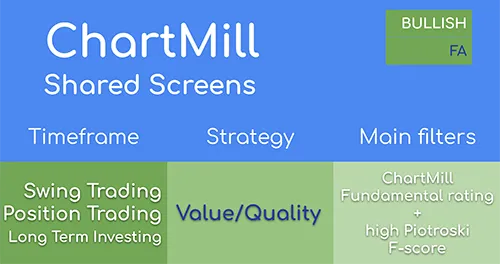

Valuation/Quality Screens - Undervalued Stocks with High Piotroski F-score

This screen lists stocks with a high Piotroski F-score (8 or 9), while having a low Price/Book value and a good ChartMill valuation rating. So we are looking for quality companies which are undervalued.

How to find the best value stocks?

Using our stock screener to find the best value stocks

What is Value Investing?

Simply put, the value investor specifically looks for companies whose market value (stock price) is lower than their current intrinsic value.

Piotroski F-score explained

The Piotroski F-score, a proven method to identify undervalued financially sound quality stocks for your long-term portfolio

Fundamental Valuation Filters

A description of the fundamental filters related to valuation, like price/earnings, price/book, peg ratio

Which Stocks to Pick when Inflation is Rising?

Which stocks to buy when inflation is rising strongly?

Piotroski F-score Stock Screener

Find or sort stocks based on their Piotroski F-score with our stock screener

Chartmill Valuation Rating: Rating >= 6

A reasonable to high ChartMill valuation ratio

Piotroski F-Score: piotroski > 7

Only select those with top Piotroski F-score values

Exchange: US Only

Only for the US market

Average Volume: 50 SMA > 200K

Have a minimum of volume/liquidity

Price Book: PB < 2

A low price/book value

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.