Breakout Screens - Symmetrical Triangle Pattern

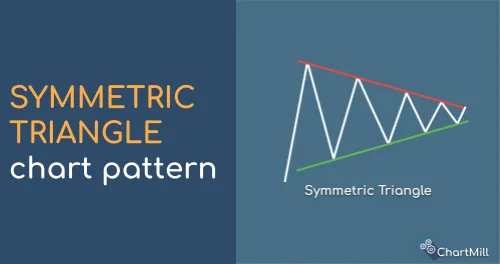

The Symmetrical Triangle Pattern can be considered both Bullish and Bearish and occurs when price is trapped between a declining resistance line and a rising support line.

Support and Resistance Stock Screener and Trading Strategies

The Stock Screener supports different support and resistance trading strategies. Some examples are listed in this article.

Triangle Chart Patterns

Triangle patterns are well-known chart patterns within the field of technical analysis. They exist in different formations, bullish, bearish or symmetrical.

Symmetrical Triangle Secrets: Enhancing Your Trading with Chart Patterns.

A symmetrical triangle is formed by drawing two converging trendlines, with the upper trendline connecting the series of lower highs and the lower trendline connecting the series of higher lows.

Related Videos

What is the triangle chart pattern and how to trade it

In depth explanation of triangle chart pattern and how to use it

Symmentrical Triangle

The Symmentrical Triangle pattern filter

Average Volume: 50 SMA > 500K

Minimum Liquidity

Support and Resistance on the chart

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.