3 Reasons to Sell EYE and 1 Stock to Buy Instead

Provided By StockStory

Last update: Jan 14, 2025

Over the past six months, National Vision’s stock price fell to $10.58. Shareholders have lost 16.6% of their capital, which is disappointing considering the S&P 500 has climbed by 4.2%. This might have investors contemplating their next move.

Is there a buying opportunity in National Vision, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we're swiping left on National Vision for now. Here are three reasons why we avoid EYE and a stock we'd rather own.

Why Do We Think National Vision Will Underperform?

Operating under multiple brands, National Vision (NYSE:EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

1. Same-Store Sales Falling Behind Peers

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

National Vision’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.9% per year.

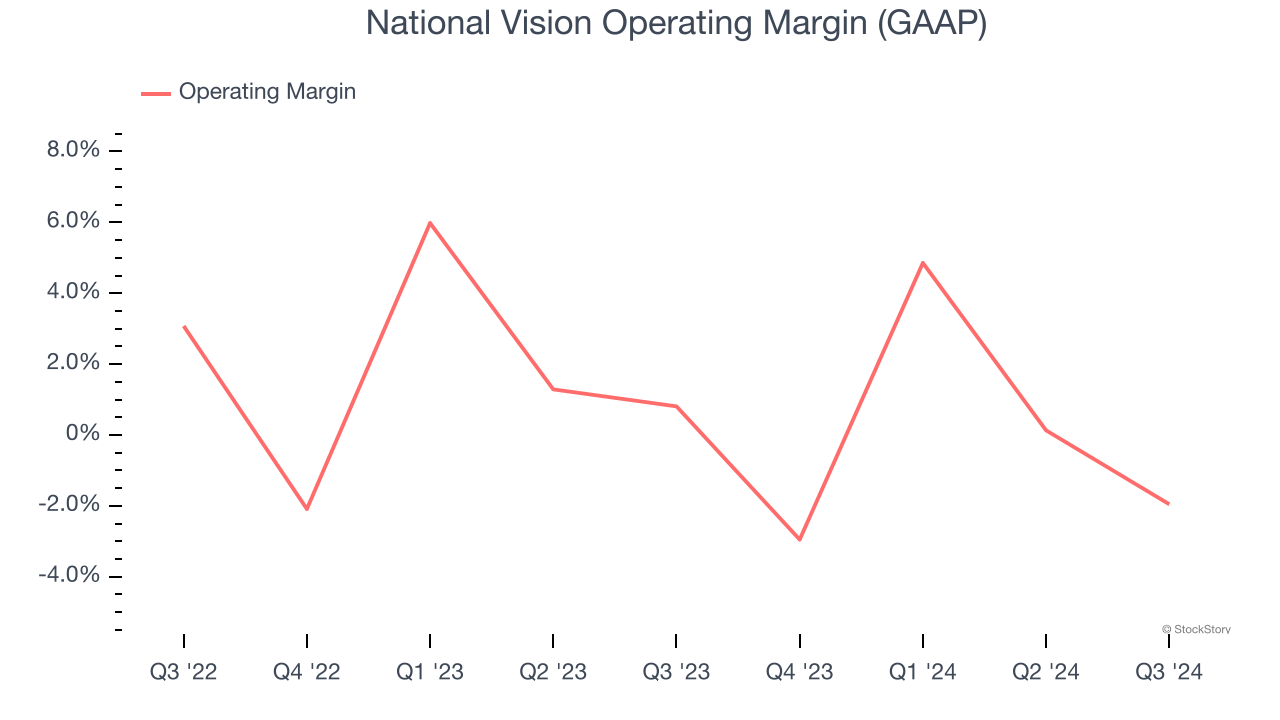

2. Breakeven Operating Raises Questions

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

National Vision was roughly breakeven when averaging the last two years of quarterly operating profits, inadequate for a consumer retail business. This result is surprising given its high gross margin as a starting point.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

National Vision historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.3%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

Final Judgment

National Vision doesn’t pass our quality test. After the recent drawdown, the stock trades at 20.8× forward price-to-earnings (or $10.58 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. Let us point you toward Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of National Vision

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.

78.89

-2.37 (-2.92%)

11.7

-0.67 (-5.42%)

657.29

-37.48 (-5.39%)

Find more stocks in the Stock Screener

UBER Latest News and Analysis

10 days ago - ChartmillWhich S&P500 stocks are the most active on Wednesday?

10 days ago - ChartmillWhich S&P500 stocks are the most active on Wednesday?Explore the S&P500 index on Wednesday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest.

12 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

12 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Monday.

12 days ago - ChartmillExplore the S&P500 index on Monday and find out which stocks are the most active in today's session.

12 days ago - ChartmillExplore the S&P500 index on Monday and find out which stocks are the most active in today's session.Curious about the most active S&P500 stocks in today's session? Join us as we explore the US markets on Monday and uncover the stocks that are leading the way in terms of trading volume and market attention.

12 days ago - ChartmillThese S&P500 stocks are moving in today's pre-market session

12 days ago - ChartmillThese S&P500 stocks are moving in today's pre-market sessionDiscover the top S&P500 movers in Monday's pre-market session and stay informed about market dynamics.

15 days ago - ChartmillThese S&P500 stocks are moving in today's session

15 days ago - ChartmillThese S&P500 stocks are moving in today's sessionGet insights into the S&P500 index performance on Friday. Explore the top gainers and losers within the S&P500 index in today's session.

15 days ago - ChartmillMost active S&P500 stocks in Friday's session

15 days ago - ChartmillMost active S&P500 stocks in Friday's sessionExplore the S&P500 index on Friday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest.

15 days ago - ChartmillLet's take a look at the S&P500 stocks that are experiencing unusual volume in today's session.

15 days ago - ChartmillLet's take a look at the S&P500 stocks that are experiencing unusual volume in today's session.Let's have a look at the S&P500 stocks with an unusual volume in today's session.

15 days ago - ChartmillTop S&P500 movers in Friday's session

15 days ago - ChartmillTop S&P500 movers in Friday's sessionUncover the latest developments among S&P500 stocks in today's session. Stay tuned to the S&P500 index's top gainers and losers on Friday.

16 days ago - ChartmillWhich S&P500 stocks are moving on Thursday?

16 days ago - ChartmillWhich S&P500 stocks are moving on Thursday?Uncover the latest developments among S&P500 stocks in today's session. Stay tuned to the S&P500 index's top gainers and losers on Thursday.

16 days ago - ChartmillMost active S&P500 stocks in Thursday's session

16 days ago - ChartmillMost active S&P500 stocks in Thursday's sessionLet's have a look at what is happening on the US markets on Thursday. Below you can find the most active S&P500 stocks in today's session.

16 days ago - ChartmillWhich S&P500 stocks are moving on Thursday?

16 days ago - ChartmillWhich S&P500 stocks are moving on Thursday?Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Thursday.

17 days ago - ChartmillWhat's going on in today's session: S&P500 movers

17 days ago - ChartmillWhat's going on in today's session: S&P500 moversStay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Wednesday.