2 Reasons to Like PCAR and 1 to Stay Skeptical

Provided By StockStory

Last update: Apr 18, 2025

Over the past six months, PACCAR’s shares (currently trading at $88.17) have posted a disappointing 19.9% loss while the S&P 500 was down 10%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for PCAR? Find out in our full research report, it’s free.

Why Does PACCAR Spark Debate?

Founded more than a century ago, PACCAR (NASDAQ:PCAR) designs and manufactures commercial trucks of various weights and sizes for the commercial trucking industry.

Two Things to Like:

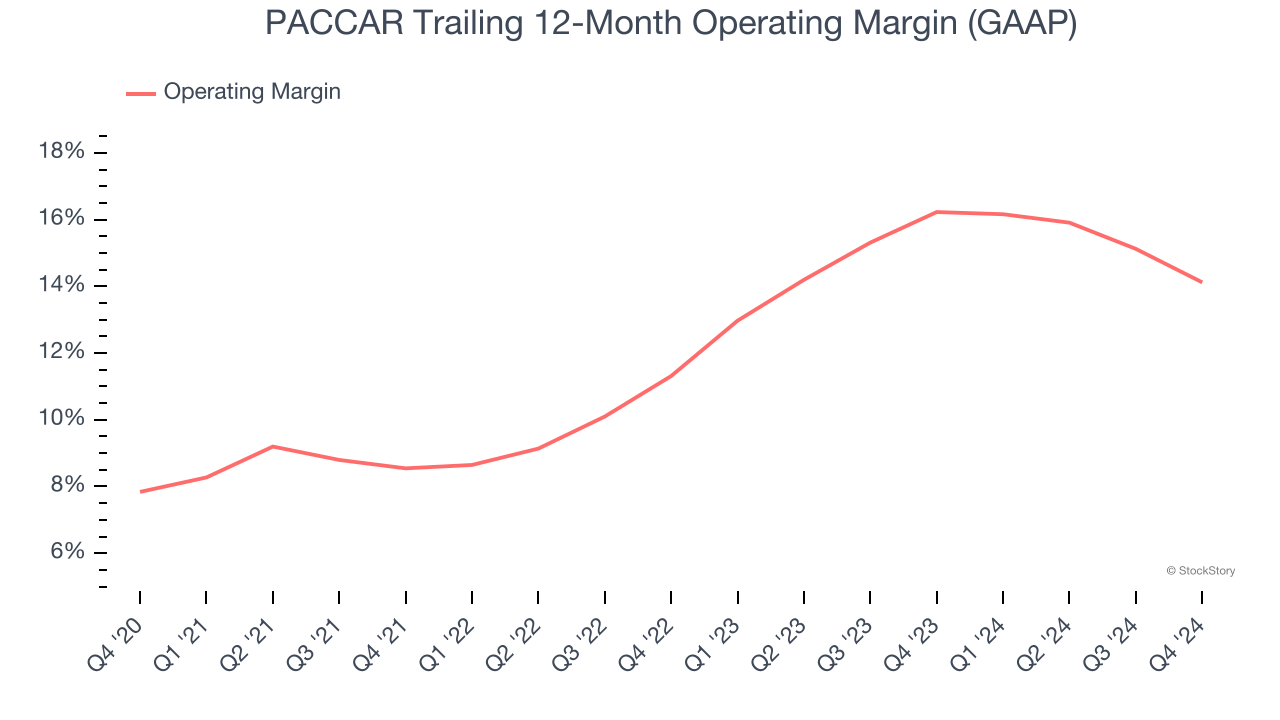

1. Operating Margin Rising, Profits Up

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, PACCAR’s operating margin rose by 6.3 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 14.1%.

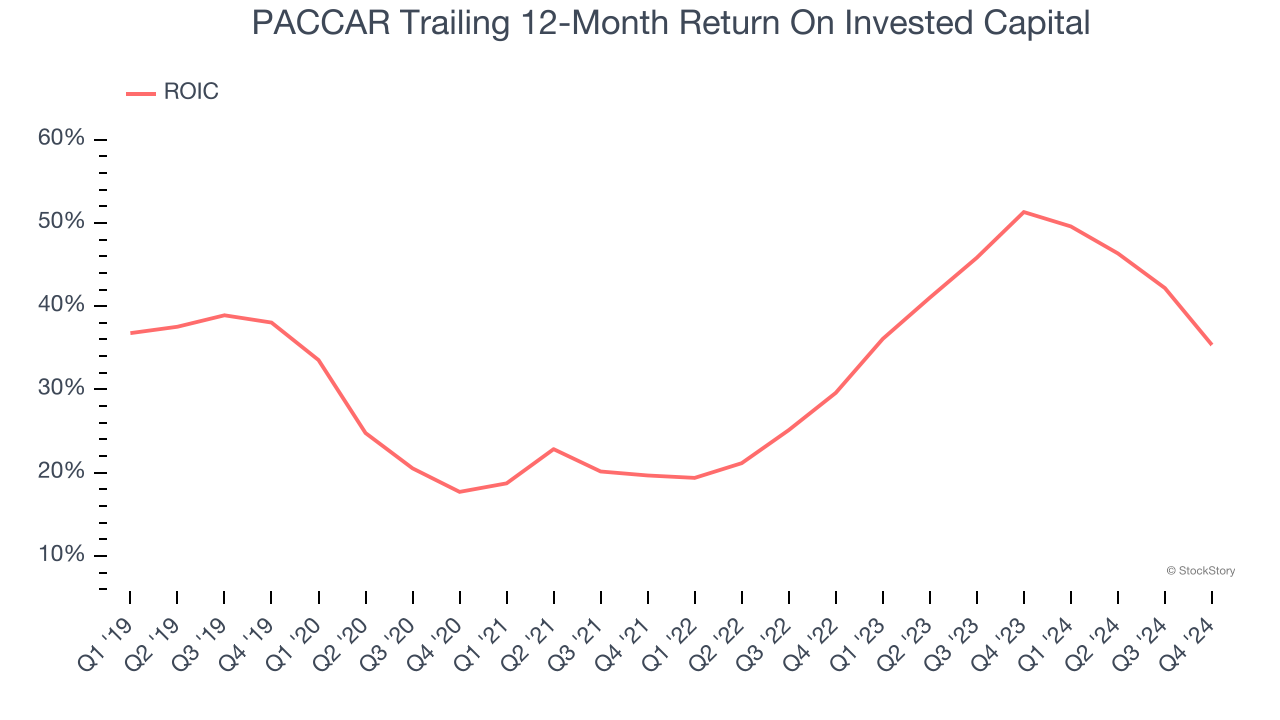

2. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, PACCAR’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

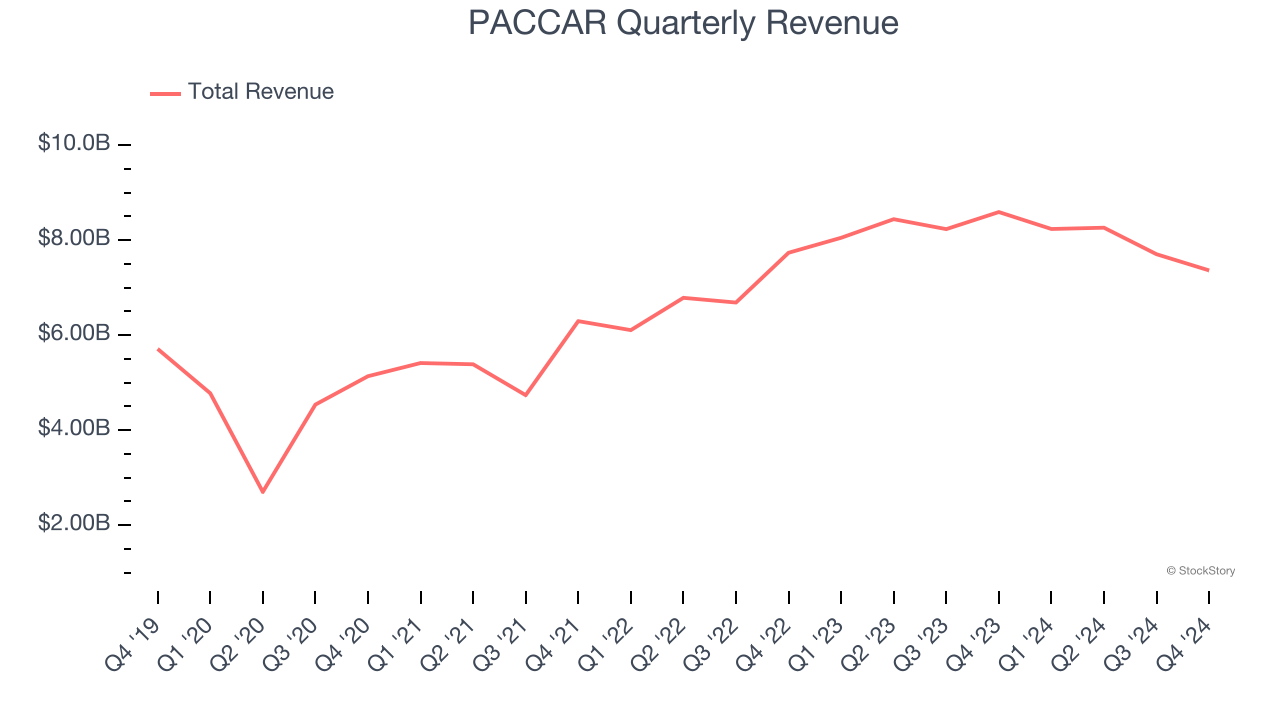

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, PACCAR grew its sales at a tepid 5.5% compounded annual growth rate. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about PACCAR.

Final Judgment

PACCAR has huge potential even though it has some open questions. With the recent decline, the stock trades at 11.5× forward price-to-earnings (or $88.17 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than PACCAR

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

NASDAQ:PCAR (4/29/2025, 3:06:09 PM)

90.4

-1.64 (-1.78%)

Find more stocks in the Stock Screener

PCAR Latest News and Analysis

3 hours ago - ChartmillExploring the top movers within the S&P500 index during today's session.

3 hours ago - ChartmillExploring the top movers within the S&P500 index during today's session.Stay updated with the movements of the S&P500 index in the middle of the day on Tuesday. Discover which stocks are leading as top gainers and losers in today's session.

5 hours ago - ChartmillWhich S&P500 stocks are gapping on Tuesday?

5 hours ago - ChartmillWhich S&P500 stocks are gapping on Tuesday?Wondering what's happening in today's session regarding gap up and gap down stocks? Explore the S&P500 index on Tuesday to uncover the stocks that are gapping in the S&P500 index.

7 hours ago - ChartmillTuesday's pre-market session: top gainers and losers in the S&P500 index

7 hours ago - ChartmillTuesday's pre-market session: top gainers and losers in the S&P500 indexThe US market session of Tuesday has yet to be opened, let's have a look at the top S&P500 gainers and losers in the pre-market session today.