Tesla Q1 Earnings 2023: What To Expect?

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: May 3, 2023

There are few companies whose Q1 results are being looked forward to as hard as Tesla Motors TSLA's. Elon Musk, the CEO, is a remarkable person who is not shy about making bold statements or contrarian decisions. Whether you hate or adore him, no one can ignore the fact that he has succeeded in shaking the entire EV industry to its foundations.

For other electric car builders (Ford Motor Company (F), General Motors (GM), Toyota Motor Corp...) it's all hands on deck to keep up with Tesla's pace because things are getting pretty darn fast!

The Rise and Fall

Until the end of 2021, trees at Tesla seemed to be growing to the sky. As a comparison, the price on the date 04/11/2019 was $22.47 (1). The closing price at the beginning of November 2022 was $407.36 (2). That's an increase of more than 1700% in just 3 years. Not surprisingly, Tesla is stirring up tempers...

However, the current bear market was unrelenting for Tesla as well. The share price fell to an all-time low of $101.8 (3) in the week of Jan. 03, 2023, but was able to recover sharply to around $180 (4) in the meantime.

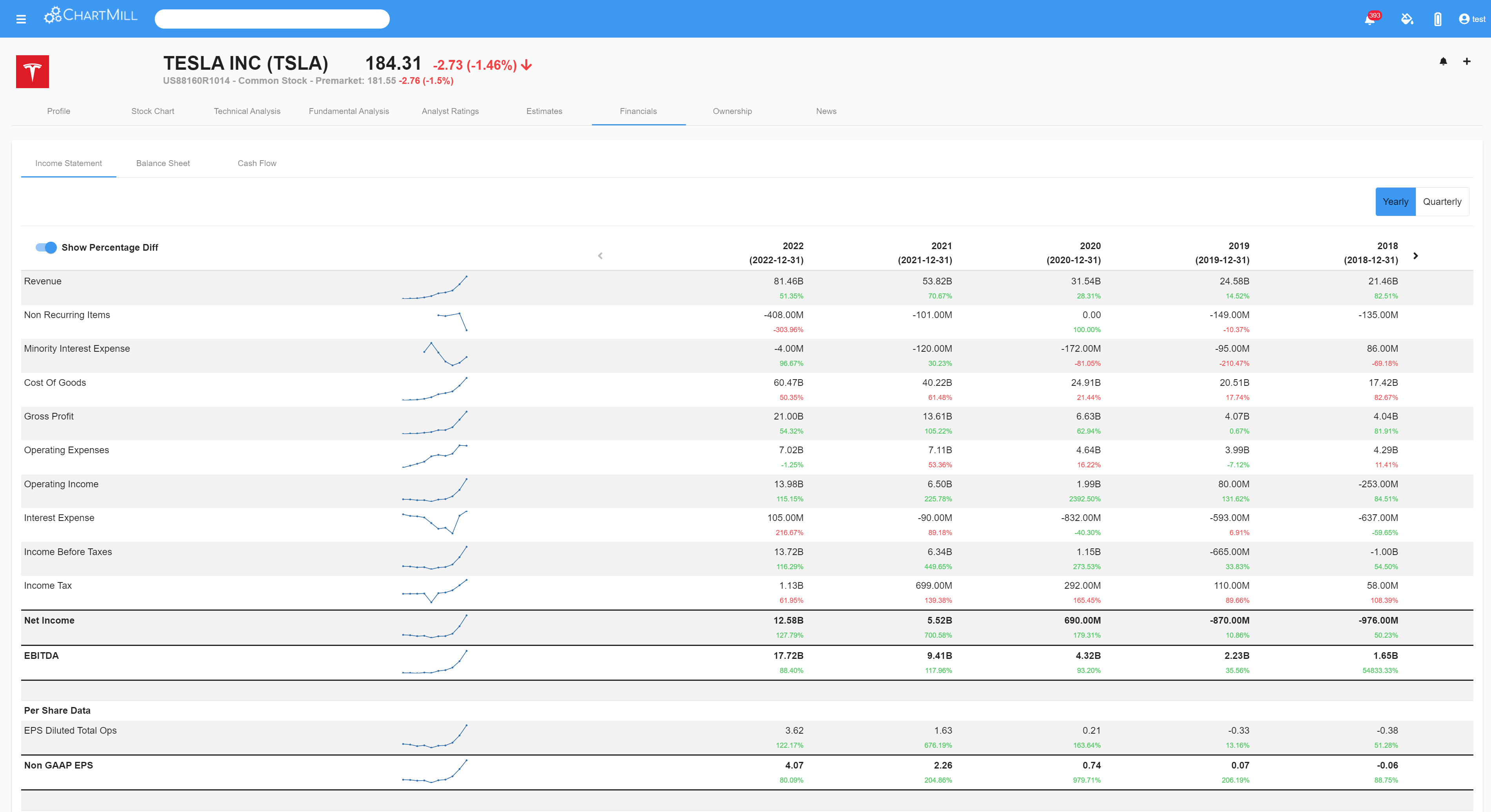

Full Year Results 2022

Tesla can look back on a successful year. Both revenue (+51%) and profits (+129%) increased significantly although they remained below analysts' expectations.

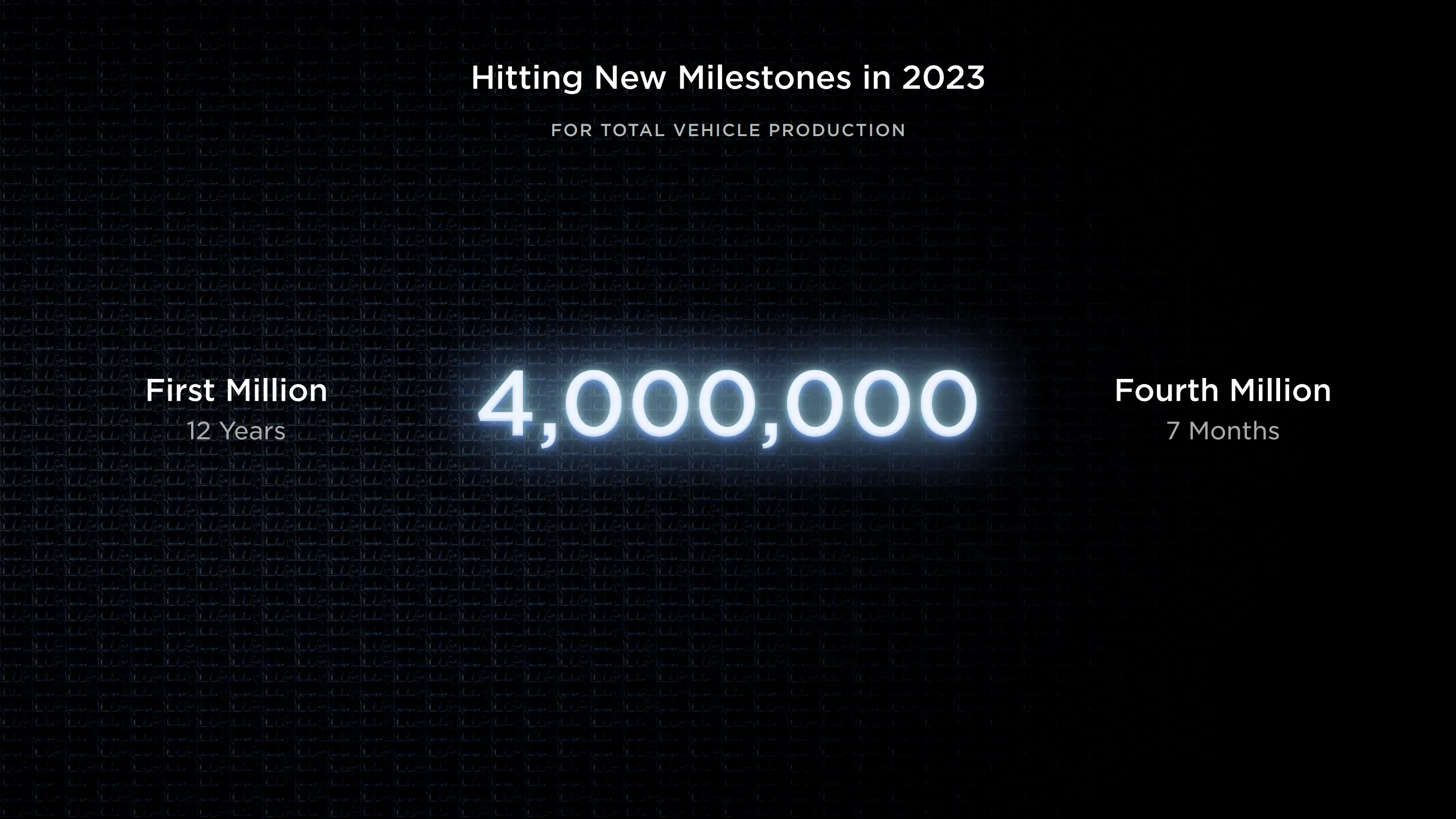

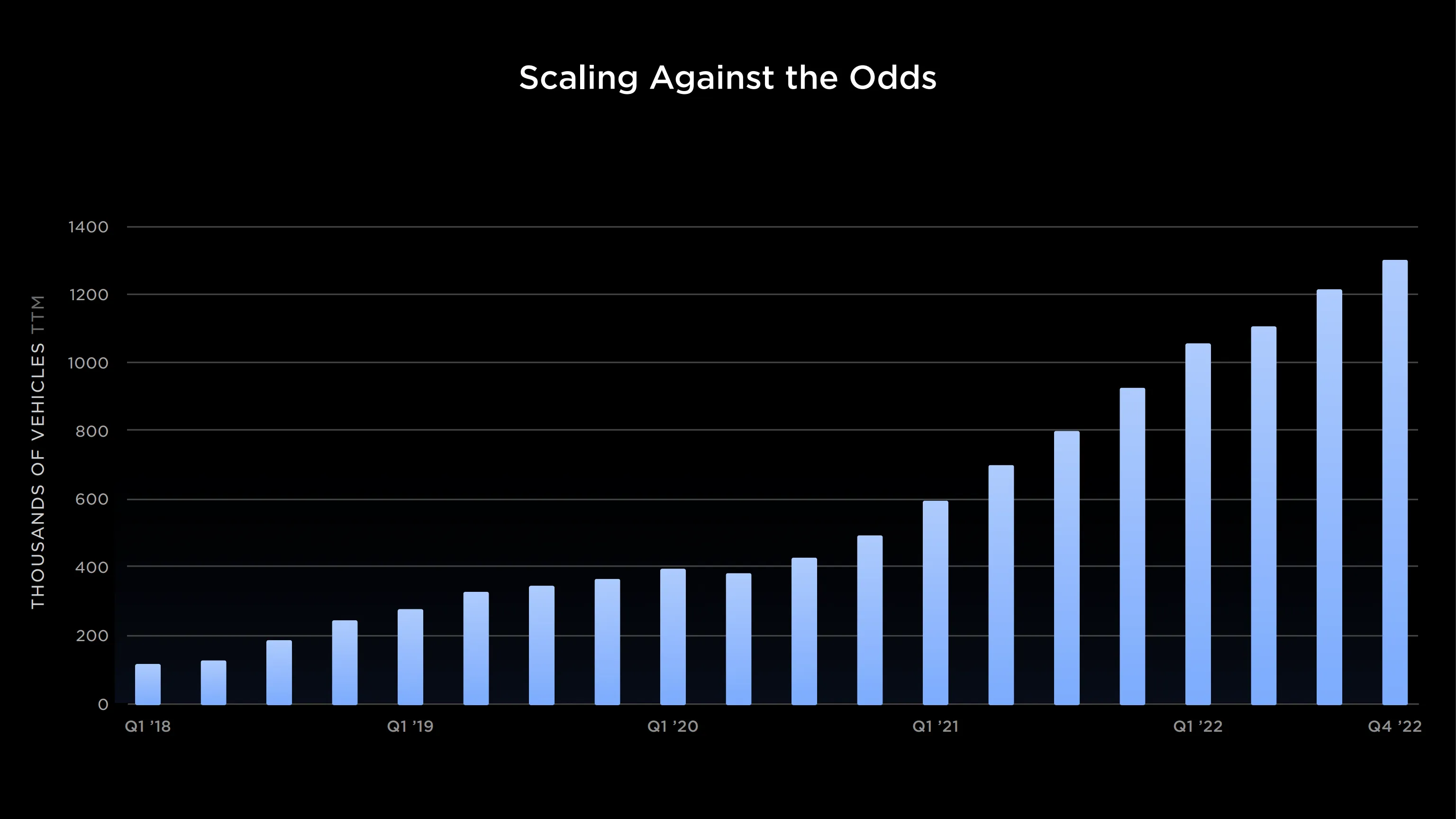

More than 1.3 million vehicles rolled off the assembly line. Production in 2022 thereby surpassed the total number of vehicles produced between 2012 and 2020. The 4,000,000-vehicle mark was already reached in 2023. Management also announced that demand in Q4 greatly exceeded production.

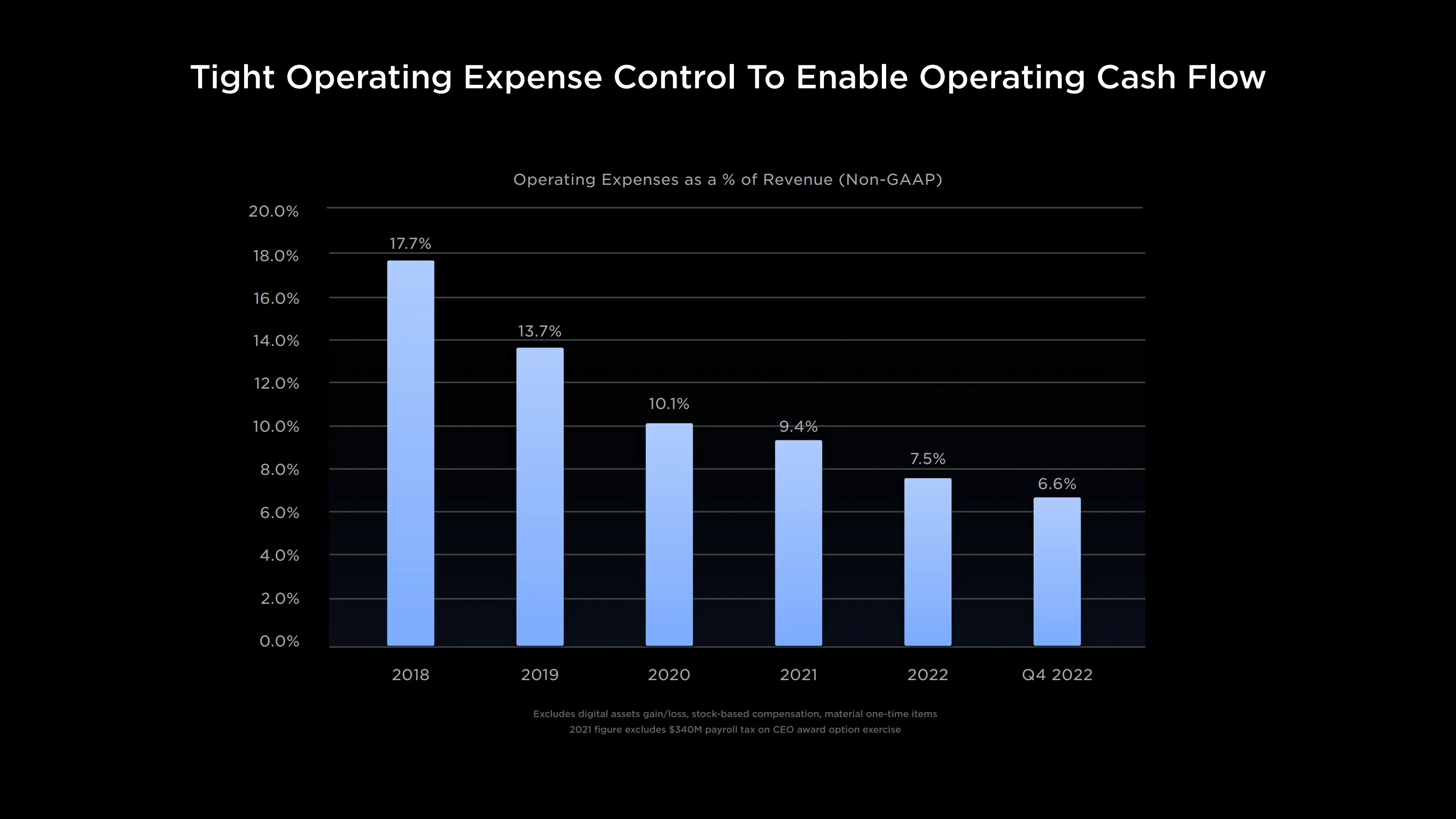

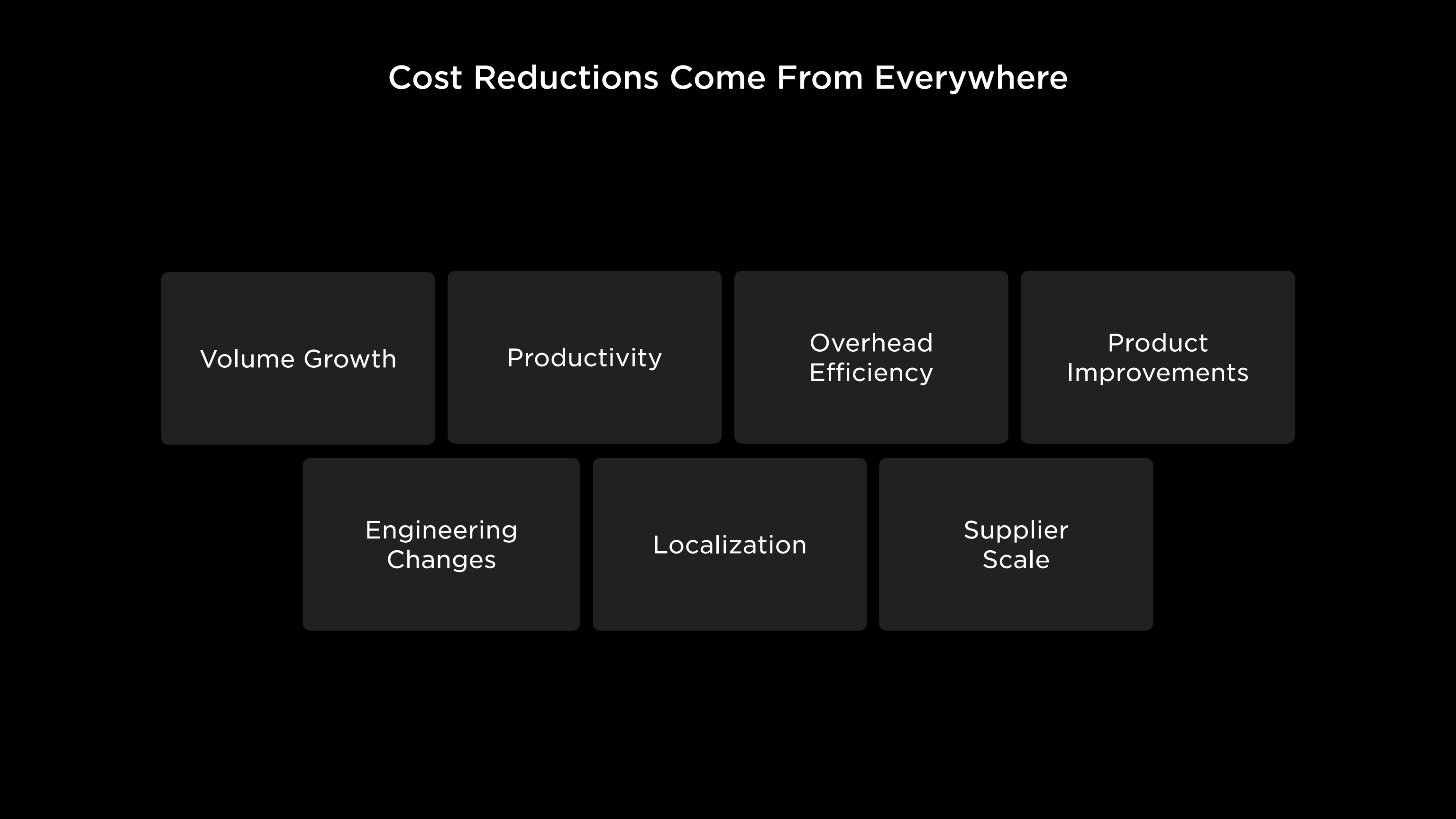

In addition to having a positive effect on sales and profits, such increased production also offers many efficiency advantages. For example, Tesla was able to significantly reduce labor costs, leading to better margins and a stronger competitive position.

DATA SOURCE: TESLA 2023 INVESTOR DAY PRESENTATION.

Aggressive price cuts

Both in January, early March, and most recently on April 14, Tesla cut prices worldwide so that demand would increase. Some investors are concerned about this and see it as a signal that demand for vehicles is deteriorating.

However, this is not consistent with the past annual results, nor with the Q4 update where it was explicitly stated that demand was significantly higher than the number of vehicles completed. Moreover, TSLA already announced in early April that deliveries and production for Q1 were at a record high. There were 422,875 cars delivered and 440,808 vehicles produced.

So the price cuts should be seen primarily as a way to gain an even greater market share and put further pressure on competitors. To that end, Tesla is taking full advantage of their higher cost efficiencies to further reduce prices while maintaining margins.

Other EV makers are under pressure to similarly offer significant discounts if they do not want to lose market share. The key question remains whether they - like Tesla - can do so in the short term without too much impact on their profitability.

2023 expectations

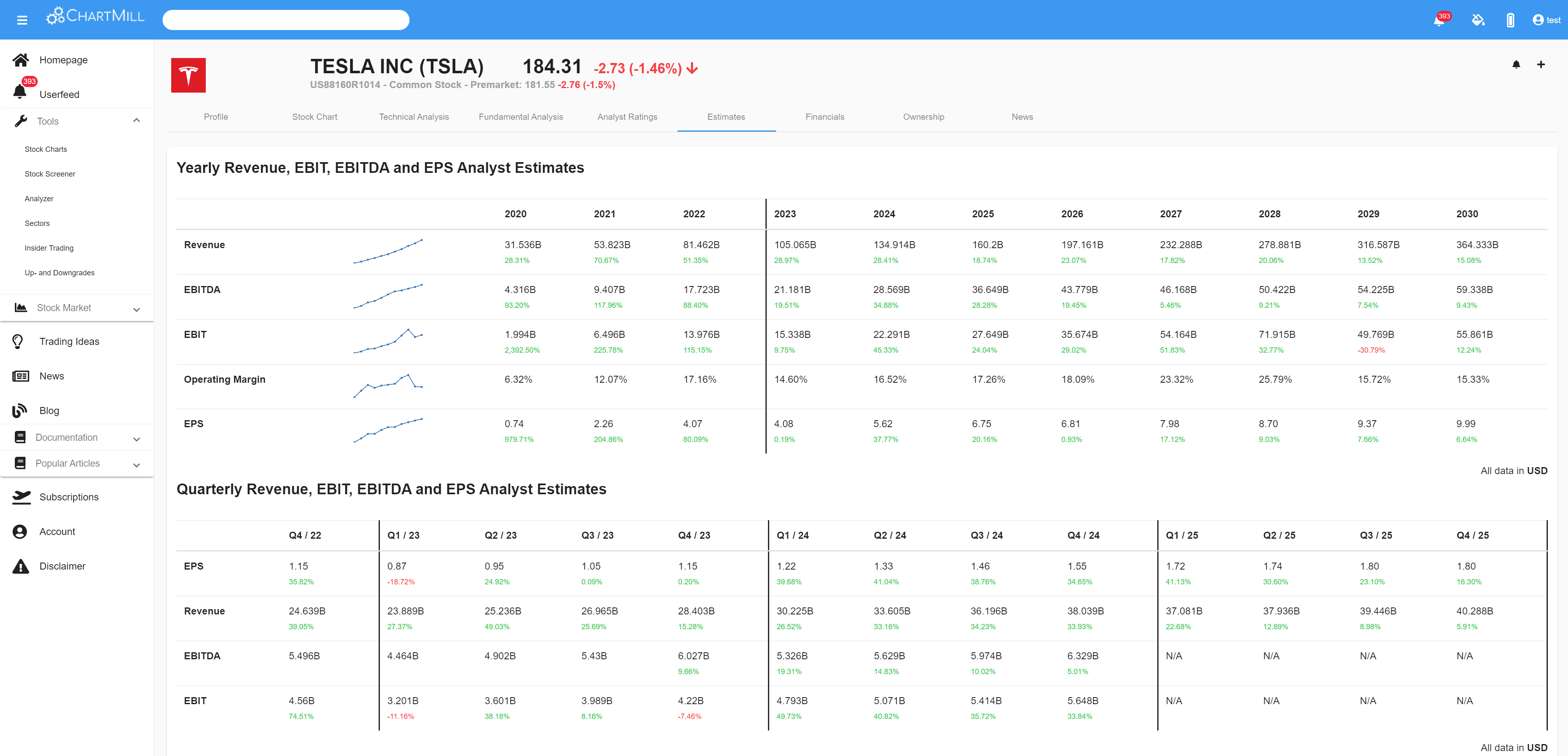

Looks like the market is assuming solid Q1 results:

-

EPS | $0.87

-

Revenue | 23.89B

-

EBITDA | 4.46B

-

EBIT | 3.20B

Investors are particularly interested in seeing the effect of the recently implemented price cuts and any margin pressure they cause. A slight decrease in those profits may be justifiable if accompanied by a strong increase in demand and sales.

In addition to the current state of affairs, management's expectations are eagerly awaited. The most recent quarterly update projected a figure of 1.8 million vehicles produced this year (+31% vs. 2022). It remains to be seen whether management will maintain this figure for 2023.

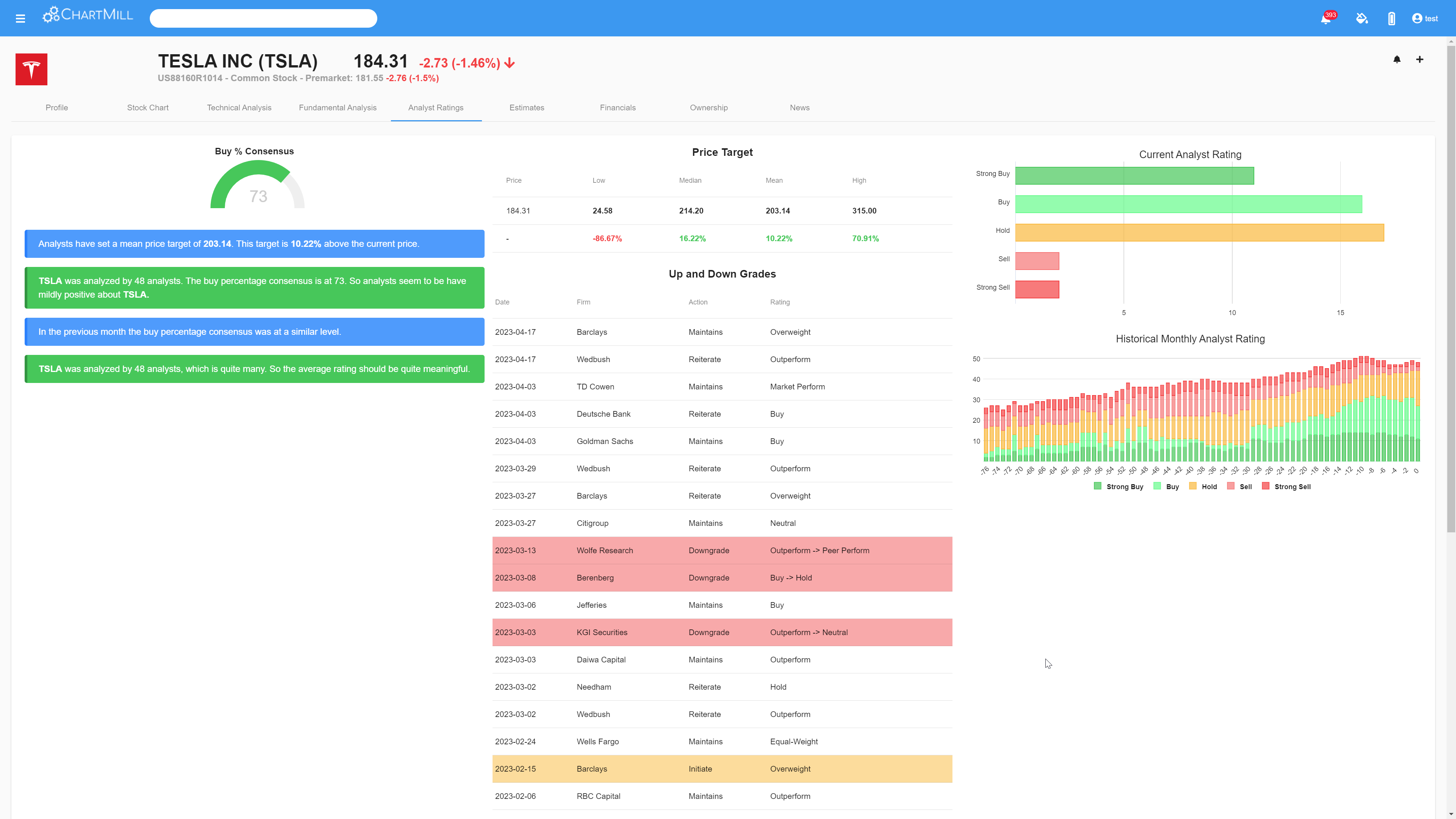

Analyst Ratings

The current buy consensus (based on 48 analysts) is at 73% with a mean price target of $203.17 (+/- 10% above the current price).

When will Tesla become buy-worthy?

ChartMill Ratings

-

ChartMill Fundamental Rating | 3.5/5

-

ChartMill Technical Rating | 1.5/5

-

ChartMill Setup Rating | 3.5/5

-

ChartMill Relative Strength Score | 54.04/100

Chart

In terms of price, Tesla is still in a long-term downtrend. Currently, the price is trapped within a sideways trend channel between the price levels $164 and $217.

The upper side of the current consolidation zone, which acts as resistance, is additionally reinforced by an almost horizontal 200SMA. A breakout with a close above that same 200SMA is a strong buy signal. In that case, we are looking at the current price top, dating from September 2022, around $313.