Apple's Q3 Results Exceed Expectations as AI Investments Boost Growth, iPhone Sales Slightly Decline

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Aug 2, 2024

Apple exceeded expectations for the past quarter, showing better results than analysts had predicted. Despite a slight 0.9% drop in iPhone sales, which was less severe than anticipated, the company's overall performance was positive, and CEO Tim Cook expressed strong optimism about AI.

Key Points:

Quarterly Revenue:

Rose 4.9% to $85.78 billion, surpassing the $84.53 billion forecast.

iPhone Sales:

Declined 0.9% to $39.30 billion, better than the expected 2.2% drop. Sales were bolstered by anticipation of new AI features.

China Sales:

Revenue decreased by 6.5% to $14.73 billion, slightly worse than expected. However, excluding currency effects, the decline was under 3%.

AI Investments:

Apple is enthusiastic about "Apple Intelligence" and plans to accelerate investments in AI. The company has spent over $100 billion on R&D over the past five years.

Product Launches:

The** iPhone 16 series** is anticipated to be released in September, and new AI products revealed in June are expected to drive upgrades.

Financial Performance:

- EPS: $1.40, beating Wall Street's estimate of $1.35.

- Gross Margin: 46.3%, close to the upper end of Apple's forecast.

- Operating Cash Flow: Reached a record $28.9 billion for the June quarter.

Other Revenue:

- Services: Increased by 14.1% to $24.21 billion.

- Macs: Sales grew by 2.5%.

- iPads: Saw a 23.7% increase in sales.

- Wearables: Revenue fell by 2.3%.

Regulatory Issues:

Apple faces scrutiny under the EU's Digital Markets Act and a U.S. Justice Department investigation for alleged market monopolization.

[What is all the fuss about these regulatory issues at Apple?]

Shareholder Returns:

The dividend remains at 25 cents per share, and the company announced a $110 billion share buyback in the previous quarter.

Apple has demonstrated resilience and adaptability in a challenging market, with quarterly results that exceeded expectations despite a slight dip in iPhone sales. The company’s strategic focus on AI, branded as "Apple Intelligence," is driving significant investments and promising future growth. While Apple's revenue in China and wearables showed some weaknesses, the strong performance in services, Macs, and iPads highlights its diverse revenue streams.

The company’s financial health remains robust, evidenced by a solid gross margin and record cash flow, which supports ongoing shareholder returns through dividends and a substantial share buyback program. However, Apple's regulatory challenges in the EU and U.S. underscore the complexities it faces in maintaining its competitive edge.

Overall, Apple’s ability to navigate these hurdles while investing heavily in AI and expanding its product lineup positions it well for sustained growth, though it must carefully balance innovation with regulatory compliance and market pressures.

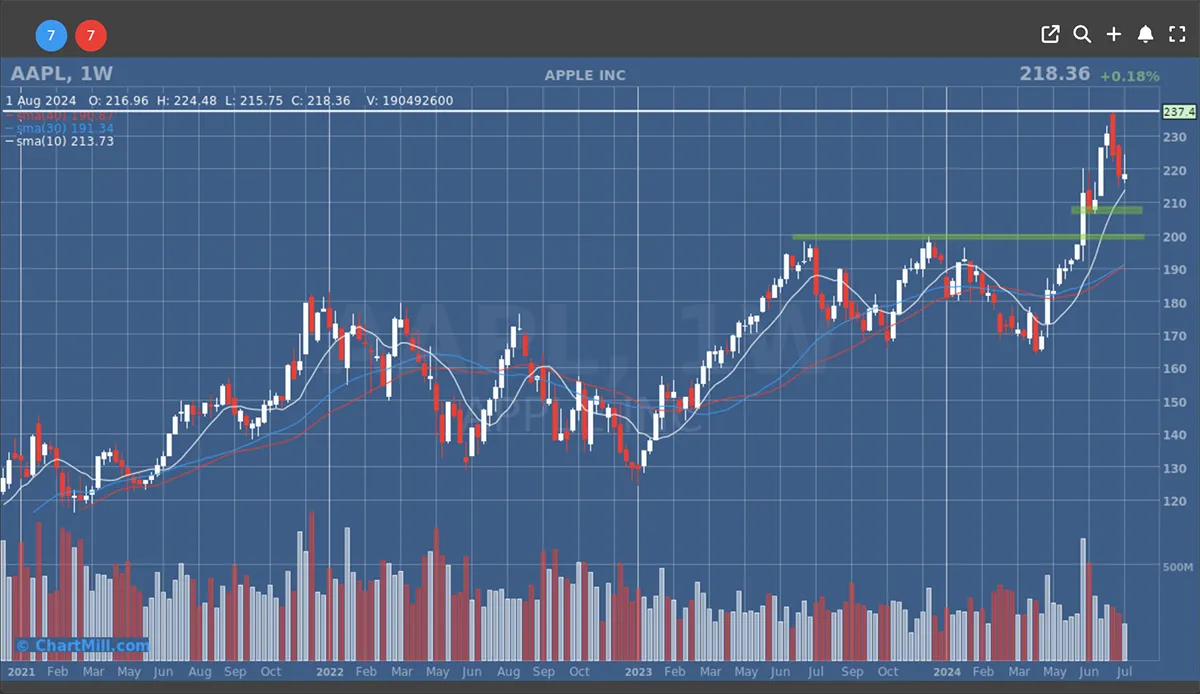

Longterm Weekly Chart