Uncovering Dividend Opportunities with WESTERN UNION CO (NYSE:WU).

By Mill Chart

Last update: Apr 29, 2025

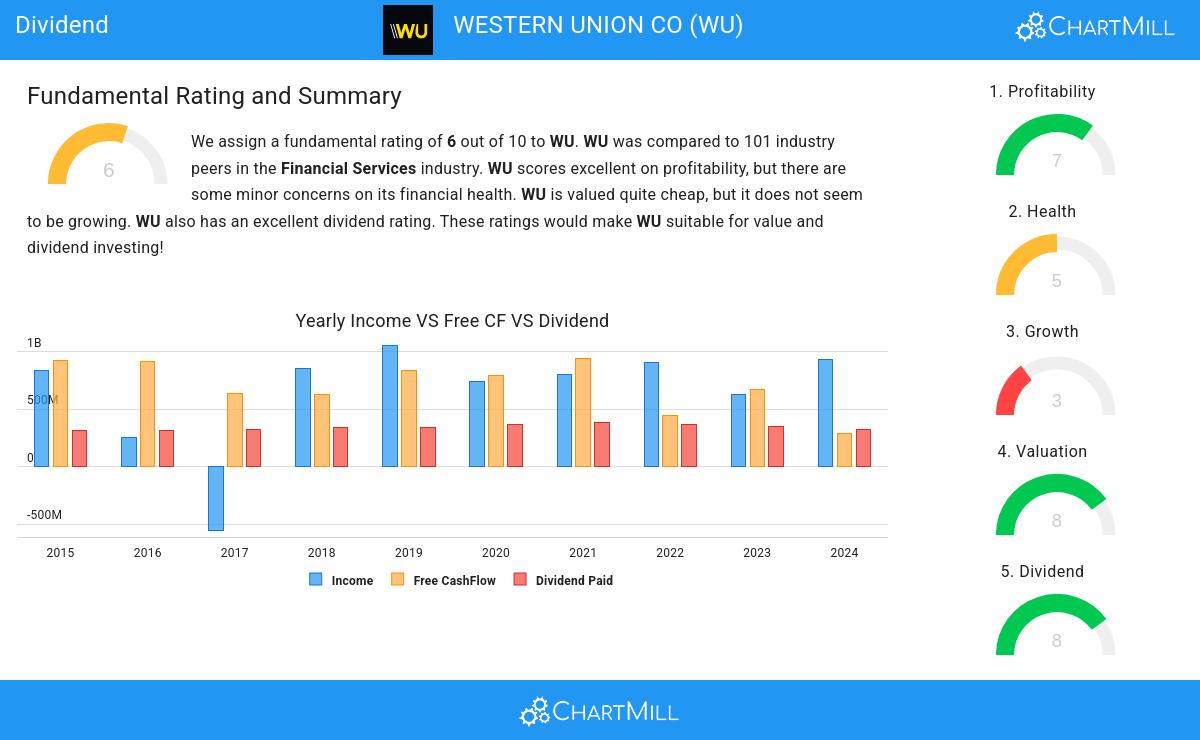

Our stock screener has singled out WESTERN UNION CO (NYSE:WU) as a promising choice for dividend investors. WU not only scores well in profitability, solvency, and liquidity but also offers a decent dividend. We'll explore this further.

Understanding WU's Dividend

ChartMill assigns a proprietary Dividend Rating to each stock. The score is computed by evaluating various valuation aspects, like the yield, the history, the dividend growth and sustainability. WU was assigned a score of 8 for dividend:

- With a Yearly Dividend Yield of 9.27%, WU is a good candidate for dividend investing.

- Compared to an average industry Dividend Yield of 4.92, WU pays a better dividend. On top of this WU pays more dividend than 96.04% of the companies listed in the same industry.

- Compared to an average S&P500 Dividend Yield of 2.46, WU pays a better dividend.

- WU has paid a dividend for at least 10 years, which is a reliable track record.

- WU has not decreased its dividend for at least 10 years, so it has a reliable track record of non decreasing dividend.

- 34.41% of the earnings are spent on dividend by WU. This is a low number and sustainable payout ratio.

Health Examination for WU

ChartMill employs its own Health Rating for stock assessment. This rating, ranging from 0 to 10, is calculated by examining various liquidity and solvency ratios. In the case of WU, the assigned 5 reflects its health status:

- WU's Altman-Z score of 1.20 is fine compared to the rest of the industry. WU outperforms 65.35% of its industry peers.

- WU has a Current Ratio of 2.17. This indicates that WU is financially healthy and has no problem in meeting its short term obligations.

- WU has a Current ratio of 2.17. This is in the better half of the industry: WU outperforms 77.23% of its industry peers.

- WU has a Quick Ratio of 2.17. This indicates that WU is financially healthy and has no problem in meeting its short term obligations.

- Looking at the Quick ratio, with a value of 2.17, WU is in the better half of the industry, outperforming 78.22% of the companies in the same industry.

Profitability Insights: WU

Discover ChartMill's exclusive Profitability Rating, a proprietary metric that assesses stocks on a scale of 0 to 10. It takes into consideration various profitability ratios and margins, both in absolute terms and relative to industry peers. Notably, WU has achieved a 7:

- With an excellent Return On Assets value of 11.16%, WU belongs to the best of the industry, outperforming 93.07% of the companies in the same industry.

- With an excellent Return On Equity value of 96.42%, WU belongs to the best of the industry, outperforming 99.01% of the companies in the same industry.

- Looking at the Return On Invested Capital, with a value of 8.37%, WU is in the better half of the industry, outperforming 79.21% of the companies in the same industry.

- WU has a Profit Margin of 22.19%. This is in the better half of the industry: WU outperforms 76.24% of its industry peers.

- In the last couple of years the Profit Margin of WU has grown nicely.

- WU has a Operating Margin of 18.22%. This is in the better half of the industry: WU outperforms 61.39% of its industry peers.

- WU's Operating Margin has improved in the last couple of years.

More Best Dividend stocks can be found in our Best Dividend screener.

Check the latest full fundamental report of WU for a complete fundamental analysis.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

10.16

+0.02 (+0.2%)

Find more stocks in the Stock Screener

WU Latest News and Analysis

a few seconds ago - ChartmillUncovering Dividend Opportunities with WESTERN UNION CO (NYSE:WU).

a few seconds ago - ChartmillUncovering Dividend Opportunities with WESTERN UNION CO (NYSE:WU).Exploring WESTERN UNION CO (NYSE:WU)'s dividend characteristics.