Is NASDAQ:QCOM suited for dividend investing?

By Mill Chart

Last update: Oct 1, 2024

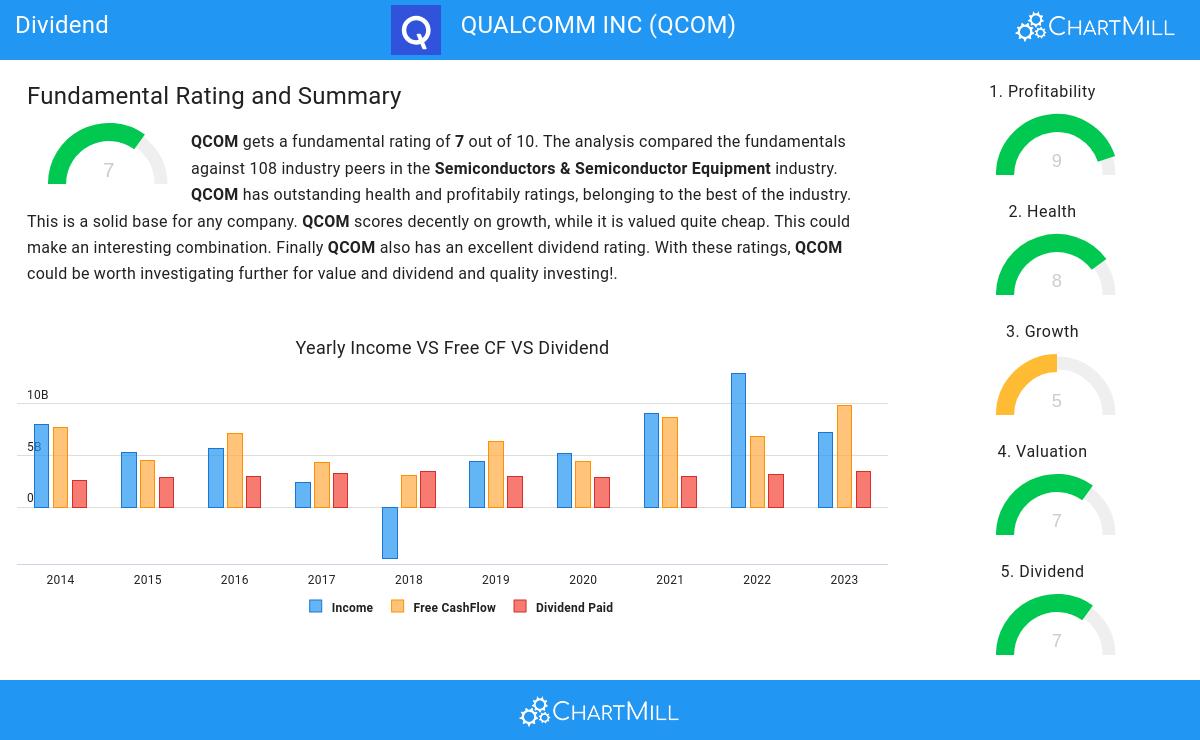

QUALCOMM INC (NASDAQ:QCOM) was identified as a stock worth exploring by dividend investors by our stock screener. NASDAQ:QCOM scores well on profitability, solvency and liquidity. At the same time it seems to pay a decent dividend. We'll explore this a bit deeper below.

Evaluating Dividend: NASDAQ:QCOM

ChartMill employs its own Dividend Rating system for all stocks. This score, on a scale of 0 to 10, is determined by evaluating different dividend factors, such as yield, historical performance, dividend growth, and sustainability. NASDAQ:QCOM has been assigned a 7 for dividend:

- QCOM's Dividend Yield is rather good when compared to the industry average which is at 2.18. QCOM pays more dividend than 89.81% of the companies in the same industry.

- QCOM has been paying a dividend for at least 10 years, so it has a reliable track record.

- QCOM has not decreased its dividend for at least 10 years, so it has a reliable track record of non decreasing dividend.

- The dividend of QCOM is growing, but earnings are growing more, so the dividend growth is sustainable.

Unpacking NASDAQ:QCOM's Health Rating

ChartMill employs a unique Health Rating system for all stocks. This rating, ranging from 0 to 10, is determined by analyzing various liquidity and solvency ratios. For NASDAQ:QCOM, the assigned 8 for health provides valuable insights:

- An Altman-Z score of 6.31 indicates that QCOM is not in any danger for bankruptcy at the moment.

- QCOM has a Altman-Z score of 6.31. This is in the better half of the industry: QCOM outperforms 64.81% of its industry peers.

- The Debt to FCF ratio of QCOM is 1.16, which is an excellent value as it means it would take QCOM, only 1.16 years of fcf income to pay off all of its debts.

- The Debt to FCF ratio of QCOM (1.16) is better than 76.85% of its industry peers.

- Even though the debt/equity ratio score it not favorable for QCOM, it has very limited outstanding debt, so we won't put too much weight on the DE evaluation.

- QCOM has a Current Ratio of 2.39. This indicates that QCOM is financially healthy and has no problem in meeting its short term obligations.

- QCOM does not score too well on the current and quick ratio evaluation. However, as it has excellent solvency and profitability, these ratios do not necessarly indicate liquidity issues and need to be evaluated against the specifics of the business.

A Closer Look at Profitability for NASDAQ:QCOM

ChartMill employs its own Profitability Rating system for stock evaluation. This score, ranging from 0 to 10, is derived from an analysis of diverse profitability metrics and margins. In the case of NASDAQ:QCOM, the assigned 9 is noteworthy for profitability:

- QCOM has a better Return On Assets (16.52%) than 88.89% of its industry peers.

- The Return On Equity of QCOM (35.31%) is better than 95.37% of its industry peers.

- QCOM's Return On Invested Capital of 17.50% is amongst the best of the industry. QCOM outperforms 91.67% of its industry peers.

- The Average Return On Invested Capital over the past 3 years for QCOM is significantly above the industry average of 10.70%.

- The 3 year average ROIC (24.51%) for QCOM is well above the current ROIC(17.50%). The reason for the recent decline needs to be investigated.

- QCOM's Profit Margin of 23.33% is amongst the best of the industry. QCOM outperforms 83.33% of its industry peers.

- QCOM has a better Operating Margin (25.50%) than 84.26% of its industry peers.

- QCOM's Operating Margin has improved in the last couple of years.

- QCOM has a better Gross Margin (55.90%) than 76.85% of its industry peers.

Our Best Dividend screener lists more Best Dividend stocks and is updated daily.

Check the latest full fundamental report of QCOM for a complete fundamental analysis.

Disclaimer

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents observations created by automated analysis but does not guarantee any trading or investment outcomes. Always trade responsibly and make independent judgments.

136.66

+0.92 (+0.68%)

Find more stocks in the Stock Screener

QCOM Latest News and Analysis

3 days ago - ChartmillWhy QUALCOMM INC (NASDAQ:QCOM) qualifies as a good dividend investing stock.

3 days ago - ChartmillWhy QUALCOMM INC (NASDAQ:QCOM) qualifies as a good dividend investing stock.Is QUALCOMM INC (NASDAQ:QCOM) suited for dividend investing?

9 days ago - ChartmillWhy the quality investor may take a look at QUALCOMM INC (NASDAQ:QCOM).

9 days ago - ChartmillWhy the quality investor may take a look at QUALCOMM INC (NASDAQ:QCOM).A fundamental analysis of (NASDAQ:QCOM): Reasonable growth and debt and a high ROIC for QUALCOMM INC (NASDAQ:QCOM).

18 days ago - ChartmillChecking the Peter Lynch growth stock criteria for QUALCOMM INC (NASDAQ:QCOM)

18 days ago - ChartmillChecking the Peter Lynch growth stock criteria for QUALCOMM INC (NASDAQ:QCOM)Peter Lynch’s investment philosophy combines fundamental analysis with a deep understanding of business models. Let’s analyze if QUALCOMM INC (NASDAQ:QCOM) meets his criteria for a solid investment.

21 days ago - ChartmillQUALCOMM INC (NASDAQ:QCOM) is a prime example of a stock that offers more than what meets the eye in terms of fundamentals.

21 days ago - ChartmillQUALCOMM INC (NASDAQ:QCOM) is a prime example of a stock that offers more than what meets the eye in terms of fundamentals.QUALCOMM INC is a hidden gem, featuring undervaluation and robust fundamentals. NASDAQ:QCOM showcases decent financial health and profitability, coupled with an attractive price.