Will LAS VEGAS SANDS CORP breakout?

By Mill Chart

Last update: Aug 8, 2023

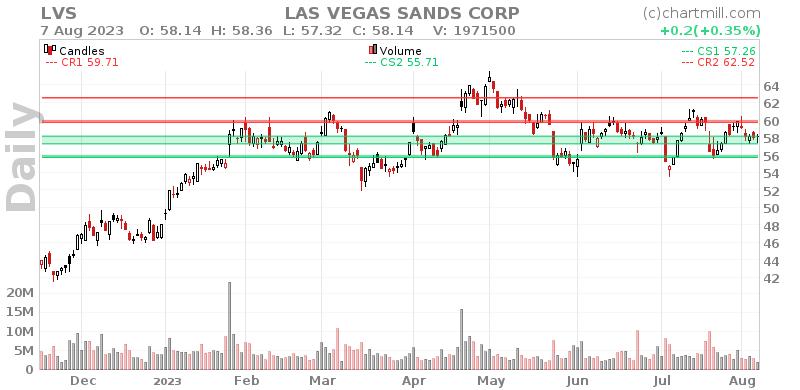

We've identified LAS VEGAS SANDS CORP (NYSE:LVS) as a potential breakout candidate based on our stock screener's analysis. This breakout setup pattern suggests that after a strong uptrend, the stock is currently consolidating, potentially signaling a continuation of the trend. Keep an eye on NYSE:LVS for further developments.

What is the technical picture of NYSE:LVS telling us.

As part of its analysis, ChartMill provides a comprehensive Technical Rating for each stock. This rating, ranging from 0 to 10, is updated on a daily basis and is based on the evaluation of various technical indicators and properties.

Overall LVS gets a technical rating of 7 out of 10. In the last year, LVS was one of the better performers in the market. There are positive signs in the very recent evolution, but the medium term picture is slightly mixed.

- The short term is neutral, but the long term trend is still positive. Not much to worry about for now.

- Looking at the yearly performance, LVS did better than 90% of all other stocks. On top of that, LVS also shows a nice and consistent pattern of rising prices.

- LVS is part of the Hotels, Restaurants & Leisure industry. There are 143 other stocks in this industry. LVS outperforms 76% of them.

- LVS is currently trading in the upper part of its 52 week range. The S&P500 Index however is currently trading near a new high, so LVS is lagging the market slightly.

- In the last month LVS has a been trading in the 55.55 - 61.25 range, which is quite wide. It is currently trading in the middle of this range where prices have been consolidating recently, this may present a good entry opportunity, but some resistance may be present above.

Check the latest full technical report of LVS for a complete technical analysis.

How do we evaluate the setup for NYSE:LVS?

ChartMill takes into account not only the Technical Rating but also assigns a Setup Rating to each stock. This rating, on a scale of 0 to 10, reflects the degree of consolidation observed based on short-term technical indicators. Currently, NYSE:LVS exhibits a 9 setup rating, indicating its consolidation status in recent days and weeks.

LVS has an excellent technical rating and also presents a decent setup pattern. We see reduced volatility while prices have been consolidating in the most recent period. A pullback is taking place, which may present a nice opportunity for an entry. There is a resistance zone just above the current price starting at 59.71. Right above this resistance zone may be a good entry point. There is a support zone below the current price at 58.14, a Stop Loss order could be placed below this zone. We notice that large players showed an interest for LVS in the last couple of days, which is a good sign.

Trading setups like NYSE:LVS

To potentially initiate a trade, it is common practice to wait for the stock to break out of the consolidation zone. This breakout signifies a potential upward movement, and traders may enter the stock at that point. Conversely, if the stock falls back below the consolidation zone, it may be sold at a loss.

Important Note: The content of this article is not intended as trading advice. It is essential to perform your own analysis and exercise caution when making trading decisions. The article presents technical observations generated by automated analysis but does not guarantee any trading outcomes. Always trade responsibly and make independent judgments.

Every day, new breakout setups can be found on ChartMill in our Breakout screener.

Disclaimer

This article should in no way be interpreted as advice in any way. The article is based on the observed metrics at the time of writing, but you should always make your own analysis and trade or invest at your own responsibility.

44.04

+0.22 (+0.5%)

Find more stocks in the Stock Screener

LVS Latest News and Analysis

19 days ago - ChartmillWhat's going on in today's session: S&P500 movers

19 days ago - ChartmillWhat's going on in today's session: S&P500 moversWondering what's happening in today's session for the S&P500 index? Stay informed with the top movers within the S&P500 index on Friday.

19 days ago - ChartmillTop S&P500 movers in Friday's session

19 days ago - ChartmillTop S&P500 movers in Friday's sessionStay updated with the movements of the S&P500 index in the middle of the day on Friday. Discover which stocks are leading as top gainers and losers in today's session.

19 days ago - ChartmillFriday's session: gap up and gap down stock in the S&P500 index

19 days ago - ChartmillFriday's session: gap up and gap down stock in the S&P500 indexLet's take a look at the S&P500 stocks that are experiencing notable price gaps in today's session on Friday. Discover the gap up and gap down stocks in the S&P500 index.

20 days ago - ChartmillTop S&P500 movers in Thursday's session

20 days ago - ChartmillTop S&P500 movers in Thursday's sessionLet's have a look at what is happening on the US markets one hour before the close of the markets on Thursday. Below you can find the top S&P500 gainers and losers in today's session.

20 days ago - ChartmillCurious about which S&P500 stocks are generating unusual volume on Thursday? Find out below.

20 days ago - ChartmillCurious about which S&P500 stocks are generating unusual volume on Thursday? Find out below.Let's have a look at the S&P500 stocks with an unusual volume in today's session.

20 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.

20 days ago - ChartmillExplore the top gainers and losers within the S&P500 index in today's session.Get insights into the S&P500 index performance on Thursday. Explore the top gainers and losers within the S&P500 index in today's session.

20 days ago - ChartmillThursday's session: gap up and gap down stock in the S&P500 index

20 days ago - ChartmillThursday's session: gap up and gap down stock in the S&P500 indexLooking for opportunities in today's market? Check out the S&P500 gap up and gap down stocks on Thursday and stay ahead of the market trends.

20 days ago - ChartmillThese S&P500 stocks that are showing activity before the opening bell on Thursday.

20 days ago - ChartmillThese S&P500 stocks that are showing activity before the opening bell on Thursday.Stay updated with the S&P500 stocks that are on the move in today's pre-market session.