Is MAXIMUS INC (NYSE:MMS) a Good Fit for Dividend Investing?

By Mill Chart

Last update: Apr 7, 2025

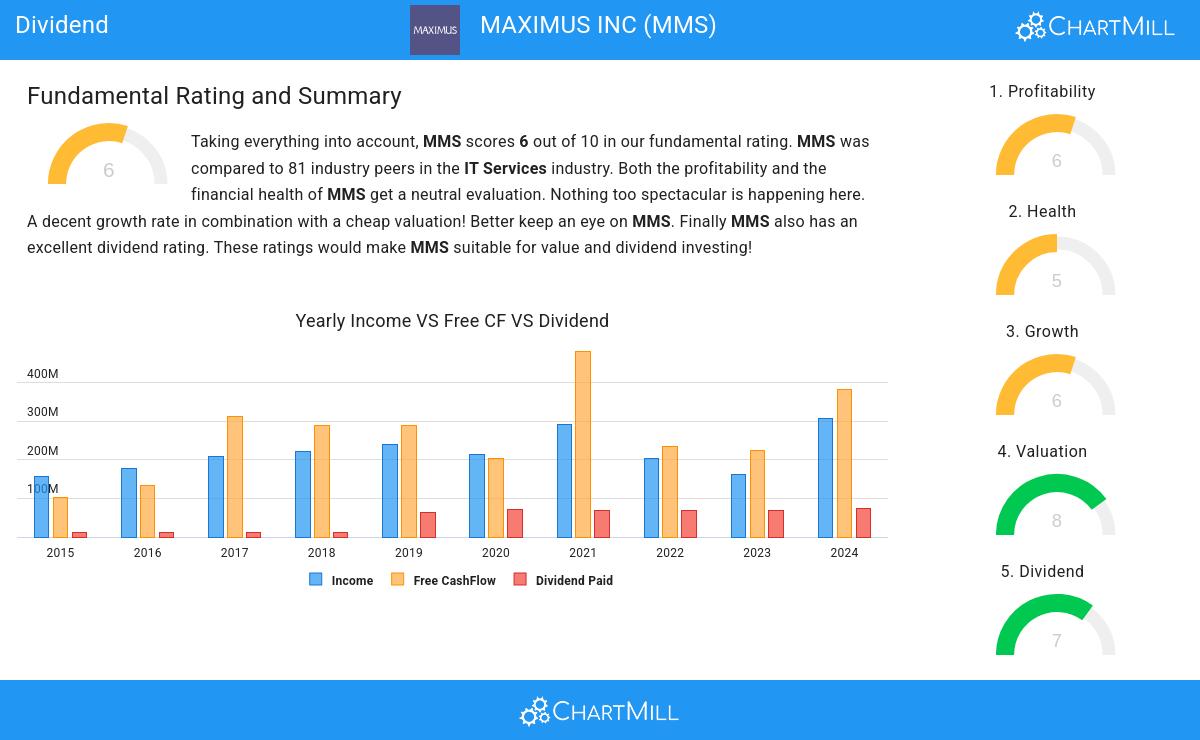

Discover MAXIMUS INC (NYSE:MMS)—a stock that our stock screener has recognized as a solid dividend pick with strong fundamentals. MMS showcases decent financial health and profitability while providing a sustainable dividend. We'll explore the specifics further.

What does the Dividend looks like for MMS

ChartMill assigns a proprietary Dividend Rating to each stock. The score is computed by evaluating various valuation aspects, like the yield, the history, the dividend growth and sustainability. MMS was assigned a score of 7 for dividend:

- MMS's Dividend Yield is rather good when compared to the industry average which is at 3.04. MMS pays more dividend than 86.42% of the companies in the same industry.

- MMS has been paying a dividend for at least 10 years, so it has a reliable track record.

- MMS has not decreased their dividend for at least 10 years, which is a reliable track record.

- 25.59% of the earnings are spent on dividend by MMS. This is a low number and sustainable payout ratio.

- MMS's earnings are growing more than its dividend. This makes the dividend growth sustainable.

Looking at the Health

To gauge a stock's financial health, ChartMill utilizes a Health Rating on a scale of 0 to 10. This comprehensive evaluation encompasses liquidity and solvency, both in absolute terms and in comparison to industry peers. MMS has earned a 5 out of 10:

- MMS has an Altman-Z score of 3.18. This indicates that MMS is financially healthy and has little risk of bankruptcy at the moment.

- Looking at the Altman-Z score, with a value of 3.18, MMS is in the better half of the industry, outperforming 60.49% of the companies in the same industry.

Profitability Assessment of MMS

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. MMS scores a 6 out of 10:

- With a decent Return On Assets value of 7.00%, MMS is doing good in the industry, outperforming 75.31% of the companies in the same industry.

- MMS has a Return On Equity of 17.24%. This is in the better half of the industry: MMS outperforms 79.01% of its industry peers.

- The Return On Invested Capital of MMS (10.55%) is better than 76.54% of its industry peers.

- The last Return On Invested Capital (10.55%) for MMS is above the 3 year average (8.80%), which is a sign of increasing profitability.

- Looking at the Profit Margin, with a value of 5.28%, MMS is in the better half of the industry, outperforming 65.43% of the companies in the same industry.

- Looking at the Operating Margin, with a value of 8.69%, MMS is in the better half of the industry, outperforming 66.67% of the companies in the same industry.

More Best Dividend stocks can be found in our Best Dividend screener.

For an up to date full fundamental analysis you can check the fundamental report of MMS

Disclaimer

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

67.72

-1.08 (-1.57%)

Find more stocks in the Stock Screener

MMS Latest News and Analysis

20 days ago - ChartmillIs MAXIMUS INC (NYSE:MMS) a Good Fit for Dividend Investing?

20 days ago - ChartmillIs MAXIMUS INC (NYSE:MMS) a Good Fit for Dividend Investing?Is MAXIMUS INC (NYSE:MMS) a Good Fit for Dividend Investing?