Automation Software Q4 Earnings: SoundHound AI (NASDAQ:SOUN) is the Best in the Biz

Provided By StockStory

Last update: Apr 18, 2025

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at SoundHound AI (NASDAQ:SOUN) and the best and worst performers in the automation software industry.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 22.2% since the latest earnings results.

Best Q4: SoundHound AI (NASDAQ:SOUN)

Founded in 2005, SoundHound AI (NASDAQ:SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

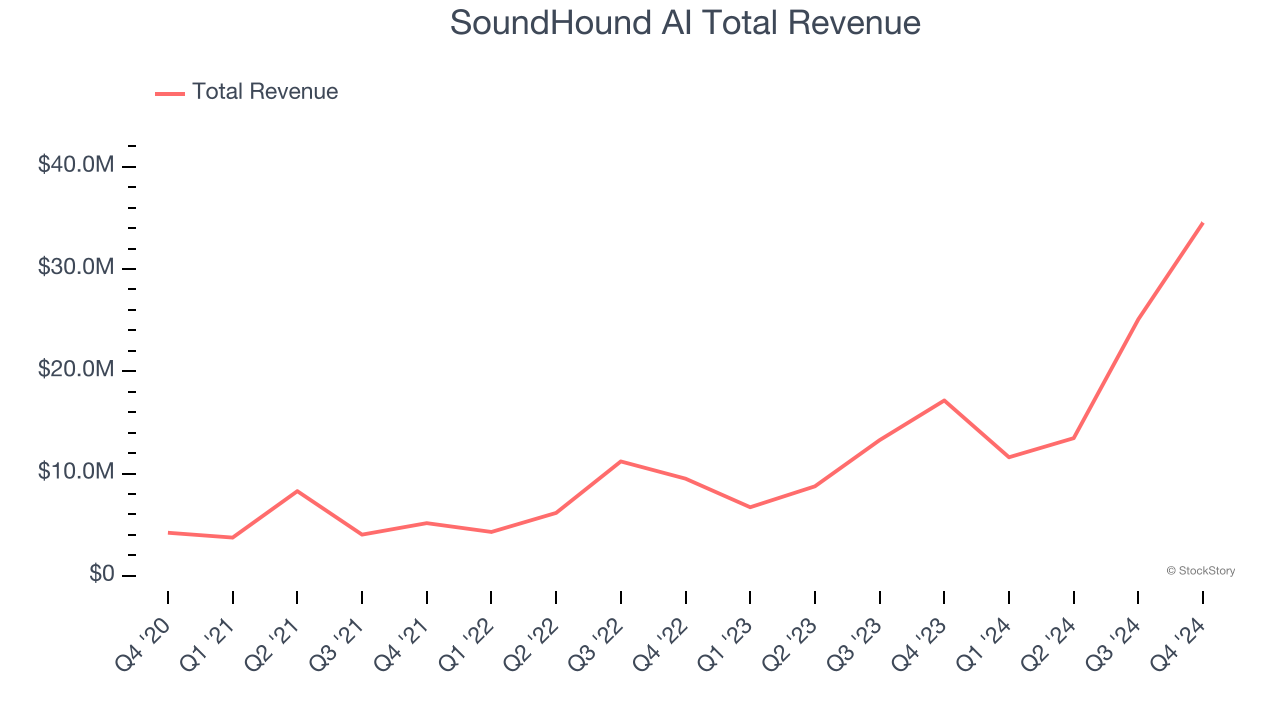

SoundHound AI reported revenues of $34.54 million, up 101% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

SoundHound AI achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 15% since reporting and currently trades at $7.83.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Microsoft (NASDAQ:MSFT)

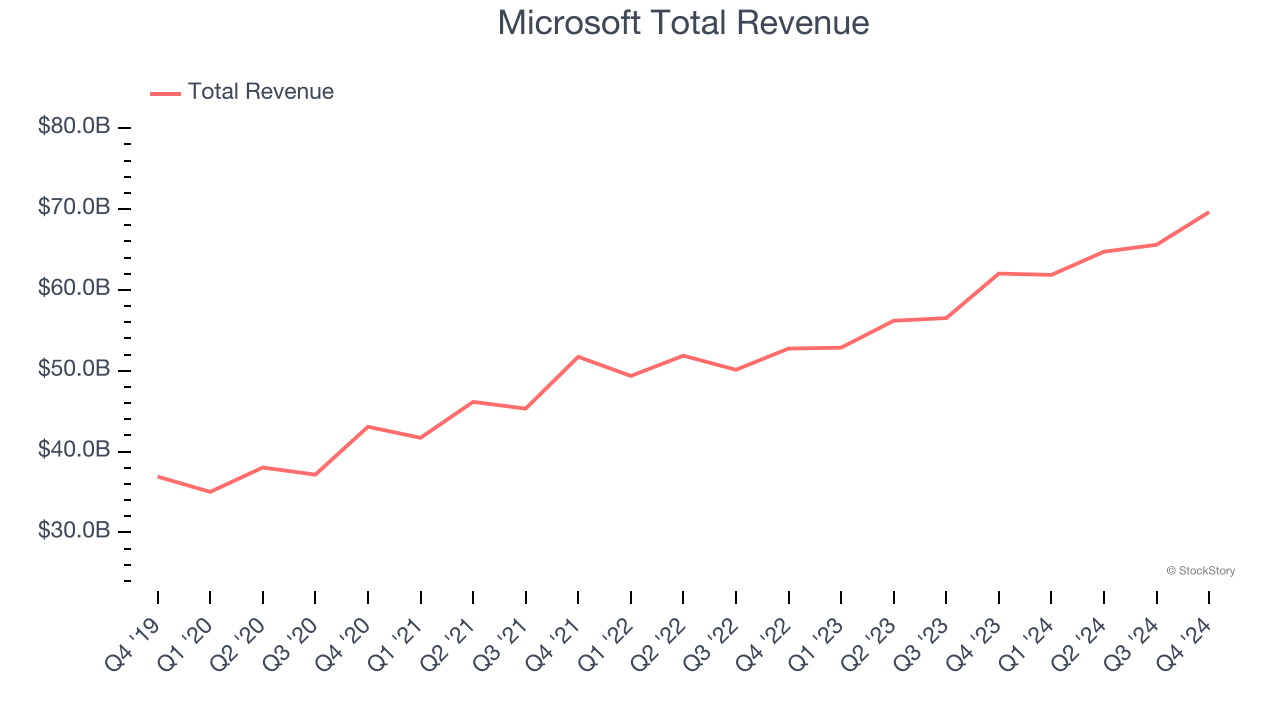

Short for microcomputer software, Microsoft (NASDAQ:MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $69.63 billion, up 12.3% year on year, outperforming analysts’ expectations by 1.1%. The business had a strong quarter. Microsoft narrowly topped analysts’ revenue expectations, as Personal Computing and Business Services beat while Intelligent Cloud was in line.

The stock is down 16.7% since reporting. It currently trades at $368.16.

Is now the time to buy Microsoft? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $423.6 million, up 4.5% year on year, in line with analysts’ expectations. It was a weaker quarter as it posted a significant miss of analysts’ billings estimates and full-year guidance of slowing revenue growth.

UiPath delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 12.2% since the results and currently trades at $10.43.

Read our full analysis of UiPath’s results here.

Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $163 million, up 8.2% year on year. This print was in line with analysts’ expectations. Aside from that, it was a weaker quarter as it recorded full-year guidance of slowing revenue growth and a miss of analysts’ billings estimates.

The stock is down 26.1% since reporting and currently trades at $10.88.

Read our full, actionable report on Jamf here, it’s free.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

ServiceNow reported revenues of $2.96 billion, up 21.3% year on year. This result met analysts’ expectations. However, it was a slower quarter as it logged a miss of analysts’ billings estimates.

The company added 89 enterprise customers paying more than $1 million annually to reach a total of 2,109. The stock is down 32.4% since reporting and currently trades at $773.90.

Read our full, actionable report on ServiceNow here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

812.7

+45.87 (+5.98%)

10.91

+0.22 (+2.06%)

8.75

+0.61 (+7.49%)

374.39

+7.57 (+2.06%)

10.87

+0.4 (+3.82%)

Find more stocks in the Stock Screener

NOW Latest News and Analysis

3 hours ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?

3 hours ago - ChartmillWhich S&P500 stocks are moving after the closing bell on Wednesday?Let's have a look at what is happening on the US markets after the closing bell on Wednesday. Below you can find the top S&P500 gainers and losers in today's after hours session.

3 hours ago - ChartmillTop movers in Wednesday's after hours session

3 hours ago - ChartmillTop movers in Wednesday's after hours sessionAs the regular session of the US market on Wednesday comes to an end, let's delve into the after-hours session and discover the top gainers and losers shaping the post-market sentiment.

5 hours ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.

5 hours ago - ChartmillStay informed with the top movers within the S&P500 index on Wednesday.Get insights into the S&P500 index performance on Wednesday. Explore the top gainers and losers within the S&P500 index in today's session.

7 hours ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.

7 hours ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.Wondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Wednesday.

11 hours ago - ChartmillWhat's going on in today's pre-market session: S&P500 movers

11 hours ago - ChartmillWhat's going on in today's pre-market session: S&P500 moversStay updated with the S&P500 stocks that are on the move in today's pre-market session.

9 days ago - ChartmillWhy SERVICENOW INC (NYSE:NOW) Is a Standout High-Growth Stock in a Consolidation Phase.

9 days ago - ChartmillWhy SERVICENOW INC (NYSE:NOW) Is a Standout High-Growth Stock in a Consolidation Phase.Based on a technical and fundamental analysis of NYSE:NOW we conclude: SERVICENOW INC (NYSE:NOW)—A High-Growth Stock Gearing Up for Its Next Upward Move.