Is NYSE:MO a Good Fit for Dividend Investing?

By Mill Chart

Last update: Nov 15, 2024

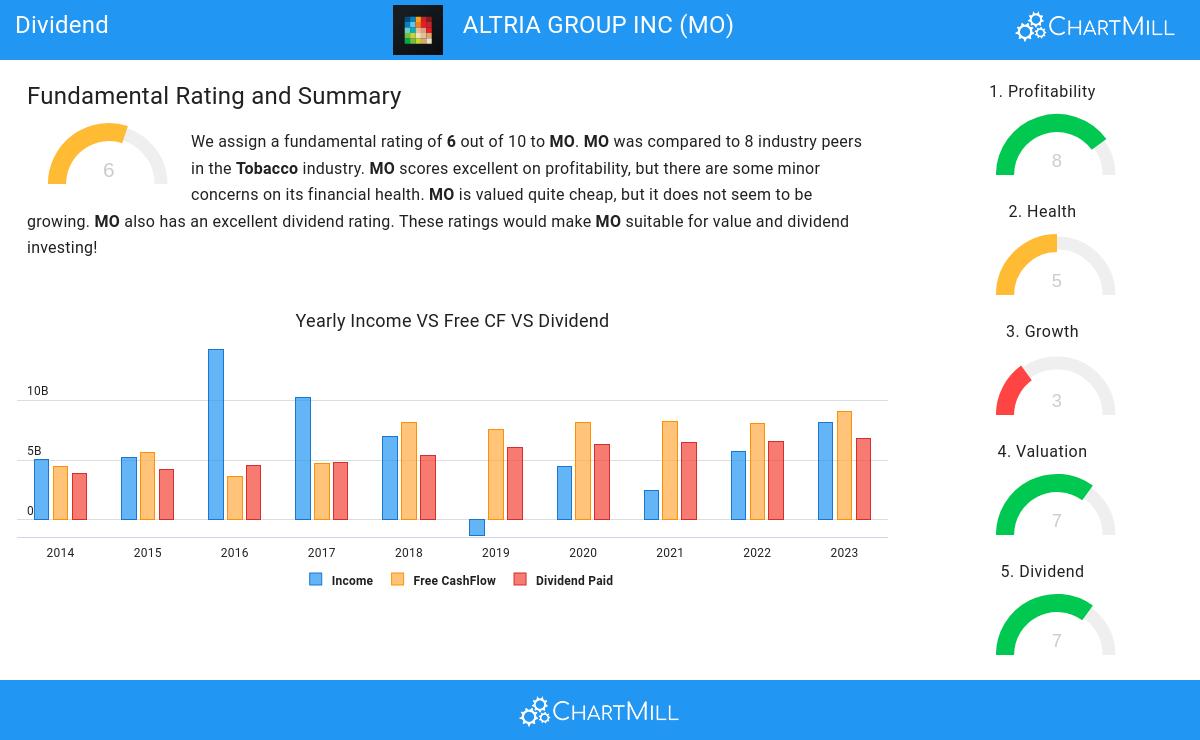

Our stock screening tool has identified ALTRIA GROUP INC (NYSE:MO) as a strong dividend contender with robust fundamentals. NYSE:MO exhibits commendable financial health and profitability, all while offering a sustainable dividend. Let's delve into each aspect below.

Analyzing Dividend Metrics

ChartMill assigns a Dividend Rating to every stock. This score ranges from 0 to 10 and evaluates the different dividend aspects, including the yield, the growth and sustainability. NYSE:MO scores a 7 out of 10:

- With a Yearly Dividend Yield of 7.62%, MO is a good candidate for dividend investing.

- Compared to an average industry Dividend Yield of 4.64, MO pays a better dividend. On top of this MO pays more dividend than 87.50% of the companies listed in the same industry.

- MO's Dividend Yield is rather good when compared to the S&P500 average which is at 2.21.

- MO has paid a dividend for at least 10 years, which is a reliable track record.

- MO has not decreased their dividend for at least 10 years, which is a reliable track record.

Health Analysis for NYSE:MO

A critical element of ChartMill's stock evaluation is the Health Rating, which spans from 0 to 10. This rating considers multiple health factors, including liquidity and solvency, both in absolute terms and relative to industry peers. NYSE:MO has received a 5 out of 10:

- An Altman-Z score of 4.56 indicates that MO is not in any danger for bankruptcy at the moment.

- With an excellent Altman-Z score value of 4.56, MO belongs to the best of the industry, outperforming 87.50% of the companies in the same industry.

- MO has a debt to FCF ratio of 2.96. This is a good value and a sign of high solvency as MO would need 2.96 years to pay back of all of its debts.

- The Debt to FCF ratio of MO (2.96) is better than 100.00% of its industry peers.

Evaluating Profitability: NYSE:MO

ChartMill utilizes a Profitability Rating to assess stocks, scoring them on a scale of 0 to 10. This rating takes into account a variety of profitability ratios and margins, both in absolute terms and in comparison to industry peers. NYSE:MO has earned a 8 out of 10:

- MO has a better Return On Assets (30.03%) than 100.00% of its industry peers.

- The Return On Invested Capital of MO (33.68%) is better than 87.50% of its industry peers.

- The 3 year average ROIC (31.67%) for MO is below the current ROIC(33.68%), indicating increased profibility in the last year.

- MO's Profit Margin of 42.72% is amongst the best of the industry. MO outperforms 100.00% of its industry peers.

- MO's Profit Margin has improved in the last couple of years.

- The Operating Margin of MO (48.16%) is better than 87.50% of its industry peers.

- MO's Operating Margin has improved in the last couple of years.

- MO has a Gross Margin of 59.12%. This is in the better half of the industry: MO outperforms 75.00% of its industry peers.

- MO's Gross Margin has improved in the last couple of years.

Our Best Dividend screener lists more Best Dividend stocks and is updated daily.

Our latest full fundamental report of MO contains the most current fundamental analsysis.

Disclaimer

This article should in no way be interpreted as advice. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

58.07

-0.32 (-0.55%)

Find more stocks in the Stock Screener

MO Latest News and Analysis