The Retracement or Pullback Strategy

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

INTRO

A retracement strategy involves looking for stocks in a long-term rising trend whose price is experiencing a temporary dip. The trader tries to take advantage of this price dip to take a position in the direction of the existing trend.

The retracement technique is opposite to the breakout strategy where a position is taken when the price breaks out above a specific price level. A specific breakout strategy based on a breakout above the 52-week average has already been described in this article with a corresponding filter screen in ChartMill.

CONDITIONS FOR A RETRACEMENT STRATEGY (LONG)

TREND

Before there is any question of a price reversal, it must be clear that the stock is in a clearly positive long-term trend. This can purely be done visually by the trader himself but the disadvantage is that manual scanning is subjective, takes a lot of time and is therefore not very efficient. By using multiple moving averages you can determine the trend much easier and moreover, completely objectively.

Rising SMA200

The SMA200 is a widely used moving average that is watched by both technical and fundamental investors. This moving average is considered a long-term indicator. A stock whose price is above this rising average is considered to be in a long-term rising trend, anything below this average is considered to be in a negative trend.

Rising SMA50

The SMA50 determines the medium term price trend. Stocks whose price is above this rising average are seen as rising in the medium term. If the price is below this average, the medium-term outlook for the stock is negative.

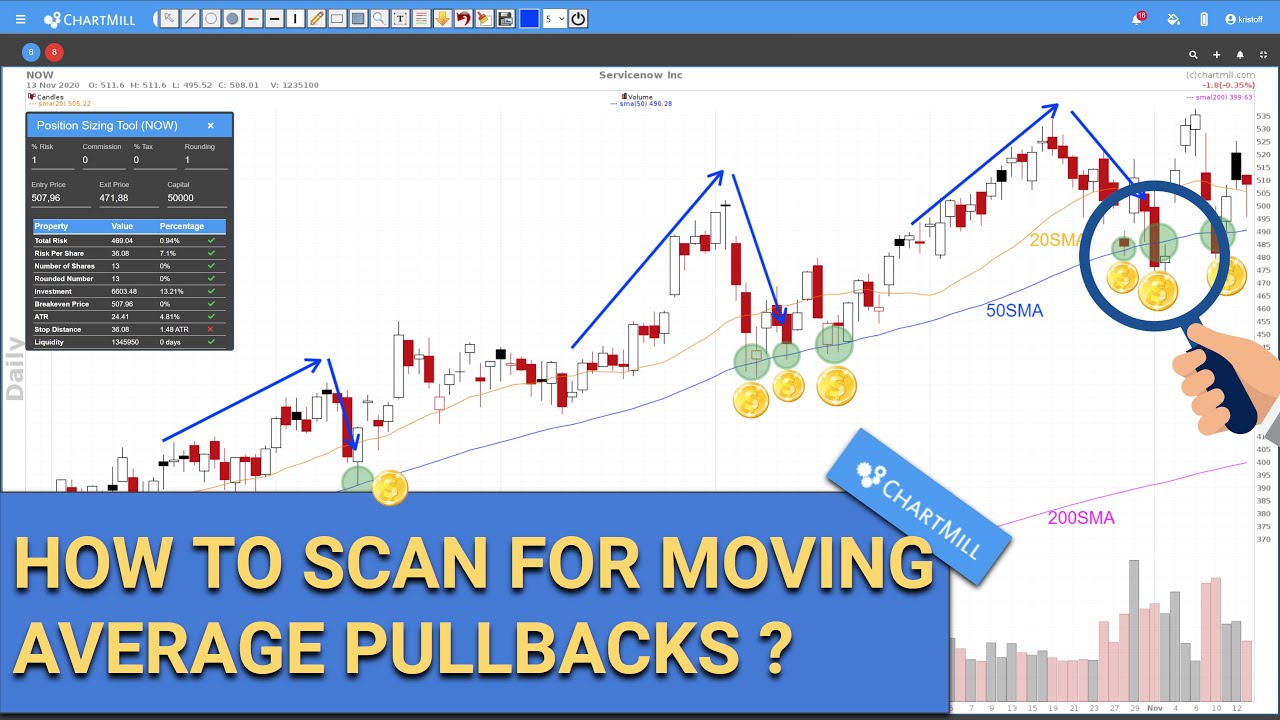

Rising SMA20

Finally, the SMA20 is a representation of the short term. Stocks whose price is above this rising average are seen as stocks that are rising in the short term. If the price is below this average, the short term for the stock is negative.

TYPES OF RETRACEMENT STRATEGIES

There are a whole range of strategies that attempt, on one basis or another, to respond to a temporary decline in price. Below we list just a few possibilities:

MOVING AVERAGES RETRACEMENTS

This is a strategy based on a price decline to a specific moving average. The time interval used for this strategy depends on the trader. Very active traders can use an SMA10 in a strong upward trend, swing traders will rather look for a price drop to the 20 or 50SMA. Long term investors or position traders mainly keep an eye on the 200SMA.

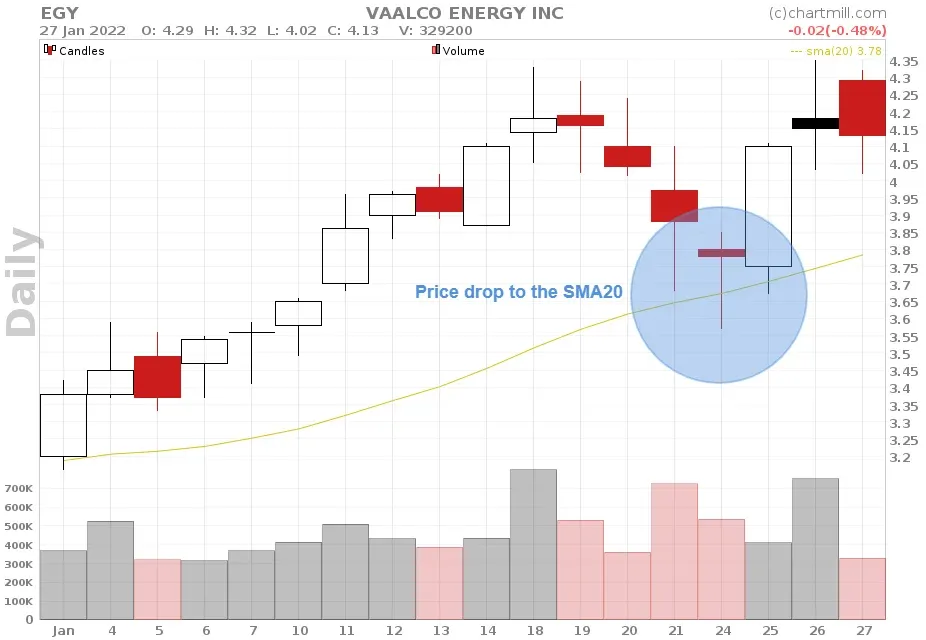

Below is an example of a stock in a rising trend with a decline to the 20SMA.

FIBONACCI RETRACEMENTS

This strategy uses the Fibonacci indicator to identify entry points in a stock that is experiencing a temporary pullback in a rising trend.

PRICE SUPPORT RETRACEMENTS

After an initial break-out above a significant price level, in many cases a retest will take place at the level of the initial break-out. This price dip is then used to take a long position.

TREND LINE RETRACEMENTS

An ascending trend line is formed by connecting two price points which together define the bottom of the trend line. The green circle is the level at which price has fallen to the extension of the trend line formed by points 1 and 2 and at which retracement traders may take a long position, speculating on a further rise in price after the trend line test.

Retracement or pull back strategies are often used in swing trading. The temporary price pullback is used to take a position in the direction of the existing main trend.

WHY CHOOSE A RETRACEMENT STRATEGY?

The main advantage of a retracement strategy is that the entry can be done very precisely as a result of which the stoploss can be kept quite short. Also psychologically, for many traders it is easier to buy stocks whose price has dropped a bit than stocks which are just reaching a new high (breakout strategy).

HOW TO FIND STOCKS THAT QUALIFY FOR A RETRACEMENT STRATEGY?

In this article and video, I show how to use the ChartMill stock screener to arrive at a selection of stocks that offer great opportunities for traders or investors who want to use the retracement strategy.