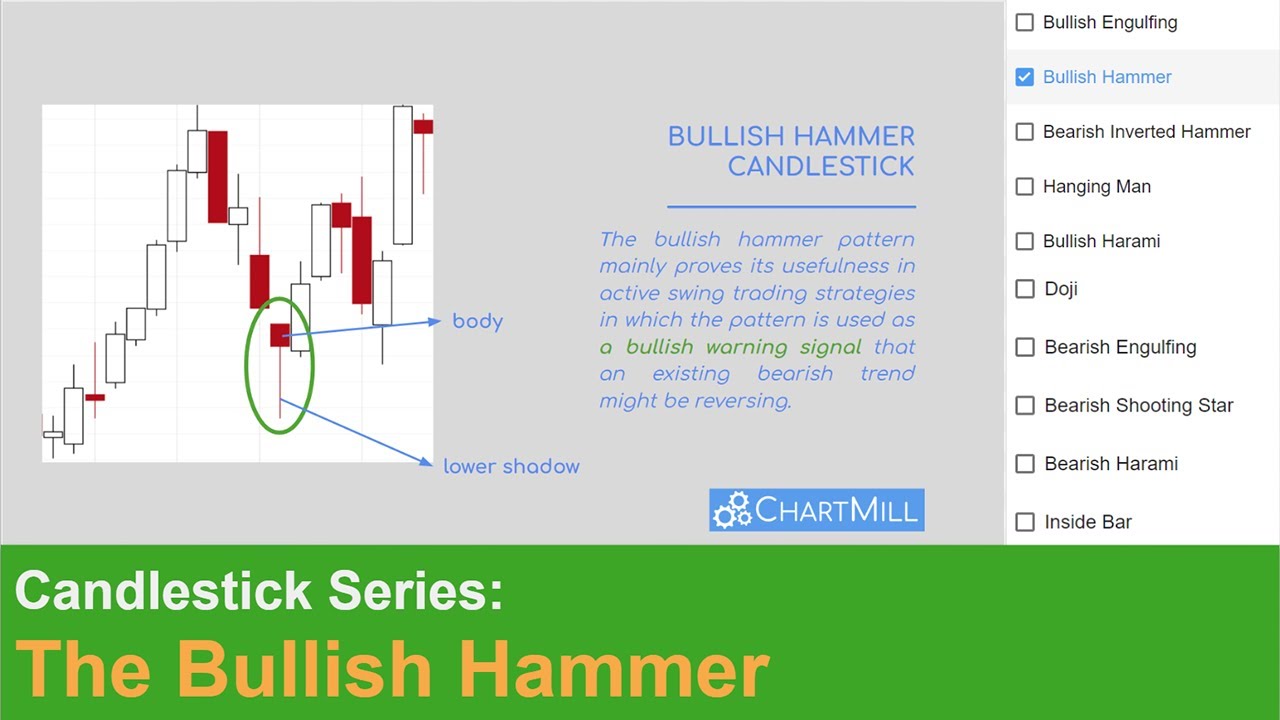

The Bullish Hammer Candlestick Pattern | Definition

The bullish hammer candlestick pattern is a candlestick pattern in technical analysis that proves especially useful in active swing trading strategies in which the pattern is used as a warning signal that an existing bearish trend could reverse.

Related Videos

The Bullish Hammer Candlestick Pattern in Technichal Analysis

Candlesticks come in all shapes and sizes, they are used as a component within technical analysis.. One of them is the bullish hammer. This specific candlestick pattern mainly proves its usefulness in active swing trading strategies in which the pattern is used as a warning signal that an existing bearish trend might be reversing. By combining this pattern with other candlesticks before and after the bullish hammer itself, even real reversal signals arise, consisting of several consecutive candlesticks, which benefits the reliability of the signal.

Average Volume: 50 SMA > 300K

Minimal liquidity

Price: Above 5

To avoid penny stocks

Candlestick: Bullish Hammer

Act as a reversal pattern

Signal: New 5 day Low Today

To identify the price pullback

ChartMill Trend: Long Term Trend Neutral or Positive

Main trend has to be neutral at least

To recognize the candlestick pattern

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.