3 Reasons to Avoid SNDR and 1 Stock to Buy Instead

Provided By StockStory

Last update: Feb 28, 2025

Schneider has been treading water for the past six months, recording a small loss of 3.3% while holding steady at $26.09. The stock also fell short of the S&P 500’s 5.1% gain during that period.

Is there a buying opportunity in Schneider, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We're cautious about Schneider. Here are three reasons why you should be careful with SNDR and a stock we'd rather own.

Why Do We Think Schneider Will Underperform?

Employing thousands of drivers across the country to make deliveries, Schneider (NYSE:SNDR) makes full truckload and intermodal deliveries regionally and across borders.

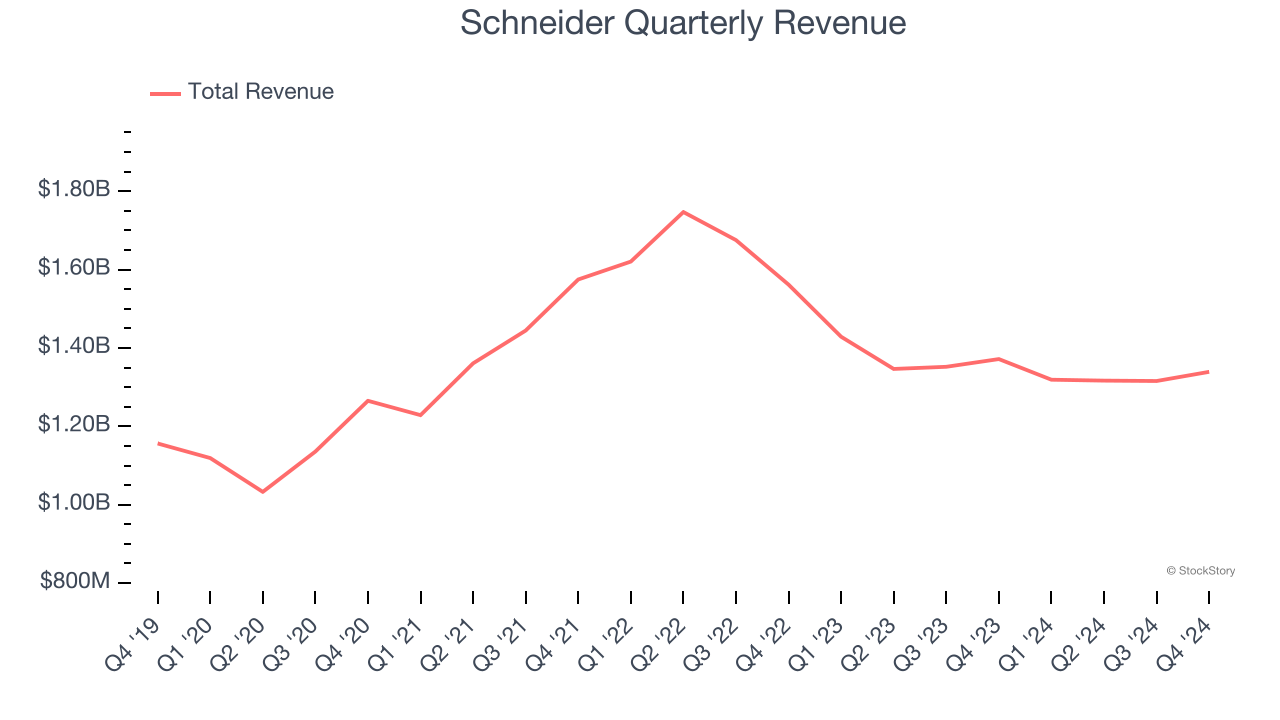

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Schneider’s 2.2% annualized revenue growth over the last five years was sluggish. This was below our standards.

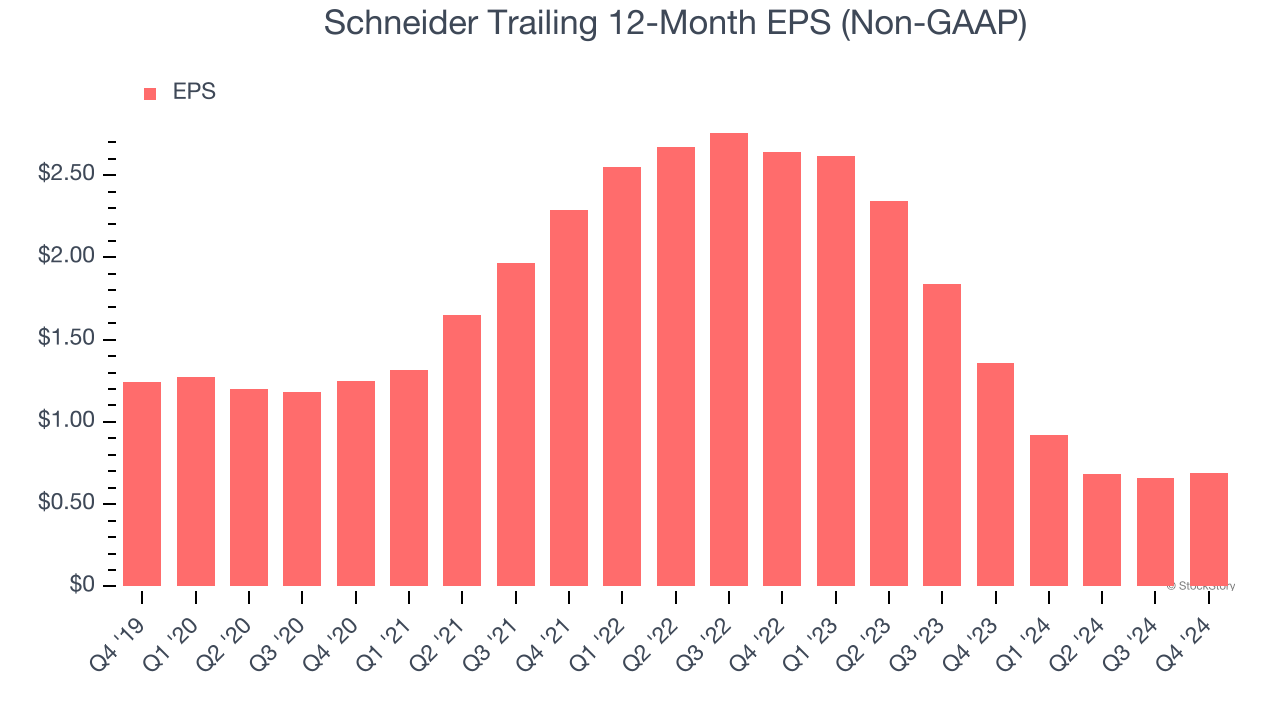

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Schneider, its EPS declined by 11% annually over the last five years while its revenue grew by 2.2%. This tells us the company became less profitable on a per-share basis as it expanded.

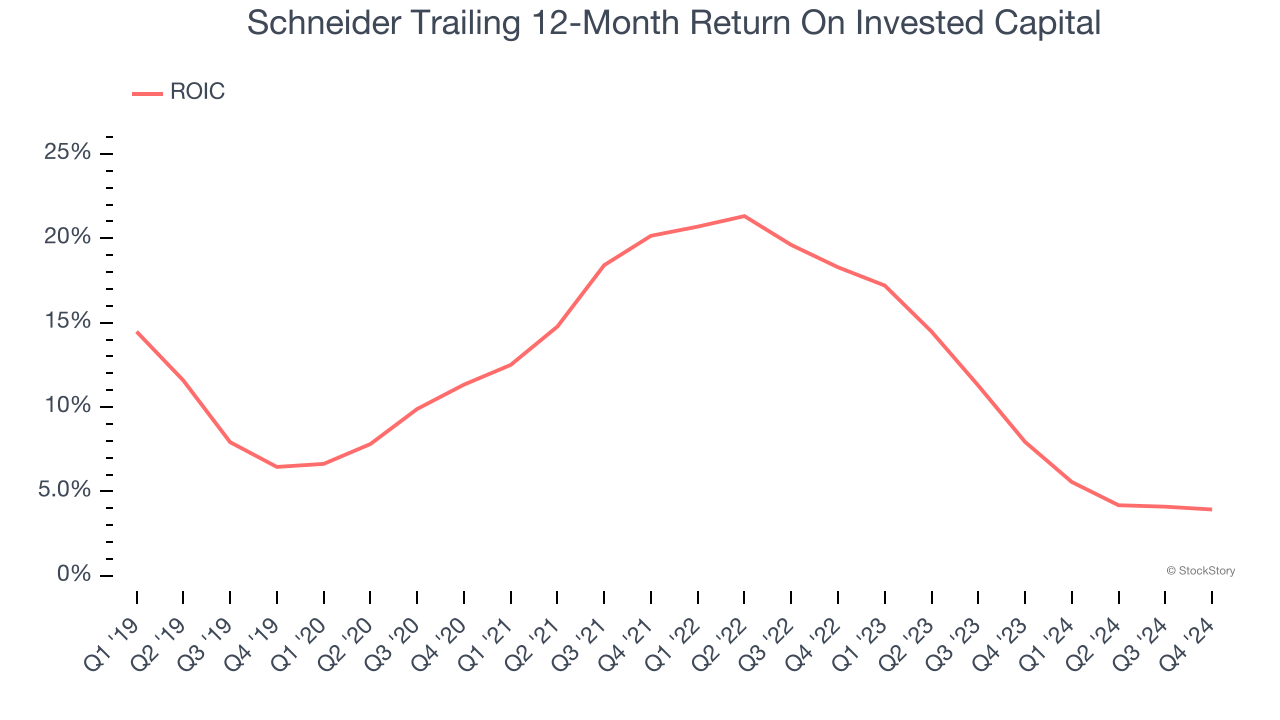

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Schneider’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies helping their customers, but in the case of Schneider, we’re out. With its shares trailing the market in recent months, the stock trades at 23× forward price-to-earnings (or $26.09 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Schneider

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

2070.41

-51.46 (-2.43%)

26.06

-0.32 (-1.21%)

Find more stocks in the Stock Screener

MELI Latest News and Analysis

8 days ago - ChartmillWhy NASDAQ:MELI qualifies as a high growth stock.

8 days ago - ChartmillWhy NASDAQ:MELI qualifies as a high growth stock.A fundamental analysis of (NASDAQ:MELI): High growth, ROE and relative strength for MERCADOLIBRE INC (NASDAQ:MELI), growth investors may appreciate this.

11 days ago - ChartmillWondering what's happening in today's after-hours session?

11 days ago - ChartmillWondering what's happening in today's after-hours session?The US market regular session of Thursday is over, let's have a look at the top gainers and losers in the after hours session today.