Caviar Cruise Full - Finding Stocks for Quality Investing

This screen also has a base version, but in this version we added some additional criteria to find stocks which qualify for quality investing. Quality investors only invest in the best and most profitable companies available. The screener can filter for criteria which are quantifiable, but besides this more research should be done on the results. Make sure to check the linked article for more information on quality investing and the screen.

Caviar Cruise – A Stock Screener for Quality Investing

An overview of our Caviar Cruise Quality screens.

EBIT vs EBITDA | A comparison

EBIT and EBITDA are both important financial metrics used to assess a company’s profitability. In this article, we examine the differences between the two ratios and provide guidance as to when it is best to use which of the two ratios when analyzing companies.

Related Videos

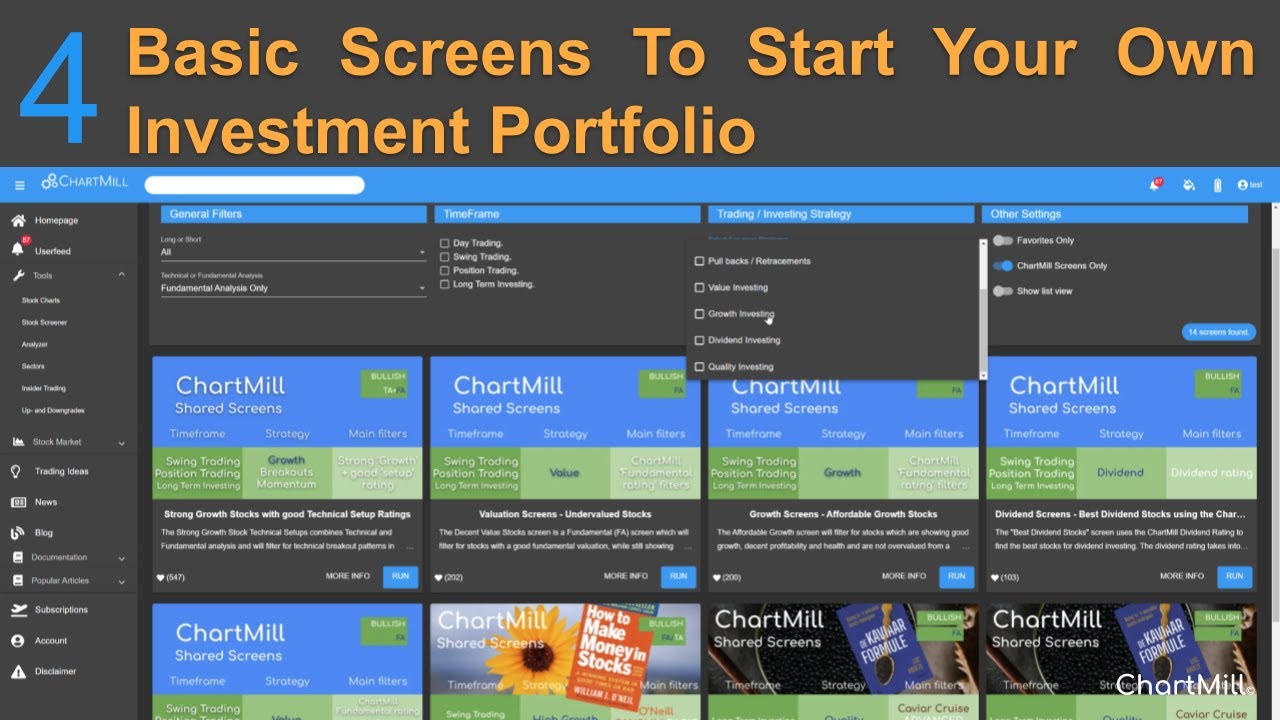

4 basic fundamental screens that will boost your search for the best stocks.

Investors come in different styles and sizes. In this article we take a look at four different fundamental screens that can serve as a basis for building your own investment portfolio with ChartMill. I'll explain what each style entails and what basic filters you can use in ChartMill to get a first basic selection.

INVESTING IN HIGH-QUALITY STOCKS? | ChartMill's most comprehensive screen filter!

In this video, we take a look at a recently added trading idea that was developed specifically to identify high-quality stocks.

Revenue growth 5Y>=5%

A yearly revenue growth of at least 5% on average in the past 5 years

Exchange: US Only

Looking at the US markets

(ebit5yGrowth>revenue5yGrowth)

The EBIT growth should be above the revenue growth.

ROIC growth 5Y>=0%

A growing ROIC, showing improving profitability.

Debt/FCF<=5

We want the Debt to Free Cash Flow ratio to be below 5, meaning it would take less than 5 years to pay of the total debt

Profit Quality(5y)>=75%

The Profit Quality is defined as the Free Cash Flow to Net Income as a percentage and expresses to what extend the company is able to turn net profit into cash. We need this to be at least 75% on average in the past 5 years.

PM growth 5Y>=0%

A growing Profit Margin, showing improving profitability.

ROICexgc>=15%

A return on Invested Capital (ROIC) of at least 15%

Revenue Next 3Y>=5%

An expected revenue growth of at least 5% per year over the next 3 years.

OM growth 5Y>=0%

A growing Operating Margin, showing improving profitability.

default setting are applied

Regional Run

Run this screen in your favorite region. You can always further fine tune the screen by changing the general settings after it opened in the screener.