Swing Trading Momentum Screens : Retracement setups

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

INTRODUCTION

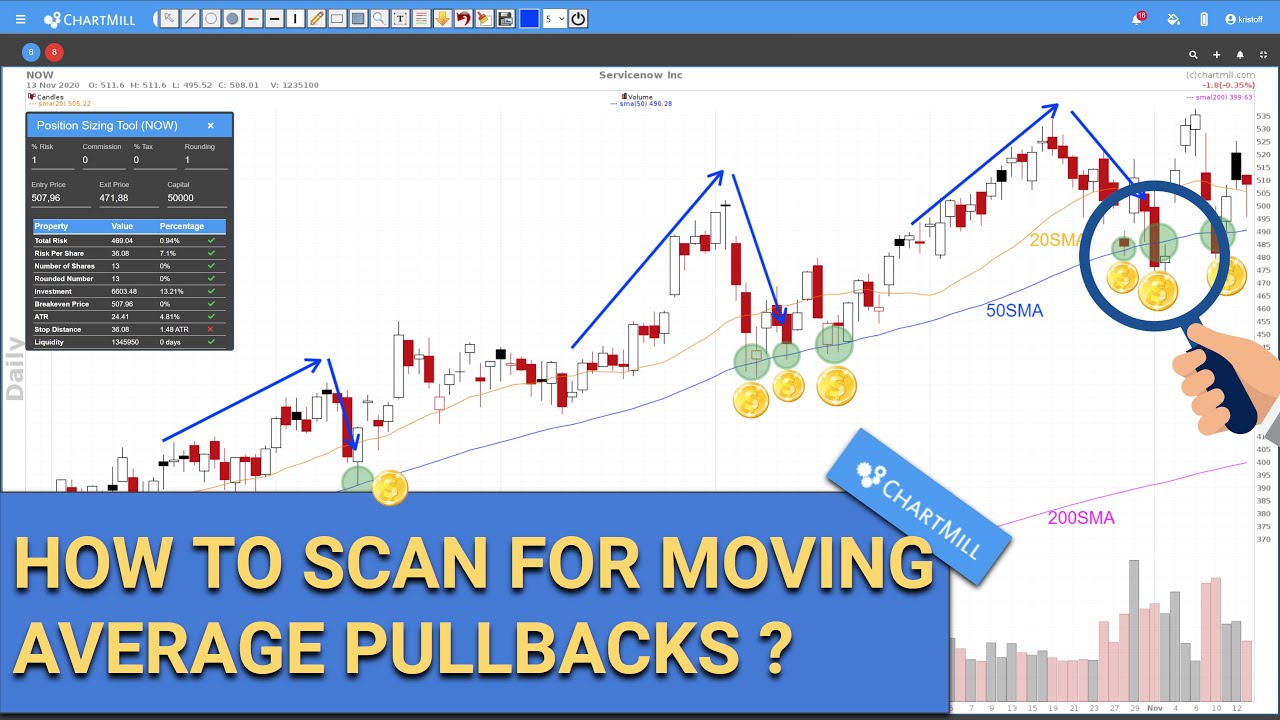

In this article I will go over a basic swing trading momentum screen, based on price retracements in stocks that are in a rising trend. There is an article available on the website which gives some more general explanation of what exactly a retracement strategy entails and the various ways in which it can be used.

For this screen we will limit ourselves to the scenario where the price is in the proximity of a number of commonly used Moving Averages such as the 20, 50 and 200SMA. Using ChartMill, we will be able to determine very precisely price levels that offer a lot of potential for such a retracement strategy.

Those who are more interested in a breakout strategy can consult this article.

CHART SETTINGS

For this strategy, we recommend plotting the SMA20, 50 and 200 as default overlays on the charts. See the screenshots below:

- On the 'Stock Screener page', select the 'Main Chart' tab.

- Press the 'plus' sign

- On the next screen, select the 'Select Overlay To add' option.

- From the drop down menu then choose 'Simple Moving Average'.

- In this last screen, select a look back period of '20' for the SMA and choose your own color. Then click on the blue 'Add Indicator' button.

- Now repeat this for the SMA50 and SMA200.

DETERMINING THE PRICE TREND

One of the main conditions to be met when looking for long setups for this strategy is the price trend which should be positive at least in the medium and long term.

For this purpose, we set up the following filters:

Select the 'Performance' tab on the 'Stock Screener page'

- For both the SMA20, 50 and 200 we set that it should be 'rising'.

- Set for the SMA20 that it should be 'higher than' the SMA50 and SMA200.

- Set for the SMA50 that it should be 'higher than' the SMA200.

The results you get with this are stocks of which both the SMA20, 50 and 200 are rising, which means that the stock has a rising trend in the short, medium and long term.

By additionally defining that these different SMA's must be in perfect order you define the condition that the average price for the short term must be higher than the medium term, which itself must also be higher than the long term. This is an additional important filter that ensures that we see clear upward trends in the retained stocks.

PRICE NEAR THE SMA

Since we are looking for stocks that are showing an intermediate price decline in a rising trend, we want to filter stocks that are in the proximity of one of the above SMAs. This can be done through a number of standard filters available but also by using custom filters created by ourselves. We will look at both options:

Standard filters

In the stock screener, for both the SMA20, 50 and 200, you can specify that the price must quote within 2% or 5% of that particular SMA.

To do this, select the 'Performance' Tab on the Stock Screener page and click on the 'Price VS SMA' menu.

Open the drop down menu and select the desired option. The 2% and 5% filters are available for both the SMA20, 50 and 200.

Below is an example of a result with the basic trend filters and the additional condition that the price must be within a 2% range of the SMA20.

A similar example but with the additional condition that the price must be within a 2% range of the SMA50.

Custom filters

Those who want even more control can use the custom expressions section. Here you can also set filters on the high, low and close of a trading day, even based on the price of the previous trading day.

The basic trend filters remain the same but with the custom filter you can even better define how close the price should be to the SMA.

Example 1

Using two separate custom filters we are going to define that the low of the last candle should be below the SMA50 but at the same time we set that the close of the same candle still ended above the SMA50.

Custom Filter 1

- LHS | Property | Low Price

- Comparison | <

- RHS | Property | SMA(50)

Custom Filter 2

- LHS | Property | Current Price

- Comparison | >

- RHS | Property | SMA(50)

One of the results on date of 2022/01/25:

Example 2

Going a step further, we now define that the closing price of the previous trading day must be below the SMA50 yet the closing price of the last completed trading day must again be above the SMA50.

Custom Filter 1

- LHS | Property | Previous Close

- Comparison | <

- RHS | Property | SMA(50)

Custom Filter 2

- LHS | Property | Current Close

- Comparison | >

- RHS | Property | SMA(50)

One of the results on date of 2022/01/25:

ADDITIONAL BASIC FILTERS

You can easily add basic filters (minimum price, volume, exchange, market capitalization) via the 'General' tab.

DIRECT LINK TO SOME PREDEFINED SCREENING FILTERS

- Price Retracement within 2% of SMA20 Worldwide -Price Retracement within 2% of SMA20 US only

- Price Retracement within 2% of SMA20 Europe only

- Price Retracement within 2% of SMA20 Canada only

- Price Retracement within 2% of SMA50 Worldwide

- Price Retracement within 2% of SMA50 US only

- Price Retracement within 2% of SMA50 Europe only

- Price Retracement within 2% of SMA50 Canada only

Keep in mind that the number of results can vary greatly from day to day and will depend on many factors. For example, if the general market is very bullish with a lot of momentum then these screens will not give many high quality setups and you may be better off with a breakout filter screen.

Not all results will be equally qualitative to withhold as an effective setup. The filter will, however, give a nice wide selection that can be used to further fine tune manually. Remember that the more converging elements are present at the same time, the better the quality of the setup.