Does IAMGOLD CORP (NYSE:IAG) show the characteristics of a Minervini super stock?

By Mill Chart

Last update: Apr 23, 2025

Our stock screener has spotted IAMGOLD CORP (NYSE:IAG) as a stocks which checks several boxes as specified by Mark Minervini. We will dive into an analysis below.

Minervini Trend Template Analysis.

The Minervini Trend Template is a set of technical criteria designed to identify stocks in strong uptrends. We can check all the boxes for IAG:

- ✔ Relative Strength is above 70.

- ✔ Current price is within 25% of it's 52-week high.

- ✔ Current price is at least 30% above it's 52-week low.

- ✔ The current price is above the 50-, 150- and 200-day SMA price line.

- ✔ The SMA(200) is trending upwards.

- ✔ The SMA(150) is above the SMA(200)

- ✔ The SMA(50) is above the SMA(150) and the SMA(200)

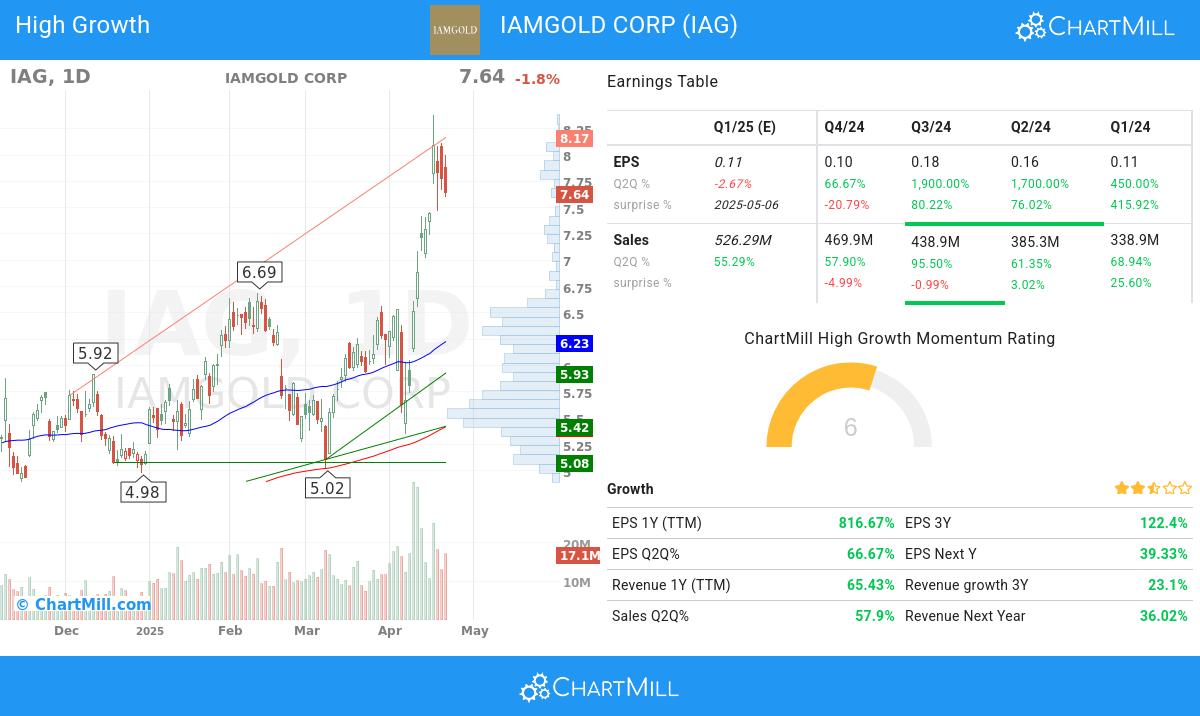

Understanding IAG's High Growth Momentum Score

ChartMill employs its own High Growth Momentum Rating (HGM) system for all stocks. This score, ranging from 0 to 10, is derived by evaluating different growth and profitability factors, such as EPS and revenue growth, as well as accelleration, surprises and revision history. IAG has earned a 6:

Explosive Earnings Growth

- With a favorable trend in its quarter-to-quarter (Q2Q) earnings per share (EPS), IAG highlights its ability to generate increasing profitability, showcasing a 66.67% growth.

- IAG has experienced 817.0% growth in EPS over a 12 month period, demonstrating its ability to generate sustained and positive earnings momentum.

- The EPS of IAG has shown consistent growth over a 3-year period, indicating the company's ability to generate increasing earnings over time.

- IAG has demonstrated strong quarter-to-quarter (Q2Q) revenue growth of 57.9%, reflecting its ability to generate consistent increases in sales. This growth highlights the company's effective market positioning and its potential for continued success.

- IAG has demonstrated strong 1-year revenue growth of 65.43%, reflecting revenue momentum and its ability to generate consistent top-line expansion. This growth underscores the company's strong market position and its potential for future success.

- IAG has a strong history of beating EPS estimates 3 times in the last 4 quarters, signaling its ability to consistently exceed market expectations. This indicates the company's strong financial performance and its potential for creating shareholder value.

Financial Strength & Profitability

- With positive growth in its operating margin over the past year, IAG showcases its ability to improve profitability through effective cost control and operational efficiency. This growth underscores the company's commitment to enhancing its financial performance.

- The profit margin of IAG has seen steady growth over the past year, signaling improved profitability.

- The free cash flow (FCF) of IAG has seen steady growth over the past year, indicating enhanced cash flow generation and financial health. This trend underscores the company's effective capital management and its ability to generate sustainable cash flows.

- With a solid Return on Equity (ROE) of 24.56%, IAG exemplifies its ability to generate favorable returns on shareholder investments. This metric demonstrates the company's commitment to maximizing shareholder value.

- With a Debt-to-Equity ratio at 0.34, IAG showcases its prudent financial management. The company's balanced approach between debt and equity reflects its commitment to maintaining a stable capital structure.

Institutional Confidence & Market Strength

- With 66.11% of the total shares held by institutional investors, IAG showcases a healthy distribution of ownership. This suggests a mix of institutional and retail investors, fostering a dynamic market for the stock.

- The Relative Strength (RS) of IAG has consistently been strong, with a current 97.67 rating. This indicates the stock's ability to exhibit relative price outperformance and reflects its competitive strength.

How does the Setup look for IAG

ChartMill assigns a Setup Rating to evaluate the consolidation level of a stock. This rating, ranging from 0 to 10, is updated daily and considers various short-term technical indicators. The current setup rating for IAG is 3:

Although IAG has an excellent technical rating, it does not offer a high quality setup at the moment. Price movement has been a little bit too volatile to find a nice entry and exit point. It is probably a good idea to wait for a consolidation first.

For an up to date full technical analysis you can check the technical report of IAG

More like this

It looks like IAMGOLD CORP meets the Minervini criteria. More high growth momentum breakout stocks can be found in our High Growth Momentum + Trend Template screen.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.

7.22

-0.42 (-5.5%)

Find more stocks in the Stock Screener

IAG Latest News and Analysis

21 hours ago - ChartmillDoes IAMGOLD CORP (NYSE:IAG) show the characteristics of a Minervini super stock?

21 hours ago - ChartmillDoes IAMGOLD CORP (NYSE:IAG) show the characteristics of a Minervini super stock?A fundamental and technical analysis of (NYSE:IAG): Why IAMGOLD CORP (NYSE:IAG) qualifies as a high growth stock.

8 days ago - ChartmillWhich stocks are gapping on Wednesday?

8 days ago - ChartmillWhich stocks are gapping on Wednesday?Today's session on Wednesday is marked by notable gaps in various stocks. Stay informed with the gap up and gap down stocks in today's session.

19 days ago - ChartmillHigh growth, ROE and relative strength for IAMGOLD CORP (NYSE:IAG), growth investors may appreciate this.

19 days ago - ChartmillHigh growth, ROE and relative strength for IAMGOLD CORP (NYSE:IAG), growth investors may appreciate this.A fundamental analysis of (NYSE:IAG): Is IAMGOLD CORP (NYSE:IAG) a Fit for Growth Investing Strategies?