Why NYSE:NOW Is a Promising High-Growth Stock in the Midst of Consolidation.

By Mill Chart

Last update: Oct 4, 2024

Growth investors are on the lookout for stocks displaying robust revenue and EPS growth. In this analysis, we'll assess whether SERVICENOW INC (NYSE:NOW) aligns with growth investing criteria, especially as it consolidates and signals a possible breakout. As always, investors should conduct their own research, but SERVICENOW INC has surfaced on our radar for growth with base formation, warranting further examination.

Growth Analysis for NYSE:NOW

Every stock receives a Growth Rating from ChartMill, ranging from 0 to 10. This rating assesses various growth aspects, including historical and projected EPS and revenue growth. NYSE:NOW boasts a 9 out of 10:

- NOW shows a strong growth in Earnings Per Share. In the last year, the EPS has been growing by 39.98%, which is quite impressive.

- The Earnings Per Share has been growing by 33.92% on average over the past years. This is a very strong growth

- The Revenue has grown by 24.17% in the past year. This is a very strong growth!

- NOW shows a strong growth in Revenue. Measured over the last years, the Revenue has been growing by 28.02% yearly.

- Based on estimates for the next years, NOW will show a very strong growth in Earnings Per Share. The EPS will grow by 21.63% on average per year.

- The Revenue is expected to grow by 19.57% on average over the next years. This is quite good.

Health Insights: NYSE:NOW

ChartMill employs a unique Health Rating system for all stocks. This rating, ranging from 0 to 10, is determined by analyzing various liquidity and solvency ratios. For NYSE:NOW, the assigned 6 for health provides valuable insights:

- NOW has an Altman-Z score of 12.54. This indicates that NOW is financially healthy and has little risk of bankruptcy at the moment.

- With an excellent Altman-Z score value of 12.54, NOW belongs to the best of the industry, outperforming 89.32% of the companies in the same industry.

- NOW has a debt to FCF ratio of 0.49. This is a very positive value and a sign of high solvency as it would only need 0.49 years to pay back of all of its debts.

- The Debt to FCF ratio of NOW (0.49) is better than 78.29% of its industry peers.

- A Debt/Equity ratio of 0.17 indicates that NOW is not too dependend on debt financing.

- The current and quick ratio evaluation for NOW is rather negative, while it does have excellent solvency and profitability. These ratios do not necessarly indicate liquidity issues and need to be evaluated against the specifics of the business.

Assessing Profitability for NYSE:NOW

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. NYSE:NOW scores a 8 out of 10:

- With an excellent Return On Assets value of 6.29%, NOW belongs to the best of the industry, outperforming 81.14% of the companies in the same industry.

- Looking at the Return On Equity, with a value of 13.22%, NOW belongs to the top of the industry, outperforming 84.34% of the companies in the same industry.

- Looking at the Return On Invested Capital, with a value of 7.92%, NOW belongs to the top of the industry, outperforming 82.92% of the companies in the same industry.

- The last Return On Invested Capital (7.92%) for NOW is above the 3 year average (4.58%), which is a sign of increasing profitability.

- With an excellent Profit Margin value of 11.51%, NOW belongs to the best of the industry, outperforming 80.07% of the companies in the same industry.

- In the last couple of years the Profit Margin of NOW has grown nicely.

- NOW's Operating Margin of 10.78% is amongst the best of the industry. NOW outperforms 81.14% of its industry peers.

- In the last couple of years the Operating Margin of NOW has grown nicely.

- With a decent Gross Margin value of 79.07%, NOW is doing good in the industry, outperforming 76.87% of the companies in the same industry.

Looking at the Setup

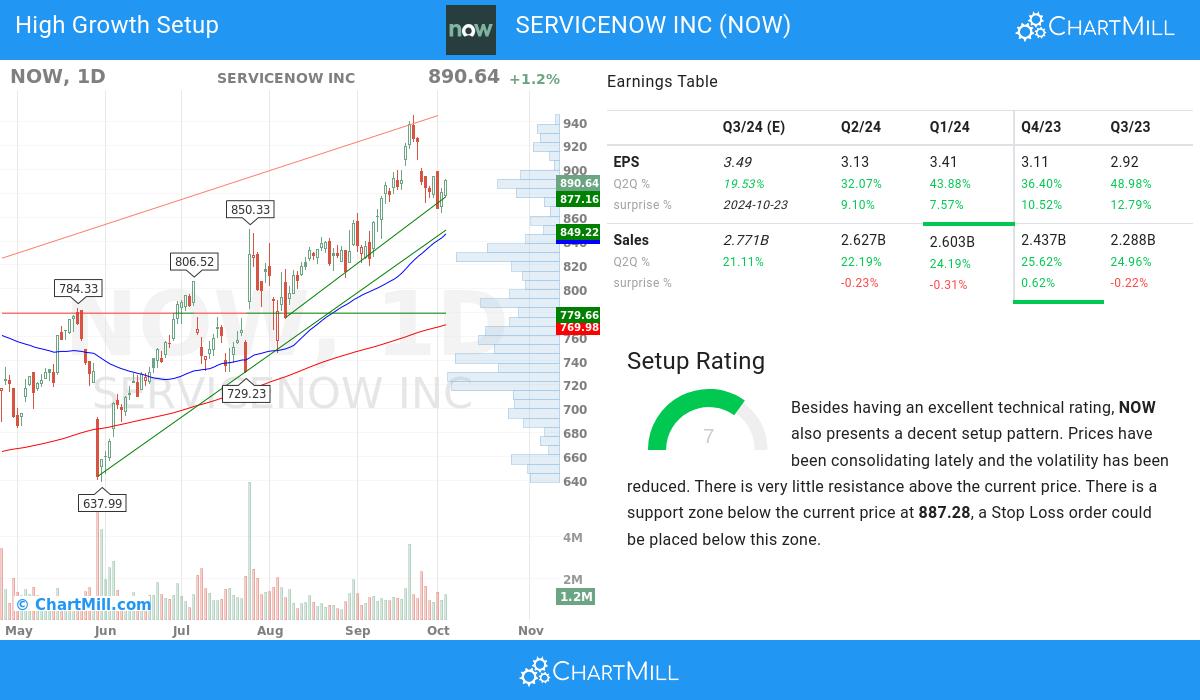

In addition to the Technical Rating, ChartMill provides a Setup Rating for each stock. This rating, ranging from 0 to 10, assesses the extent of consolidation in the stock based on multiple short-term technical indicators. Currently, NYSE:NOW has a 7 as its setup rating:

NOW has an excellent technical rating and also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. There is very little resistance above the current price. There is a support zone below the current price at 887.28, a Stop Loss order could be placed below this zone.

More Strong Growth stocks can be found in our Strong Growth screener.

For an up to date full fundamental analysis you can check the fundamental report of NOW

Our latest full technical report of NOW contains the most current technical analsysis.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

772.16

-24.5 (-3.08%)

Find more stocks in the Stock Screener

NOW Latest News and Analysis

3 days ago - ChartmillWhy SERVICENOW INC (NYSE:NOW) Is a Standout High-Growth Stock in a Consolidation Phase.

3 days ago - ChartmillWhy SERVICENOW INC (NYSE:NOW) Is a Standout High-Growth Stock in a Consolidation Phase.Based on a technical and fundamental analysis of NYSE:NOW we conclude: SERVICENOW INC (NYSE:NOW)—A High-Growth Stock Gearing Up for Its Next Upward Move.

15 days ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?

15 days ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?After the conclusion of the US market's regular session on Wednesday, let's examine the after-hours session and unveil the notable S&P500 performers among the top gainers and losers.

18 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocks

18 days ago - ChartmillWhat's going on in today's session: S&P500 gap up and gap down stocksLet's take a look at the S&P500 stocks that are experiencing notable price gaps in today's session on Monday. Discover the gap up and gap down stocks in the S&P500 index.

20 days ago - ChartmillTop gainers and losers in the S&P500 index during Friday's after-hours session.

20 days ago - ChartmillTop gainers and losers in the S&P500 index during Friday's after-hours session.The regular session of the US market on Friday is now over, but let's get a preview of the after-hours session and explore the top S&P500 gainers and losers driving the post-market movements.