Why NASDAQ:PLTR Is a Standout High-Growth Stock in a Consolidation Phase.

By Mill Chart

Last update: Dec 24, 2024

In this article, we'll take a closer look at PALANTIR TECHNOLOGIES INC-A (NASDAQ:PLTR) as a potential candidate for growth investing. While it's important for investors to conduct their own research, PALANTIR TECHNOLOGIES INC-A has piqued our interest by appearing on our strong growth and breakout radar. Let's explore further.

Growth Assessment of NASDAQ:PLTR

ChartMill assigns a Growth Rating to every stock. This score ranges from 0 to 10 and evaluates the different growth aspects like EPS and Revenue, both in the past as in the future. NASDAQ:PLTR scores a 8 out of 10:

- The Earnings Per Share has grown by an impressive 66.67% over the past year.

- Looking at the last year, PLTR shows a very strong growth in Revenue. The Revenue has grown by 24.52%.

- The Revenue has been growing by 30.17% on average over the past years. This is a very strong growth!

- Based on estimates for the next years, PLTR will show a very strong growth in Earnings Per Share. The EPS will grow by 28.84% on average per year.

- PLTR is expected to show a strong growth in Revenue. In the coming years, the Revenue will grow by 22.75% yearly.

Health Analysis for NASDAQ:PLTR

ChartMill utilizes a Health Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of liquidity and solvency ratios, both in absolute terms and in comparison to industry peers. NASDAQ:PLTR has earned a 8 out of 10:

- PLTR has an Altman-Z score of 87.11. This indicates that PLTR is financially healthy and has little risk of bankruptcy at the moment.

- PLTR has a better Altman-Z score (87.11) than 98.92% of its industry peers.

- PLTR has no outstanding debt. Therefor its Debt/Equity and Debt/FCF ratios are 0 and belong to the best of the industry.

- PLTR has a Current Ratio of 5.67. This indicates that PLTR is financially healthy and has no problem in meeting its short term obligations.

- PLTR has a Current ratio of 5.67. This is amongst the best in the industry. PLTR outperforms 89.25% of its industry peers.

- A Quick Ratio of 5.67 indicates that PLTR has no problem at all paying its short term obligations.

- PLTR's Quick ratio of 5.67 is amongst the best of the industry. PLTR outperforms 89.25% of its industry peers.

Evaluating Profitability: NASDAQ:PLTR

ChartMill's Profitability Rating offers a unique perspective on stock analysis, providing scores from 0 to 10. These ratings consider a wide range of profitability metrics and margins, both in comparison to industry peers and on their own merits. For NASDAQ:PLTR, the assigned 6 is a significant indicator of profitability:

- PLTR's Return On Assets of 8.26% is amongst the best of the industry. PLTR outperforms 84.23% of its industry peers.

- With an excellent Return On Equity value of 10.59%, PLTR belongs to the best of the industry, outperforming 80.65% of the companies in the same industry.

- With a decent Return On Invested Capital value of 5.98%, PLTR is doing good in the industry, outperforming 77.78% of the companies in the same industry.

- PLTR has a better Profit Margin (18.01%) than 85.30% of its industry peers.

- Looking at the Operating Margin, with a value of 13.80%, PLTR belongs to the top of the industry, outperforming 82.08% of the companies in the same industry.

- With an excellent Gross Margin value of 81.10%, PLTR belongs to the best of the industry, outperforming 83.51% of the companies in the same industry.

- PLTR's Gross Margin has improved in the last couple of years.

How does the Setup look for NASDAQ:PLTR

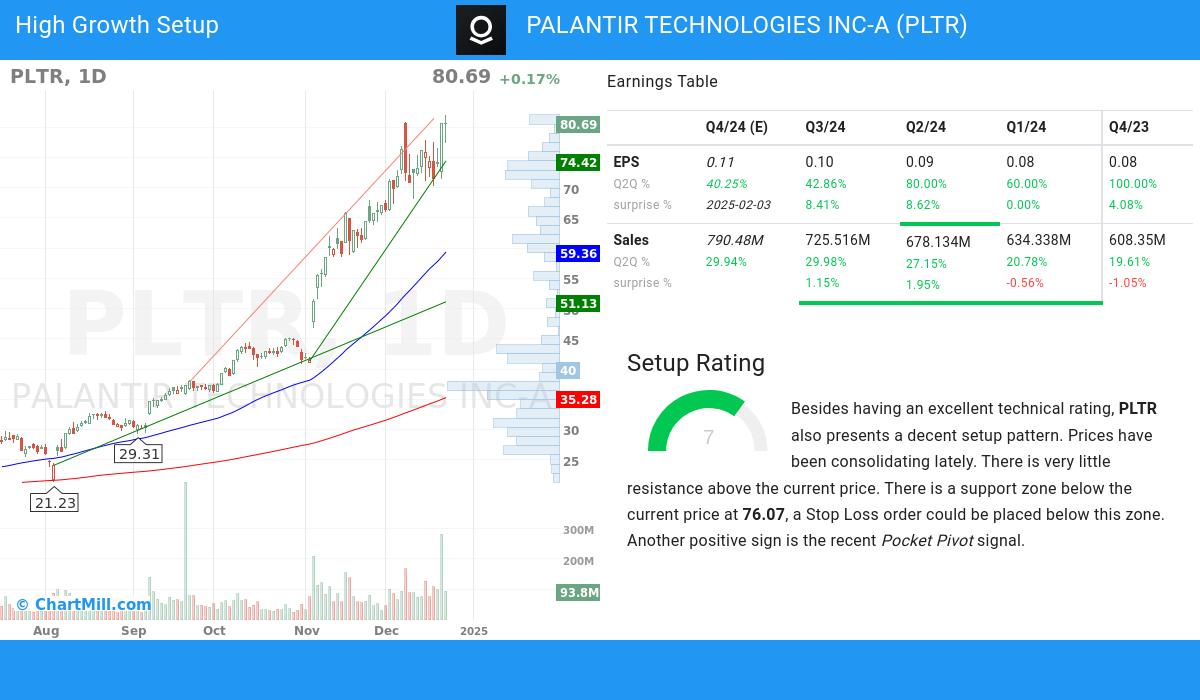

ChartMill also assign a Setup Rating to every stock. With this score it is determined to what extend the stock has been trading in a range in the recent days and weeks. This score also ranges from 0 to 10 and is updated daily. The setup score evaluates various short term technical indicators. NASDAQ:PLTR scores a 7 out of 10:

PLTR has an excellent technical rating and also presents a decent setup pattern. Prices have been consolidating lately. There is very little resistance above the current price. There is a support zone below the current price at 76.07, a Stop Loss order could be placed below this zone. Another positive sign is the recent Pocket Pivot signal.

More Strong Growth stocks can be found in our Strong Growth screener.

For an up to date full fundamental analysis you can check the fundamental report of PLTR

Check the latest full technical report of PLTR for a complete technical analysis.

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

93.78

+1.07 (+1.15%)

Find more stocks in the Stock Screener

PLTR Latest News and Analysis

6 hours ago - ChartmillThursday's session: most active stock in the S&P500 index

6 hours ago - ChartmillThursday's session: most active stock in the S&P500 indexLooking for the most active S&P500 stocks in today's session? Join us as we dive into the US markets on Thursday and discover the stocks that are dominating the trading activity and setting the pace for the market.

6 hours ago - ChartmillMost active stocks in Thursday's session

6 hours ago - ChartmillMost active stocks in Thursday's sessionThursday's session is buzzing with activity. Check out the stocks that are attracting the most attention and driving market activity!

a day ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.

a day ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.Let's delve into the developments on the US markets one hour before the close of the markets on Wednesday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.

a day ago - ChartmillMost active S&P500 stocks in Wednesday's session

a day ago - ChartmillMost active S&P500 stocks in Wednesday's sessionStay informed about the most active S&P500 stocks in today's session as we take a closer look at what's happening on the US markets on Wednesday. Discover the stocks that are generating the highest trading volume and driving market activity.

a day ago - ChartmillMost active stocks in Wednesday's session

a day ago - ChartmillMost active stocks in Wednesday's sessionCurious about the most active stocks in today's session? Get a glimpse into the stocks that are generating the highest trading volume and capturing market attention.

a day ago - ChartmillDiscover which S&P500 stocks are making waves on Wednesday.

a day ago - ChartmillDiscover which S&P500 stocks are making waves on Wednesday.Let's delve into the developments on the US markets in the middle of the day on Wednesday. Below, you'll find the top gainers and losers within the S&P500 index during today's session.

a day ago - ChartmillWednesday's session: gap up and gap down stock in the S&P500 index

a day ago - ChartmillWednesday's session: gap up and gap down stock in the S&P500 indexLet's take a look at the S&P500 stocks that are experiencing notable price gaps in today's session on Wednesday. Discover the gap up and gap down stocks in the S&P500 index.

2 days ago - ChartmillMarket Monitor April 16 ( Netflix, Palantir UP, Nvidia, Applied Digital DOWN)

2 days ago - ChartmillMarket Monitor April 16 ( Netflix, Palantir UP, Nvidia, Applied Digital DOWN)Calm Trading on Wall Street as Netflix Shines, Nvidia Stumbles after-hours

2 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

2 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Stay informed about the performance of the S&P500 index one hour before the close of the markets on Tuesday. Uncover the top gainers and losers in today's session for valuable insights.

2 days ago - ChartmillMost active S&P500 stocks in Tuesday's session

2 days ago - ChartmillMost active S&P500 stocks in Tuesday's sessionStay informed about the most active S&P500 stocks in today's session as we take a closer look at what's happening on the US markets on Tuesday. Discover the stocks that are generating the highest trading volume and driving market activity.

2 days ago - ChartmillCurious about the most active stocks on Tuesday?

2 days ago - ChartmillCurious about the most active stocks on Tuesday?Discover the most active stocks in Tuesday's session. Stay informed about the stocks that are generating the most trading volume!

2 days ago - ChartmillWhich S&P500 stocks are moving on Tuesday?

2 days ago - ChartmillWhich S&P500 stocks are moving on Tuesday?Stay informed about the performance of the S&P500 index in the middle of the day on Tuesday. Uncover the top gainers and losers in today's session for valuable insights.