Three Reasons Why JAMF is Risky and One Stock to Buy Instead

Provided By StockStory

Last update: Jan 6, 2025

Over the past six months, Jamf’s stock price fell to $14.70. Shareholders have lost 14.6% of their capital, which is disappointing considering the S&P 500 has climbed by 7%. This might have investors contemplating their next move.

Is there a buying opportunity in Jamf, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even though the stock has become cheaper, we're swiping left on Jamf for now. Here are three reasons why we avoid JAMF and a stock we'd rather own.

Why Is Jamf Not Exciting?

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

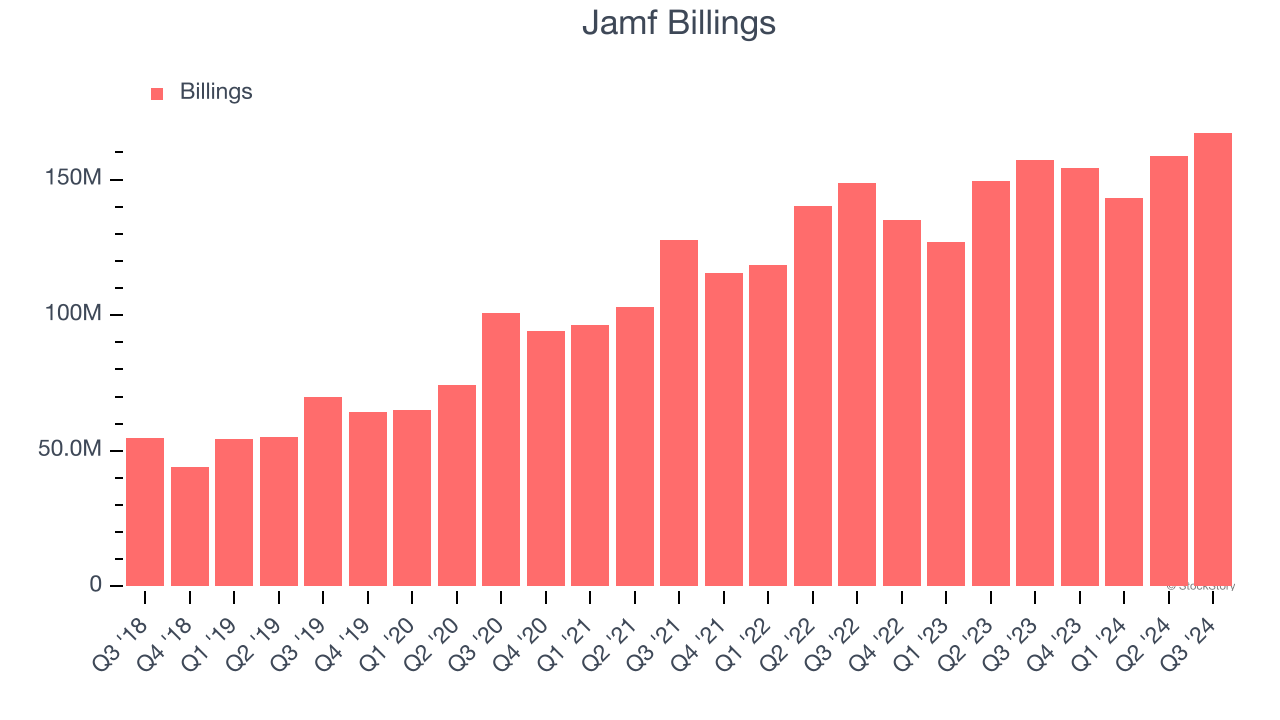

1. Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Jamf’s billings came in at $167.3 million in Q3, and over the last four quarters, its year-on-year growth averaged 9.9%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in acquiring/retaining customers.

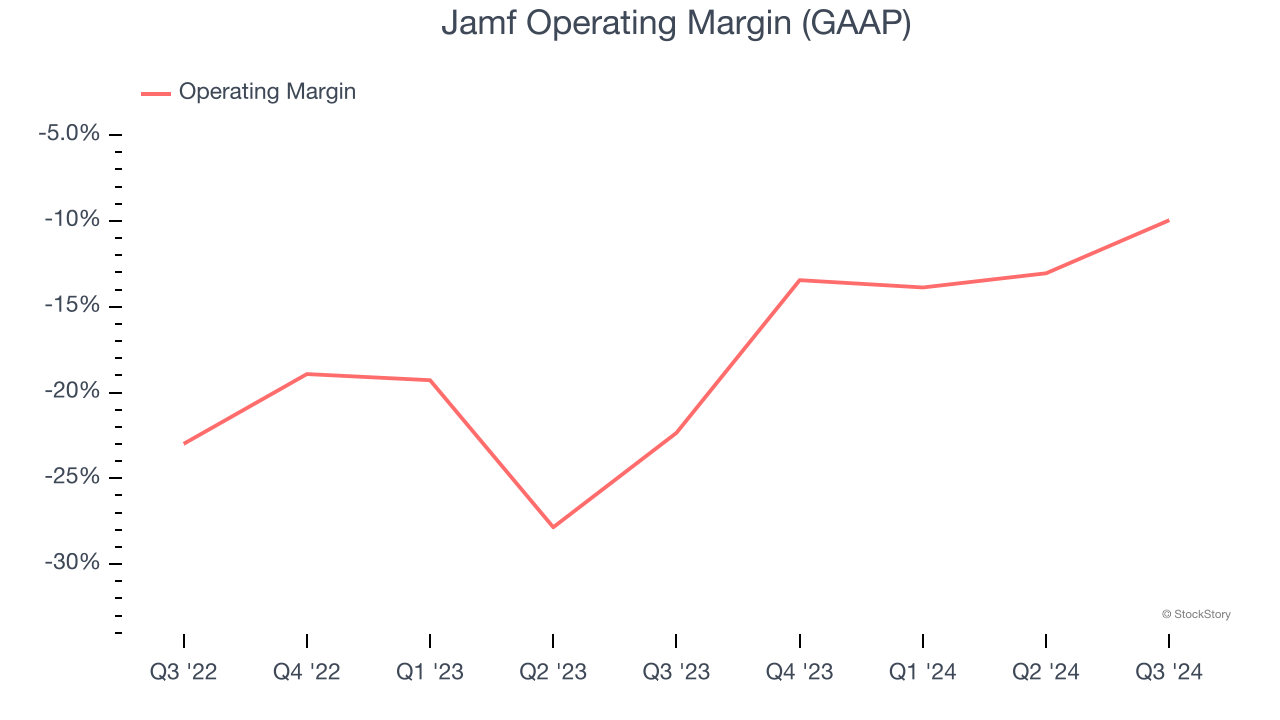

2. Operating Losses Sound the Alarms

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Jamf’s expensive cost structure has contributed to an average operating margin of negative 12.6% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Jamf reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

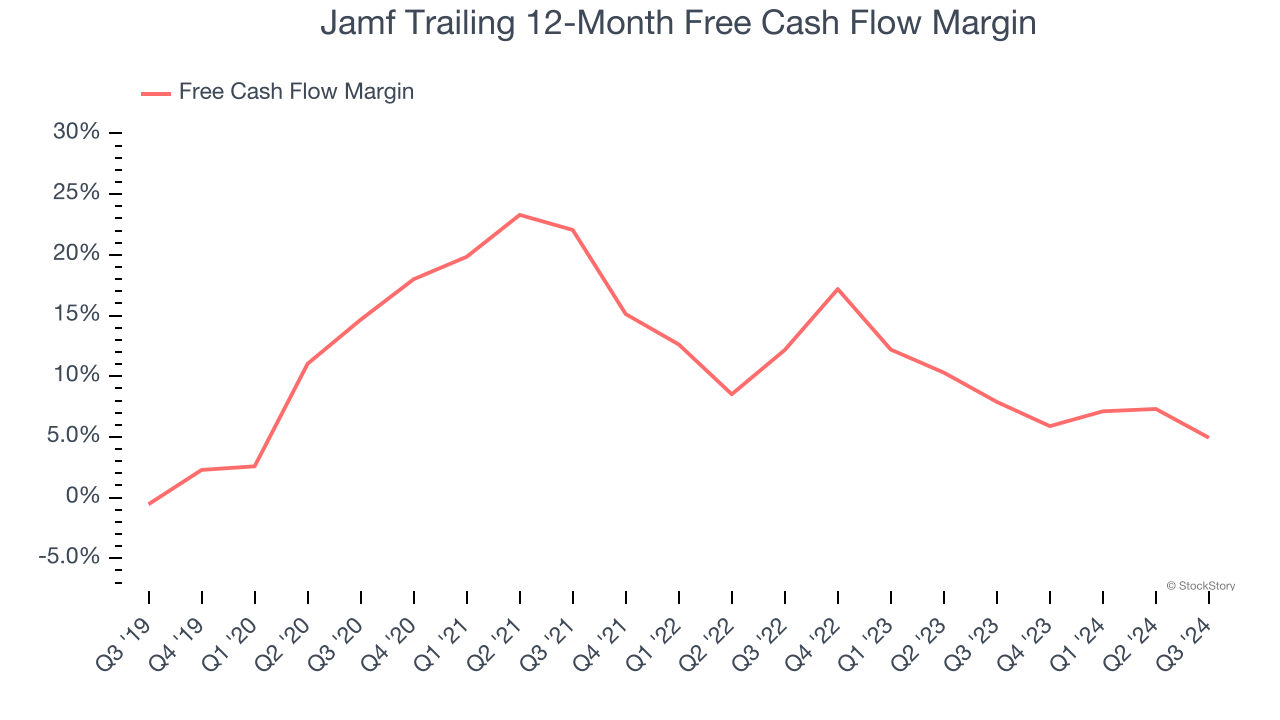

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Jamf has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, subpar for a software business.

Final Judgment

Jamf isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.7× forward price-to-sales (or $14.70 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. Let us point you toward The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Jamf

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

245.55

-0.28 (-0.11%)

364

-18.13 (-4.74%)

14.96

-0.16 (-1.06%)

72.06

-3.67 (-4.85%)

Find more stocks in the Stock Screener

AAPL Latest News and Analysis

2 days ago - ChartmillThese S&P500 stocks are the most active in today's session

2 days ago - ChartmillThese S&P500 stocks are the most active in today's sessionLet's have a look at what is happening on the US markets on Friday. Below you can find the most active S&P500 stocks in today's session.

9 days ago - ChartmillWhich S&P500 stocks are the most active on Friday?

9 days ago - ChartmillWhich S&P500 stocks are the most active on Friday?Looking for the most active S&P500 stocks in today's session? Join us as we dive into the US markets on Friday and discover the stocks that are dominating the trading activity and setting the pace for the market.

9 days ago - ChartmillWhy APPLE INC (NASDAQ:AAPL) Deserves Consideration as a Quality Investment.

9 days ago - ChartmillWhy APPLE INC (NASDAQ:AAPL) Deserves Consideration as a Quality Investment.A fundamental analysis of (NASDAQ:AAPL): Why Quality Investors May Find APPLE INC (NASDAQ:AAPL) Attractive.

10 days ago - ChartmillThursday's session: most active stock in the S&P500 index

10 days ago - ChartmillThursday's session: most active stock in the S&P500 indexCurious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

11 days ago - ChartmillWhich S&P500 stocks are the most active on Wednesday?

11 days ago - ChartmillWhich S&P500 stocks are the most active on Wednesday?Explore the S&P500 index on Wednesday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest.

12 days ago - ChartmillTuesday's session: most active stock in the S&P500 index

12 days ago - ChartmillTuesday's session: most active stock in the S&P500 indexExplore the S&P500 index on Tuesday and find out which stocks are the most active in today's session. Stay updated with the stocks that are capturing market interest and driving market movements.

18 days ago - ChartmillMarket Monitor February 4th

18 days ago - ChartmillMarket Monitor February 4thWall Street: Spotify and Palantir Surge Higher, Alphabet’s Capital Spending Concerns Investors

19 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?

19 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?Stay informed about the most active S&P500 stocks in today's session as we take a closer look at what's happening on the US markets on Tuesday. Discover the stocks that are generating the highest trading volume and driving market activity.

20 days ago - ChartmillWhich S&P500 stocks are the most active on Monday?

20 days ago - ChartmillWhich S&P500 stocks are the most active on Monday?Curious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

20 days ago - ChartmillTop S&P500 movers in Monday's session

20 days ago - ChartmillTop S&P500 movers in Monday's sessionStay informed about the performance of the S&P500 index in the middle of the day on Monday. Uncover the top gainers and losers in today's session for valuable insights.