There are signs that NYSE:SU may be ready to breakout.

By Mill Chart

Last update: Aug 8, 2023

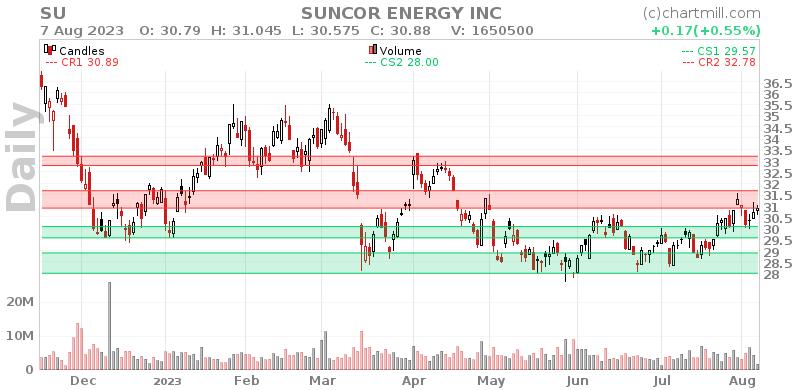

Our stock screener has spotted SUNCOR ENERGY INC (NYSE:SU) as a possible breakout candidate. A technical breakout setup pattern occurs when the stock is consolidating after a nice uptrend. Whether the actual breakout occurs remains to be seen of course, but it may be interesting to keep an eye on NYSE:SU.

What is the technical picture of NYSE:SU telling us.

ChartMill utilizes a proprietary algorithm to assign a Technical Rating to every stock. This rating, ranging from 0 to 10, is computed daily by analyzing a variety of technical indicators and properties.

We assign a technical rating of 7 out of 10 to SU. SU has been a medium performer in the overall market. Some doubts are observed in the medium time frame, but recent action was very positive.

- The long and short term trends are both positive. This is looking good!

- In the last month SU has a been trading in the 28.65 - 31.57 range, which is quite wide. It is currently trading near the high of this range.

- When comparing the performance of all stocks over the past year, SU turns out to be only a medium performer in the overall market: it outperformed 51% of all stocks.

- SU is currently trading in the middle of its 52 week range. The S&P500 Index however is currently trading near new highs, so SU is lagging the market.

Check the latest full technical report of SU for a complete technical analysis.

Looking at the Setup

Besides the Technical Rating, ChartMill also assign a Setup Rating to every stock. This setup score also ranges from 0 to 10 and determines to which extend the stock is consolidating. This is achieved by evaluating multiple short term technical indicators. NYSE:SU currently has a 9 as setup rating:

SU has an excellent technical rating and also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. A pullback is taking place, which may present a nice opportunity for an entry. There is a resistance zone just above the current price starting at 30.89. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 30.07, a Stop Loss order could be placed below this zone. Very recently a Pocket Pivot signal was observed. This is another positive sign.

How to trade NYSE:SU?

One way to play this would be to wait for the actual breakout to happen and buy when the stock breaks out above the current consolidation zone. A possible place for a stop loss would be below this zone.

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents technical observations generated by automated analysis but does not guarantee any trading outcomes. Always trade responsibly and make independent judgments.

More breakout setups can be found in our Breakout screener.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

35.6

+0.52 (+1.48%)

Find more stocks in the Stock Screener

SU Latest News and Analysis

13 days ago - ChartmillWhy the dividend investor may take a look at SUNCOR ENERGY INC (NYSE:SU).

13 days ago - ChartmillWhy the dividend investor may take a look at SUNCOR ENERGY INC (NYSE:SU).Exploring SUNCOR ENERGY INC (NYSE:SU)'s dividend characteristics.