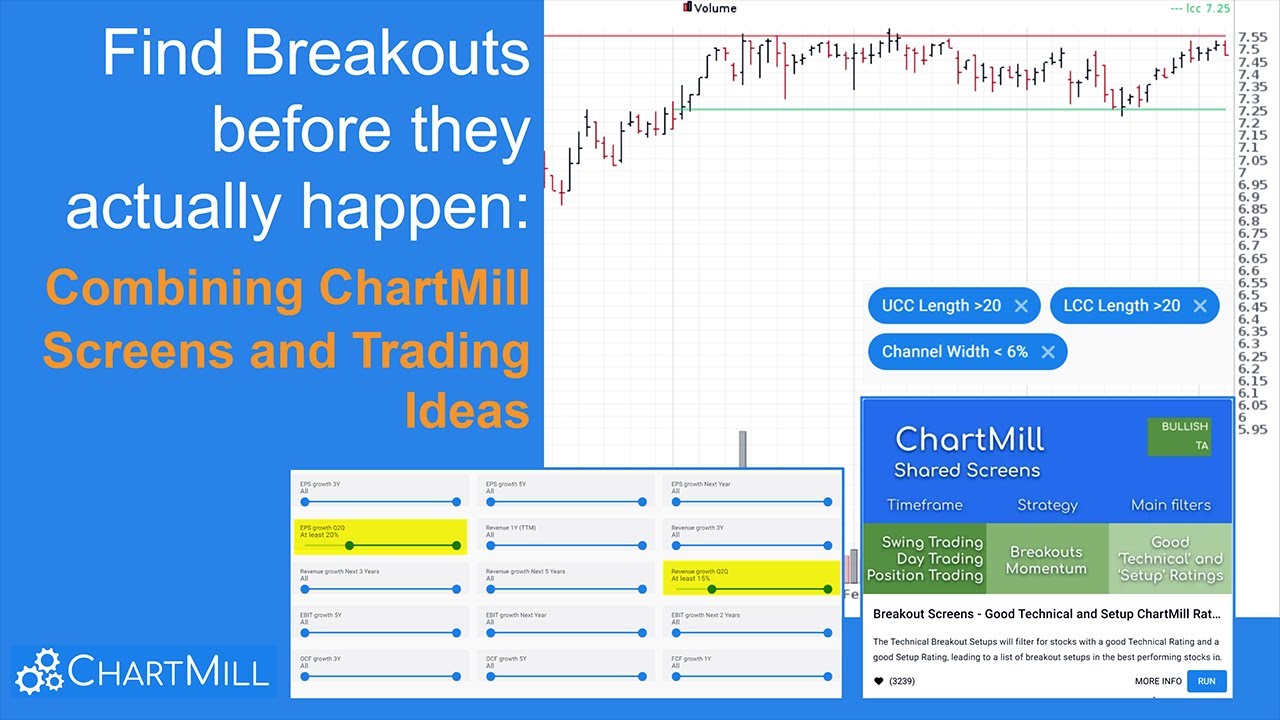

Breakout Screens - Good Technical and Setup ChartMill Ratings

The Technical Breakout Setups will filter for stocks with a good Technical Rating and a good Setup Rating, leading to a list of breakout setups in the best performing stocks in the market.

Analyzer Intro

The analyzer module introduced

Chartmill Technical Rating and Setup Quality scores

View the technical health and setup quality of any stock with these ChartMill ratings.

General Trading Tips & FAQ

Some general pointers on trading, setups, position sizing and money management.

The importance of Volume in trading and investing

In this article we will deal with the concept of 'volume' in trading and investing and the way this indicator can give important indications when making buying or selling decisions.

Technical Breakout Setups

The Technical Breakout Setups screen finds consolidations in strong stocks in the market

Related Videos

Find breakouts before they actually happen by combining ChartMill Screens and Trading Ideas

Learn how to combine ChartMill Screens and Trading Ideas to find those low-risk breakout trading setups.

Trend Following Swing Trading Strategy Guide

WHY TREND FOLLOWING? Typical trend investors have only three consecutive goals in mind: 1. Identify new potential long-term trends 2. Stay invested in clear strong trends as long as possible 3. Close positions as quickly as possible when it is clear that the trend has ended. Thus, the purpose of a Trend Following Swing Trading Strategy is not to predict tops or bottoms. The typical trend trader will try to identify the main trend before taking a position and then open a position in the direction of that prevailing trend in order to maximize potential profits. In this video we take a look at some trend following entry techniques.

Chartmill TA Rating: Rating >= 7

The Technical Rating should be at least 7 in order to assure we are looking at solid technical stocks

Price: Above 20

Minimal price

Chartmill Setup Quality: SetupQ >= 7

The Setup Quality should be at least 7 to select stocks which show a decent technical setup pattern.

ATR in %: ATR > 1

Minimal Volatility

Average Volume: 50 SMA > 500K

Minimal Liquidity

Default chart settings

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.