3 Reasons TXN is Risky and 1 Stock to Buy Instead

Provided By StockStory

Last update: Apr 8, 2025

Shareholders of Texas Instruments would probably like to forget the past six months even happened. The stock dropped 22.9% and now trades at $156. This might have investors contemplating their next move.

Is there a buying opportunity in Texas Instruments, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why TXN doesn't excite us and a stock we'd rather own.

Why Is Texas Instruments Not Exciting?

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ:TXN) is the world’s largest producer of analog semiconductors.

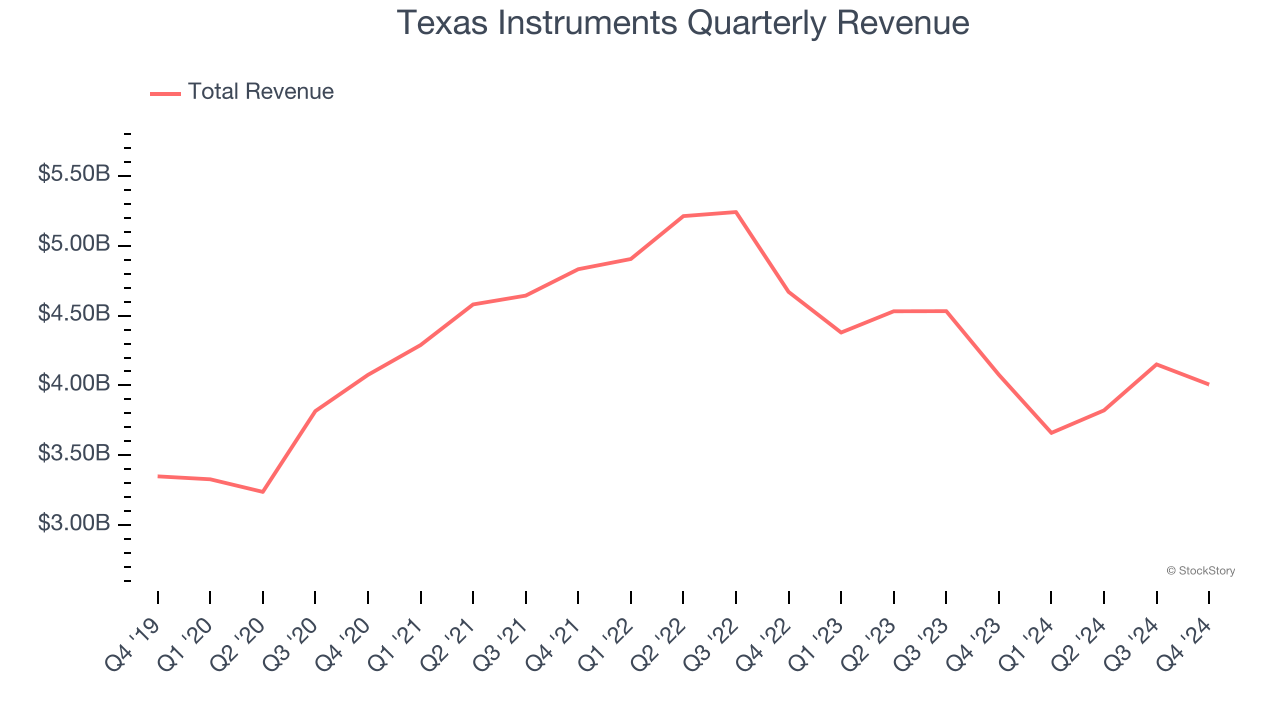

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Texas Instruments’s 1.7% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

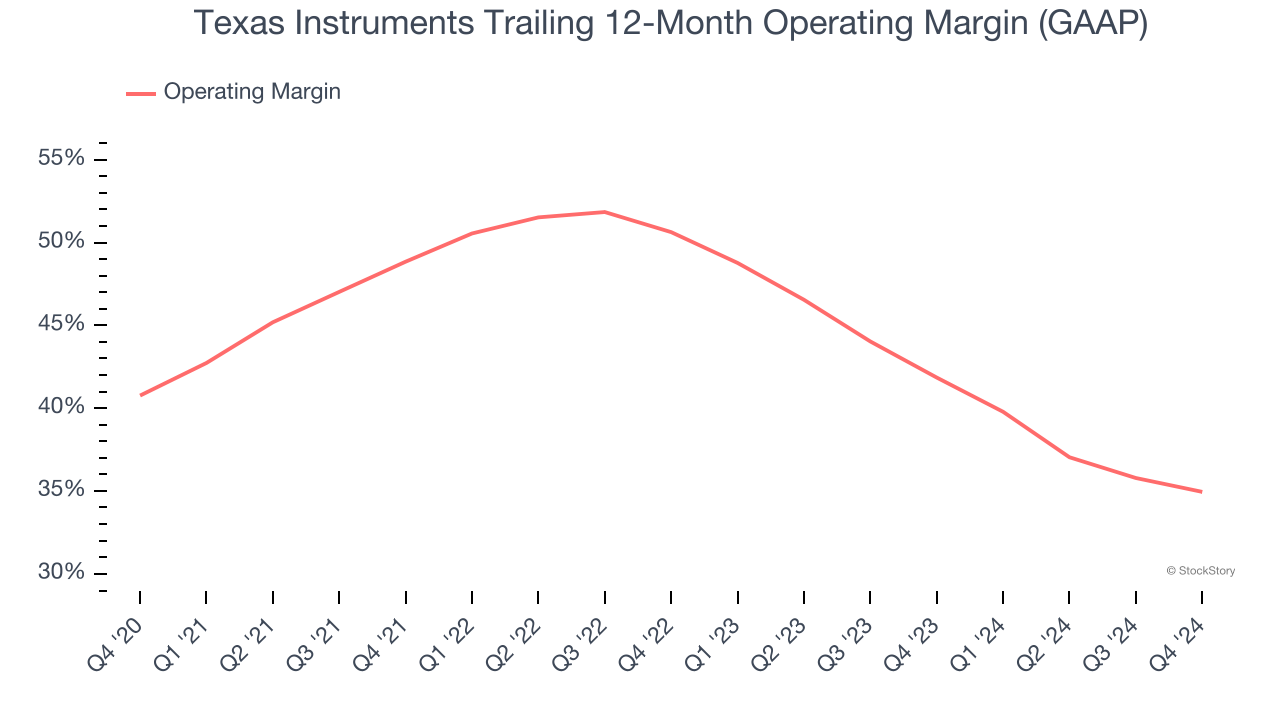

2. Shrinking Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Texas Instruments’s operating margin decreased by 5.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 34.9%.

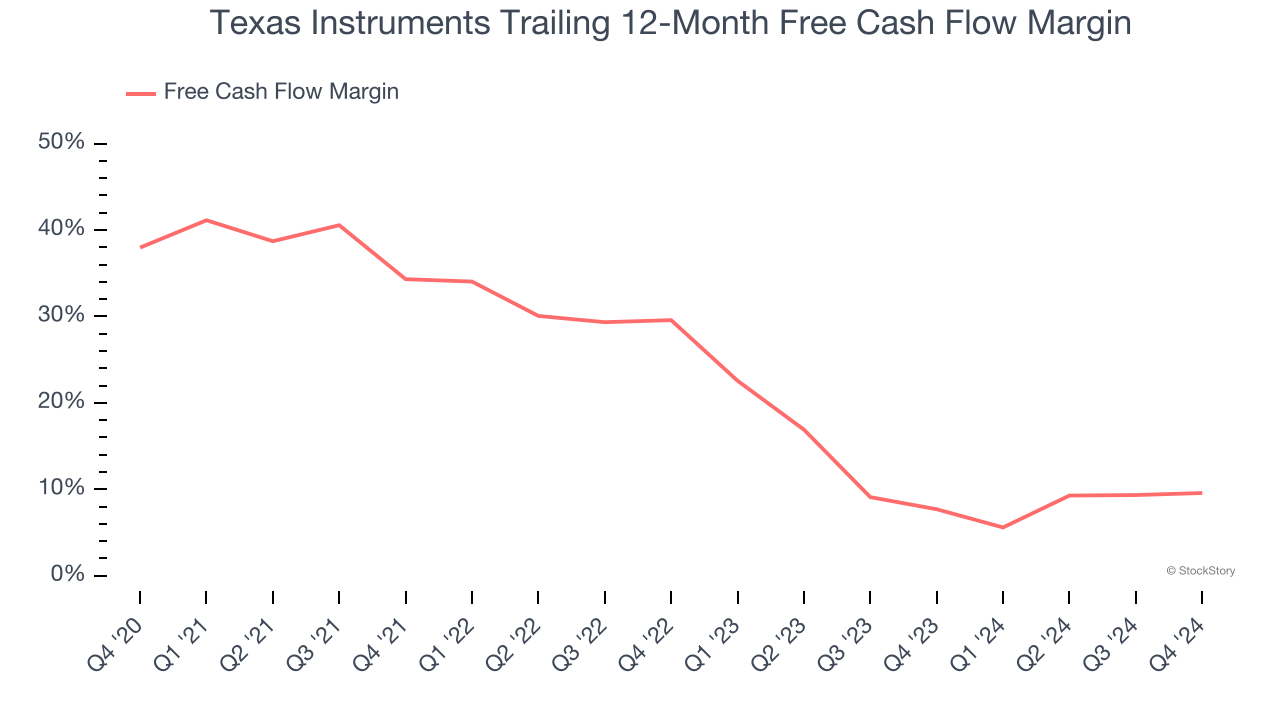

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Texas Instruments’s margin dropped by 28.4 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Texas Instruments’s free cash flow margin for the trailing 12 months was 9.6%.

Final Judgment

Texas Instruments isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 25.7× forward price-to-earnings (or $156 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Texas Instruments

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

162.86

+0.73 (+0.45%)

977.16

+1.68 (+0.17%)

Find more stocks in the Stock Screener

TXN Latest News and Analysis

21 hours ago - ChartmillMarket Monitor April 25 ( Texas Instruments, Nvidia & Amazon UP, IBM, PepsiCo & Comcast DOWN)

21 hours ago - ChartmillMarket Monitor April 25 ( Texas Instruments, Nvidia & Amazon UP, IBM, PepsiCo & Comcast DOWN)Wall Street Rallies Again: Tech Leads the Charge, Alphabet Shines After-Hours

2 days ago - ChartmillThursday's pre-market session: top gainers and losers in the S&P500 index

2 days ago - ChartmillThursday's pre-market session: top gainers and losers in the S&P500 indexLet's have a look at what is happening on the US markets before the opening bell on Thursday. Below you can find the top S&P500 gainers and losers in today's pre-market session.

2 days ago - ChartmillMarket Monitor April 24 ( Tesla, Boeing, Intel UP, Enphase Energy DOWN)

2 days ago - ChartmillMarket Monitor April 24 ( Tesla, Boeing, Intel UP, Enphase Energy DOWN)U.S. Markets Rally on Softer Trump Tone and Strong Corporate Earnings

2 days ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?

2 days ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?Let's have a look at what is happening on the US markets after the closing bell on Wednesday. Below you can find the top S&P500 gainers and losers in today's after hours session.

4 days ago - ChartmillMarket Monitor April 22 ( Netflix UP, Tesla, Uber DOWN)

4 days ago - ChartmillMarket Monitor April 22 ( Netflix UP, Tesla, Uber DOWN)Wall Street Stumbles as Trump Targets Fed Chair Powell Again, While Netflix Shines

11 days ago - ChartmillMarket Monitor April 15 Before Market Open ( Dell, Palantir UP, Meta DOWN)

11 days ago - ChartmillMarket Monitor April 15 Before Market Open ( Dell, Palantir UP, Meta DOWN)Wall Street Starts Easter Week Strong as Tariff Concerns Ease

14 days ago - ChartmillThese S&P500 stocks are moving in today's session

14 days ago - ChartmillThese S&P500 stocks are moving in today's sessionStay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Friday.

14 days ago - ChartmillWhich S&P500 stocks are moving on Friday?

14 days ago - ChartmillWhich S&P500 stocks are moving on Friday?Curious about the S&P500 stocks that are in motion on Friday? Join us as we explore the top movers within the S&P500 index during today's session.

14 days ago - ChartmillWhich S&P500 stocks are gapping on Friday?

14 days ago - ChartmillWhich S&P500 stocks are gapping on Friday?Curious about the S&P500 stocks that are gapping on Friday? Explore the gap up and gap down stocks in the S&P500 index during today's session.

16 days ago - ChartmillWhy TEXAS INSTRUMENTS INC (NASDAQ:TXN) provides a good dividend, while having solid fundamentals.

16 days ago - ChartmillWhy TEXAS INSTRUMENTS INC (NASDAQ:TXN) provides a good dividend, while having solid fundamentals.Balancing Dividends and Fundamentals: The Case of TEXAS INSTRUMENTS INC (NASDAQ:TXN).