Ford (F): Buy, Sell, or Hold Post Q4 Earnings?

Provided By StockStory

Last update: Feb 28, 2025

Over the past six months, Ford’s stock price fell to $9.31. Shareholders have lost 15.7% of their capital, which is disappointing considering the S&P 500 has climbed by 5.1%. This might have investors contemplating their next move.

Is there a buying opportunity in Ford, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we don't have much confidence in Ford. Here are three reasons why we avoid F and a stock we'd rather own.

Why Do We Think Ford Will Underperform?

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE:F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

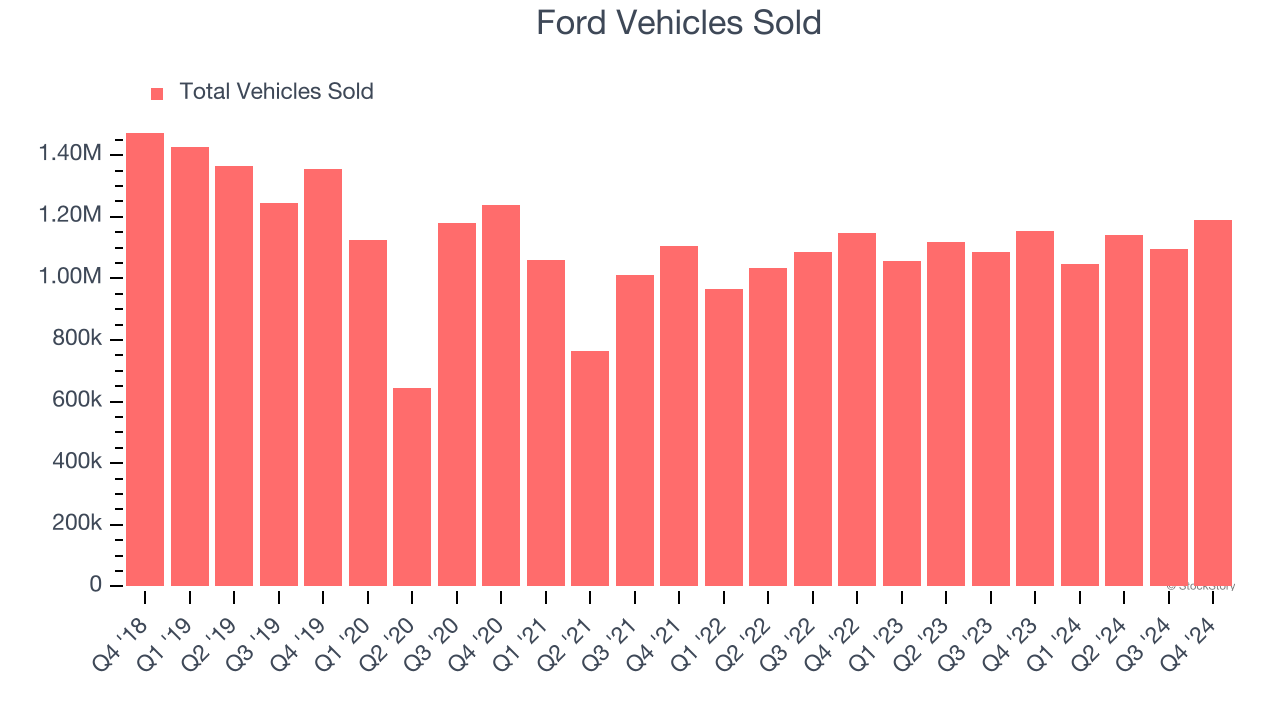

1. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Automobile Manufacturing company because there’s a ceiling to what customers will pay.

Ford’s vehicles sold came in at 1.19 million in the latest quarter, and over the last two years, averaged 2.9% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

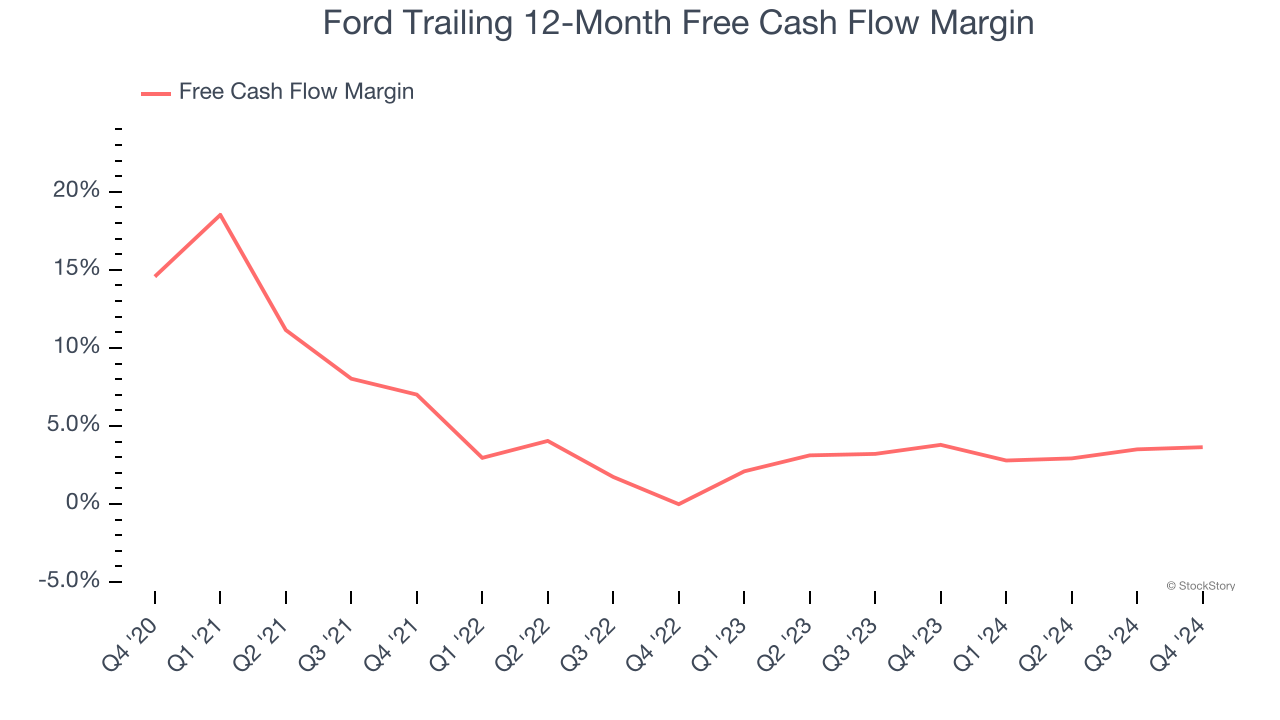

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Ford’s margin dropped by 10.9 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Ford’s free cash flow margin for the trailing 12 months was 3.6%.

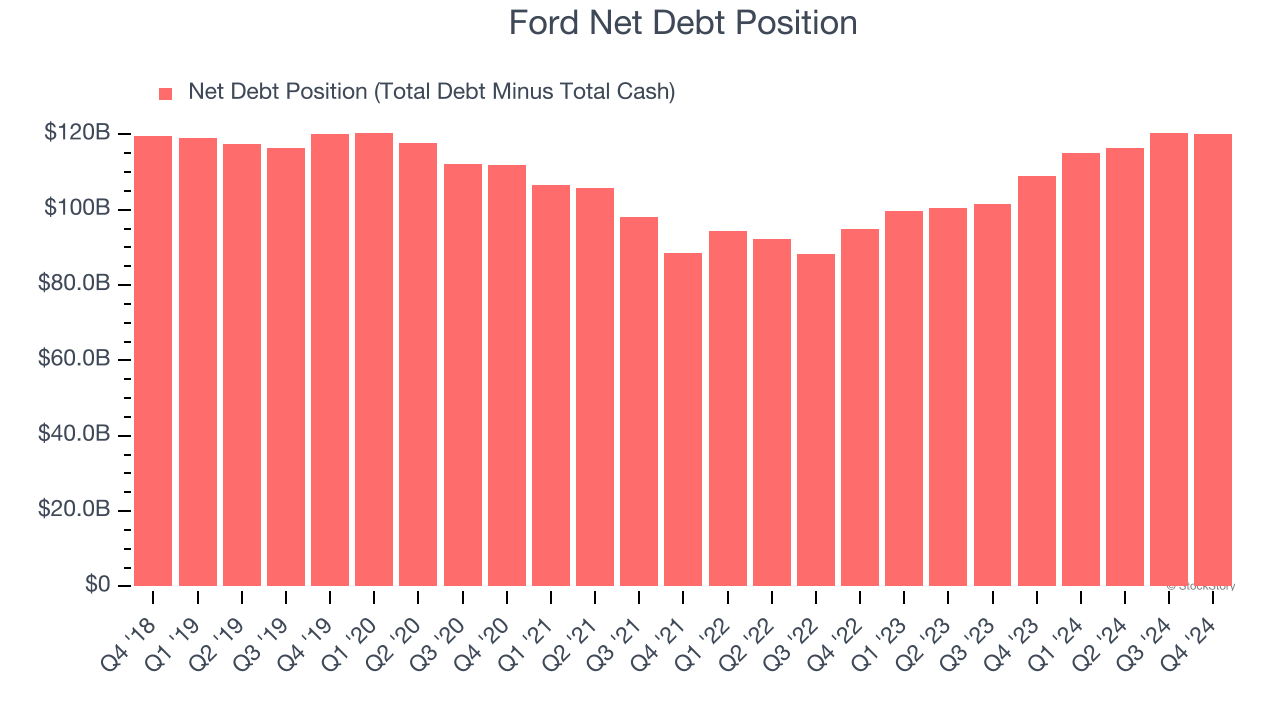

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Ford’s $158.5 billion of debt exceeds the $38.35 billion of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $16.08 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Ford could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Ford can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Ford falls short of our quality standards. After the recent drawdown, the stock trades at 5.6× forward price-to-earnings (or $9.31 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Ford

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

9.39

-0.16 (-1.68%)

691.15

-17.69 (-2.5%)

Find more stocks in the Stock Screener

F Latest News and Analysis

3 hours ago - ChartmillMost active S&P500 stocks in Monday's session

3 hours ago - ChartmillMost active S&P500 stocks in Monday's sessionCurious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

3 hours ago - ChartmillMost active stocks in Monday's session

3 hours ago - ChartmillMost active stocks in Monday's sessionStay updated with the latest market activity on Monday. Explore the most active stocks in today's session and stay informed about the stocks that are in the spotlight.

3 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Friday?

3 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Friday?Explore the S&P500 index on Friday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest and driving market movements.

3 days ago - ChartmillCheck out the stocks that are attracting the most attention and driving market activity.

3 days ago - ChartmillCheck out the stocks that are attracting the most attention and driving market activity.Stay updated with the latest market activity on Friday. Explore the most active stocks in today's session and stay informed about the stocks that are in the spotlight.

4 days ago - ChartmillWhat's going on in today's session: S&P500 most active stocks

4 days ago - ChartmillWhat's going on in today's session: S&P500 most active stocksCurious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

5 days ago - ChartmillMost active S&P500 stocks in Wednesday's session

5 days ago - ChartmillMost active S&P500 stocks in Wednesday's sessionCurious about the most active S&P500 stocks in today's session? Join us as we explore the US markets on Wednesday and uncover the stocks that are leading the way in terms of trading volume and market attention.

6 days ago - ChartmillCurious about the most active S&P500 stocks in today's session?

6 days ago - ChartmillCurious about the most active S&P500 stocks in today's session?Let's have a look at what is happening on the US markets on Tuesday. Below you can find the most active S&P500 stocks in today's session.

7 days ago - ChartmillMost active S&P500 stocks in Monday's session

7 days ago - ChartmillMost active S&P500 stocks in Monday's sessionStay informed about the most active S&P500 stocks in today's session as we take a closer look at what's happening on the US markets on Monday. Discover the stocks that are generating the highest trading volume and driving market activity.

10 days ago - ChartmillThese S&P500 stocks are the most active in today's session

10 days ago - ChartmillThese S&P500 stocks are the most active in today's sessionLet's have a look at what is happening on the US markets on Friday. Below you can find the most active S&P500 stocks in today's session.

11 days ago - ChartmillCurious about the most active S&P500 stocks in today's session?

11 days ago - ChartmillCurious about the most active S&P500 stocks in today's session?Explore the S&P500 index on Thursday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest and driving market movements.

12 days ago - ChartmillWhich S&P500 stocks are the most active on Wednesday?

12 days ago - ChartmillWhich S&P500 stocks are the most active on Wednesday?Stay informed about the most active stocks in the S&P500 index on Wednesday's session. Discover the stocks that are generating the highest trading volume and driving market activity.

13 days ago - ChartmillWhich S&P500 stocks are the most active on Tuesday?

13 days ago - ChartmillWhich S&P500 stocks are the most active on Tuesday?Let's have a look at what is happening on the US markets on Tuesday. Below you can find the most active S&P500 stocks in today's session.