Is NYSE:MRK suited for dividend investing?

By Mill Chart

Last update: Jan 7, 2025

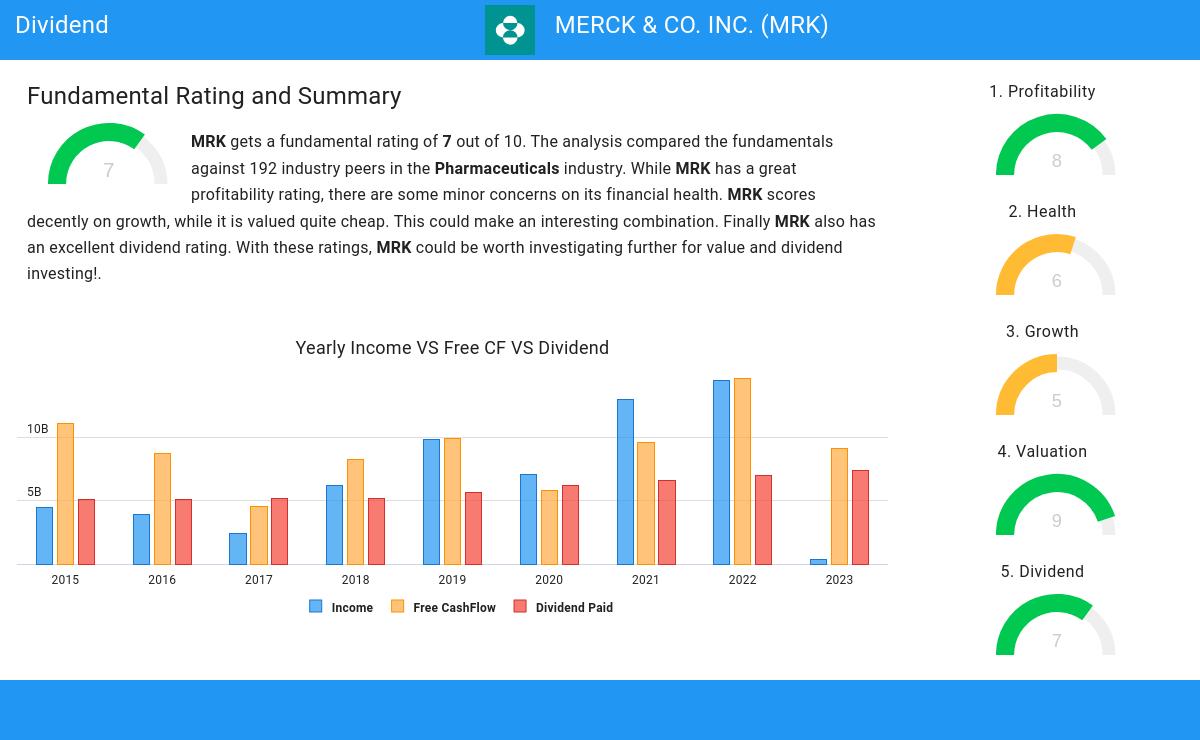

MERCK & CO. INC. (NYSE:MRK) is a hidden gem unveiled by our stock screening tool, featuring a promising dividend outlook alongside solid fundamentals. NYSE:MRK demonstrates decent financial health and profitability while ensuring a sustainable dividend. Let's break it down further.

Dividend Assessment of NYSE:MRK

ChartMill assigns a Dividend Rating to each stock, ranging from 0 to 10. This rating is calculated by analyzing various dividend elements, such as yield, historical performance, dividend growth, and sustainability. NYSE:MRK has been awarded a 7 for its dividend quality:

- Compared to an average industry Dividend Yield of 4.34, MRK pays a better dividend. On top of this MRK pays more dividend than 92.93% of the companies listed in the same industry.

- MRK's Dividend Yield is a higher than the S&P500 average which is at 2.33.

- The dividend of MRK is nicely growing with an annual growth rate of 8.47%!

- MRK has paid a dividend for at least 10 years, which is a reliable track record.

- MRK has not decreased their dividend for at least 10 years, which is a reliable track record.

- MRK's earnings are growing more than its dividend. This makes the dividend growth sustainable.

Evaluating Health: NYSE:MRK

A critical element of ChartMill's stock evaluation is the Health Rating, which spans from 0 to 10. This rating considers multiple health factors, including liquidity and solvency, both in absolute terms and relative to industry peers. NYSE:MRK has received a 6 out of 10:

- MRK has an Altman-Z score of 4.06. This indicates that MRK is financially healthy and has little risk of bankruptcy at the moment.

- Looking at the Altman-Z score, with a value of 4.06, MRK is in the better half of the industry, outperforming 77.72% of the companies in the same industry.

- The Debt to FCF ratio of MRK is 2.57, which is a good value as it means it would take MRK, 2.57 years of fcf income to pay off all of its debts.

- The Debt to FCF ratio of MRK (2.57) is better than 94.02% of its industry peers.

A Closer Look at Profitability for NYSE:MRK

ChartMill assigns a proprietary Profitability Rating to each stock. The score is computed by evaluating various profitability ratios and margins and ranges from 0 to 10. NYSE:MRK was assigned a score of 8 for profitability:

- Looking at the Return On Assets, with a value of 10.34%, MRK belongs to the top of the industry, outperforming 94.02% of the companies in the same industry.

- MRK's Return On Equity of 27.30% is amongst the best of the industry. MRK outperforms 95.11% of its industry peers.

- With an excellent Return On Invested Capital value of 19.49%, MRK belongs to the best of the industry, outperforming 95.65% of the companies in the same industry.

- The 3 year average ROIC (12.63%) for MRK is below the current ROIC(19.49%), indicating increased profibility in the last year.

- MRK has a better Profit Margin (19.23%) than 92.39% of its industry peers.

- Looking at the Operating Margin, with a value of 34.34%, MRK belongs to the top of the industry, outperforming 95.65% of the companies in the same industry.

- The Gross Margin of MRK (76.59%) is better than 82.61% of its industry peers.

Every day, new Best Dividend stocks can be found on ChartMill in our Best Dividend screener.

Check the latest full fundamental report of MRK for a complete fundamental analysis.

Keep in mind

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

NYSE:MRK (2/19/2025, 3:04:08 PM)

84.92

+1.63 (+1.96%)

Find more stocks in the Stock Screener

MRK Latest News and Analysis

a day ago - ChartmillWhy NYSE:MRK is a Top Pick for Dividend Investors.

a day ago - ChartmillWhy NYSE:MRK is a Top Pick for Dividend Investors.Why MERCK & CO. INC. (NYSE:MRK) provides a good dividend, while having solid fundamentals.

5 days ago - ChartmillIn a market where value is scarce, NYSE:MRK offers a refreshing opportunity with its solid fundamentals.

5 days ago - ChartmillIn a market where value is scarce, NYSE:MRK offers a refreshing opportunity with its solid fundamentals.MERCK & CO. INC. has caught the attention as a great value stock. NYSE:MRK excels in profitability, solvency, and liquidity, all while being very reasonably priced.

15 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

15 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Let's have a look at the top S&P500 gainers and losers one hour before the close of the markets of today's session.

15 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?

15 days ago - ChartmillLooking for the most active stocks in the S&P500 index on Tuesday?Stay informed about the most active S&P500 stocks in today's session as we take a closer look at what's happening on the US markets on Tuesday. Discover the stocks that are generating the highest trading volume and driving market activity.

15 days ago - ChartmillCurious about which S&P500 stocks are generating unusual volume on Tuesday? Find out below.

15 days ago - ChartmillCurious about which S&P500 stocks are generating unusual volume on Tuesday? Find out below.Let's have a look at the S&P500 stocks with an unusual volume in today's session.

15 days ago - ChartmillDiscover which S&P500 stocks are making waves on Tuesday.

15 days ago - ChartmillDiscover which S&P500 stocks are making waves on Tuesday.Join us in exploring the top gainers and losers within the S&P500 index in the middle of the day on Tuesday as we examine the latest happenings in today's session.

15 days ago - ChartmillGapping S&P500 stocks in Tuesday's session

15 days ago - ChartmillGapping S&P500 stocks in Tuesday's sessionWondering which stocks are making significant price gaps? Explore the S&P500 index on Tuesday to find the gap up and gap down stocks in today's session.

15 days ago - ChartmillGet insights into the top movers in the S&P500 index of Tuesday's pre-market session.

15 days ago - ChartmillGet insights into the top movers in the S&P500 index of Tuesday's pre-market session.Stay updated with the S&P500 stocks that are on the move in today's pre-market session.