Philip Morris (PM) To Report Earnings Tomorrow: Here Is What To Expect

Provided By StockStory

Last update: Apr 22, 2025

Tobacco company Philip Morris International (NYSE:PM) will be reporting earnings tomorrow before market open. Here’s what investors should know.

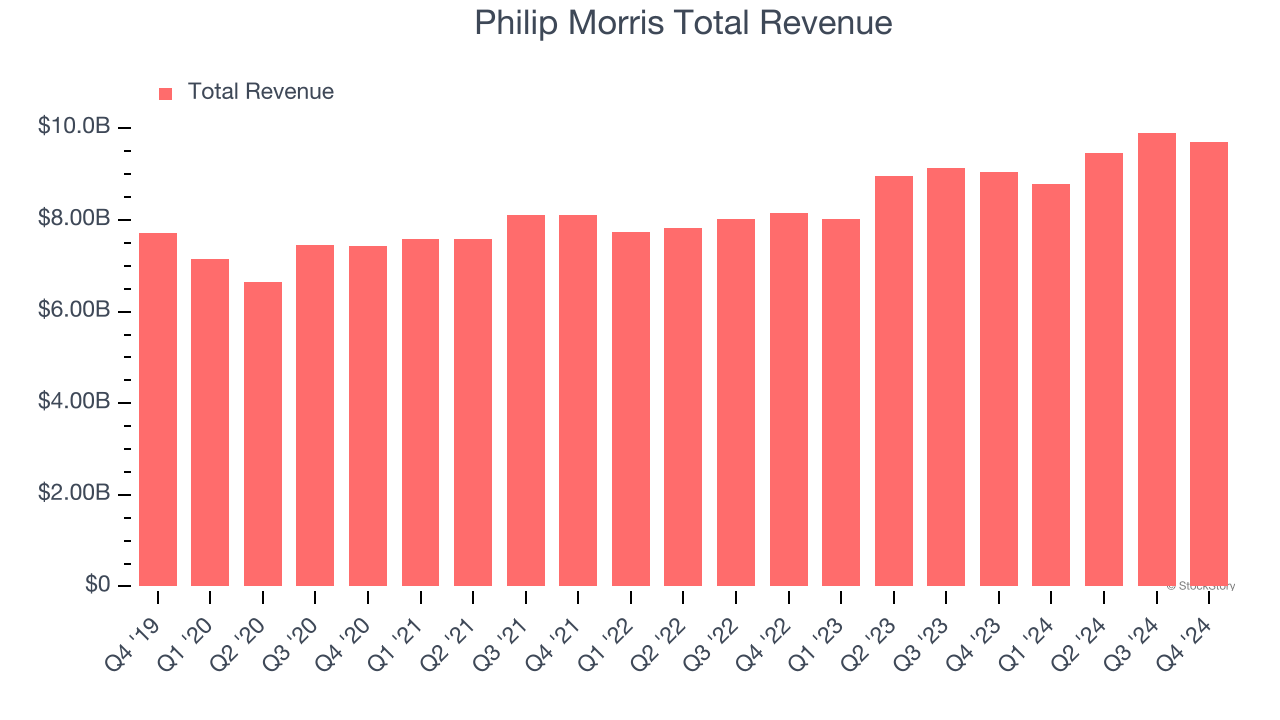

Philip Morris beat analysts’ revenue expectations by 2.8% last quarter, reporting revenues of $9.71 billion, up 7.3% year on year. It was a strong quarter for the company, with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ gross margin estimates.

Is Philip Morris a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Philip Morris’s revenue to grow 3.1% year on year to $9.06 billion, slowing from the 9.7% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.61 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Philip Morris has missed Wall Street’s revenue estimates twice over the last two years.

Looking at Philip Morris’s peers in the consumer staples segment, some have already reported their Q1 results, giving us a hint as to what we can expect. Constellation Brands delivered year-on-year revenue growth of 1.2%, beating analysts’ expectations by 1.9%, and Tilray reported a revenue decline of 1.4%, falling short of estimates by 10.1%. Constellation Brands’s stock price was unchanged after the results, while Tilray was down 8.6%.

Read our full analysis of Constellation Brands’s results here and Tilray’s results here.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

109.02

+0.29 (+0.27%)

186.28

+0.53 (+0.29%)

0.4898

+0.01 (+2.7%)

170.26

+1.09 (+0.64%)

96.06

-0.33 (-0.34%)

Find more stocks in the Stock Screener

NVDA Latest News and Analysis

40 minutes ago - ChartmillDiscover the top S&P500 movers in Tuesday's after-hours session.

40 minutes ago - ChartmillDiscover the top S&P500 movers in Tuesday's after-hours session.After the conclusion of the US market's regular session on Tuesday, let's examine the after-hours session and unveil the notable S&P500 performers among the top gainers and losers.

4 hours ago - ChartmillWhich S&P500 stocks are the most active on Tuesday?

4 hours ago - ChartmillWhich S&P500 stocks are the most active on Tuesday?Curious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

17 hours ago - ChartmillMarket Monitor April 29 ( IBM UP, Nvidia DOWN)

17 hours ago - ChartmillMarket Monitor April 29 ( IBM UP, Nvidia DOWN)Wall Street Holds Steady Ahead of Major Earnings and Economic Data

a day ago - ChartmillThese S&P500 stocks are moving in today's session

a day ago - ChartmillThese S&P500 stocks are moving in today's sessionCurious about the S&P500 stocks that are in motion on Monday? Join us as we explore the top movers within the S&P500 index during today's session.

a day ago - ChartmillWhat's going on in today's session: S&P500 most active stocks

a day ago - ChartmillWhat's going on in today's session: S&P500 most active stocksCurious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.

a day ago - ChartmillCurious about the most active stocks on Monday?

a day ago - ChartmillCurious about the most active stocks on Monday?Get a pulse on the US markets on Monday by checking out the most active stocks in today's session. Discover the stocks that are leading the way in terms of trading volume and market activity.

a day ago - ChartmillExploring the top movers within the S&P500 index during today's session.

a day ago - ChartmillExploring the top movers within the S&P500 index during today's session.Join us in exploring the top gainers and losers within the S&P500 index in the middle of the day on Monday as we examine the latest happenings in today's session.

a day ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocks

a day ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocksCurious about the S&P500 stocks that are gapping on Monday? Explore the gap up and gap down stocks in the S&P500 index during today's session.

2 days ago - ChartmillMarket Monitor April 28 ( Alphabet, Nvidia & Meta UP, Intel DOWN)

2 days ago - ChartmillMarket Monitor April 28 ( Alphabet, Nvidia & Meta UP, Intel DOWN)US Markets Rise as Big Tech Shines, Trade Tensions Remain a Concern

3 days ago - ChartmillExploring the Growth Potential of NVIDIA CORP (NASDAQ:NVDA) as It Nears a Breakout.

3 days ago - ChartmillExploring the Growth Potential of NVIDIA CORP (NASDAQ:NVDA) as It Nears a Breakout.Based on a technical and fundamental analysis of NASDAQ:NVDA we conclude: NVIDIA CORP (NASDAQ:NVDA)—A High-Growth Stock Gearing Up for Its Next Upward Move.

4 days ago - ChartmillThese S&P500 stocks are moving in today's session

4 days ago - ChartmillThese S&P500 stocks are moving in today's sessionCurious about the S&P500 stocks that are in motion on Friday? Join us as we explore the top movers within the S&P500 index during today's session.

4 days ago - ChartmillExplore the S&P500 index on Friday and find out which stocks are the most active in today's session.

4 days ago - ChartmillExplore the S&P500 index on Friday and find out which stocks are the most active in today's session.Curious about the most active S&P500 stocks in today's session? Get insights into the stocks that are leading the way in terms of trading volume and market attention.