In the world of growth stocks, NYSE:TDW shines as a value proposition.

By Mill Chart

Last update: Dec 10, 2024

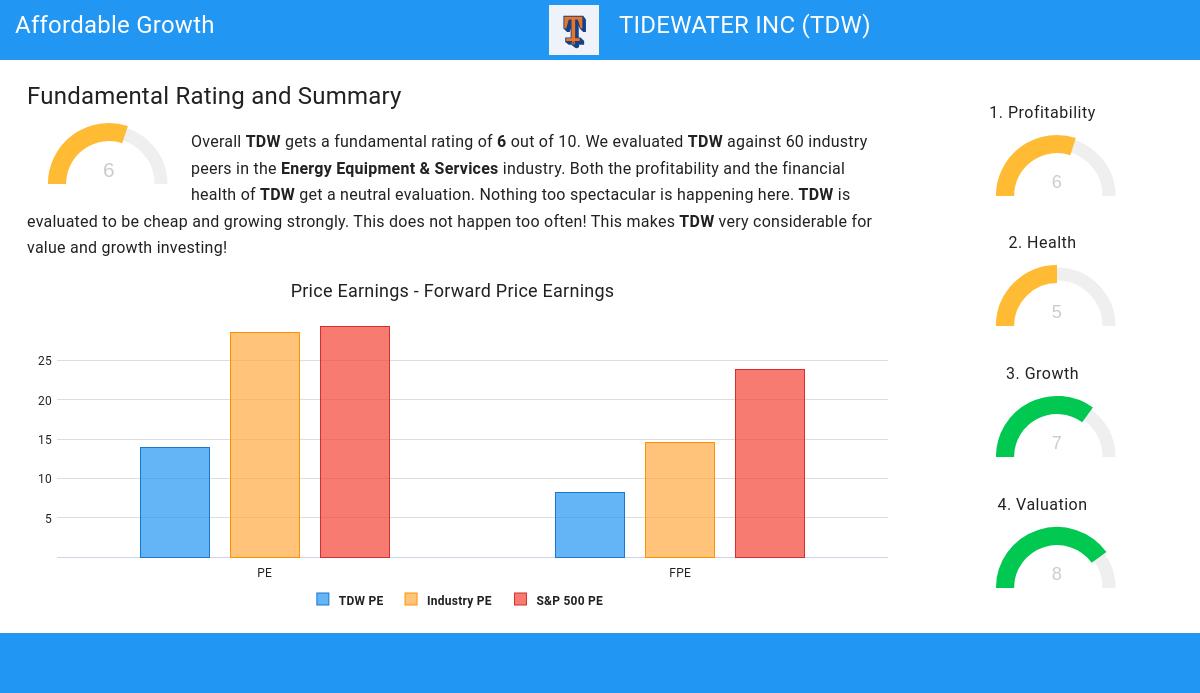

Here's TIDEWATER INC (NYSE:TDW) for you, a growth stock our stock screener believes is undervalued. NYSE:TDW is scoring impressively in terms of growth while demonstrating strong financials. On top of that, it remains attractively priced. Let's break it down further.

ChartMill's Evaluation of Growth

To evaluate a stock's growth potential, ChartMill utilizes a Growth Rating on a scale of 0 to 10. This comprehensive assessment considers various growth aspects, including historical and estimated EPS and revenue growth. NYSE:TDW has achieved a 7 out of 10:

- The Earnings Per Share has grown by an impressive 151.85% over the past year.

- The Revenue has grown by 45.78% in the past year. This is a very strong growth!

- The Revenue has been growing by 19.96% on average over the past years. This is quite good.

- The Earnings Per Share is expected to grow by 79.52% on average over the next years. This is a very strong growth

- Based on estimates for the next years, TDW will show a very strong growth in Revenue. The Revenue will grow by 20.17% on average per year.

ChartMill's Evaluation of Valuation

ChartMill employs its own Valuation Rating system for all stocks. This score, ranging from 0 to 10, is determined by evaluating different valuation factors, including price to earnings and free cash flow, both in absolute terms and relative to the market and industry. NYSE:TDW has earned a 8 for valuation:

- 68.33% of the companies in the same industry are more expensive than TDW, based on the Price/Earnings ratio.

- Compared to an average S&P500 Price/Earnings ratio of 29.37, TDW is valued rather cheaply.

- Based on the Price/Forward Earnings ratio of 8.22, the valuation of TDW can be described as reasonable.

- Based on the Price/Forward Earnings ratio, TDW is valued cheaper than 90.00% of the companies in the same industry.

- TDW's Price/Forward Earnings ratio indicates a rather cheap valuation when compared to the S&P500 average which is at 23.84.

- TDW's Price/Free Cash Flow ratio is a bit cheaper when compared to the industry. TDW is cheaper than 61.67% of the companies in the same industry.

- TDW's low PEG Ratio(NY), which compensates the Price/Earnings for growth, indicates a rather cheap valuation of the company.

- The decent profitability rating of TDW may justify a higher PE ratio.

- TDW's earnings are expected to grow with 79.52% in the coming years. This may justify a more expensive valuation.

What does the Health looks like for NYSE:TDW

To gauge a stock's financial health, ChartMill utilizes a Health Rating on a scale of 0 to 10. This comprehensive evaluation encompasses liquidity and solvency, both in absolute terms and in comparison to industry peers. NYSE:TDW has earned a 5 out of 10:

- With a decent Altman-Z score value of 2.52, TDW is doing good in the industry, outperforming 68.33% of the companies in the same industry.

- The Debt to FCF ratio of TDW is 3.28, which is a good value as it means it would take TDW, 3.28 years of fcf income to pay off all of its debts.

- A Current Ratio of 2.29 indicates that TDW has no problem at all paying its short term obligations.

- Looking at the Current ratio, with a value of 2.29, TDW is in the better half of the industry, outperforming 66.67% of the companies in the same industry.

- A Quick Ratio of 2.19 indicates that TDW has no problem at all paying its short term obligations.

- Looking at the Quick ratio, with a value of 2.19, TDW is in the better half of the industry, outperforming 80.00% of the companies in the same industry.

Understanding NYSE:TDW's Profitability

Discover ChartMill's exclusive Profitability Rating, a proprietary metric that assesses stocks on a scale of 0 to 10. It takes into consideration various profitability ratios and margins, both in absolute terms and relative to industry peers. Notably, NYSE:TDW has achieved a 6:

- TDW has a Return On Assets of 8.86%. This is in the better half of the industry: TDW outperforms 75.00% of its industry peers.

- Looking at the Return On Equity, with a value of 16.25%, TDW is in the better half of the industry, outperforming 75.00% of the companies in the same industry.

- TDW's Return On Invested Capital of 10.70% is fine compared to the rest of the industry. TDW outperforms 78.33% of its industry peers.

- TDW has a Profit Margin of 13.92%. This is amongst the best in the industry. TDW outperforms 85.00% of its industry peers.

- TDW has a better Operating Margin (21.16%) than 85.00% of its industry peers.

- TDW has a better Gross Margin (47.41%) than 88.33% of its industry peers.

- In the last couple of years the Gross Margin of TDW has grown nicely.

More Affordable Growth stocks can be found in our Affordable Growth screener.

Check the latest full fundamental report of TDW for a complete fundamental analysis.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

NYSE:TDW (12/23/2025, 9:55:41 AM)

51.17

-0.08 (-0.16%)

Find more stocks in the Stock Screener