Global Business Travel (NYSE:GBTG) Surprises With Q4 Sales But Full-Year Sales Guidance Misses Expectations Significantly

Provided By StockStory

Last update: Feb 27, 2025

B2B travel services company Global Business Travel (NYSE:GBTG) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 7.7% year on year to $591 million. On the other hand, the company’s full-year revenue guidance of $2.53 billion at the midpoint came in 1.7% below analysts’ estimates. Its GAAP profit of $0.30 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Global Business Travel? Find out by accessing our full research report, it’s free.

Global Business Travel (GBTG) Q4 CY2024 Highlights:

- Revenue: $591 million vs analyst estimates of $588 million (7.7% year-on-year growth, 0.5% beat)

- EPS (GAAP): $0.30 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $110 million vs analyst estimates of $108 million (18.6% margin, 1.9% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.53 billion at the midpoint, missing analyst estimates by 1.7% and implying 4.2% growth (vs 5.8% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $545 million at the midpoint, above analyst estimates of $538.3 million

- Operating Margin: 5.1%, up from 0.5% in the same quarter last year

- Free Cash Flow Margin: 5.6%, down from 9.9% in the previous quarter

- Transaction Value: 6.9 billion, up 598 million year on year

- Market Capitalization: $4.06 billion

Paul Abbott, Amex GBT’s Chief Executive Officer, stated: “We delivered on our financial targets for 2024 with a strong finish in the fourth quarter, thanks to consistent execution of our commercial strategy and focus on cost control. Our efficient financial model is demonstrating its ability to generate attractive double-digit earnings growth, by adding share gains on top of stable industry growth and then expanding margins with a scalable cost base. In 2025, we expect this model to generate 11-17% growth for Adjusted EBITDA on 5%-7% Constant Currency revenue growth at the top line, while also continuing to invest to drive revenue growth, margin expansion and earnings growth in the years ahead.”

Company Overview

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Spend Management Software

The adoption of financial technology software is propelled by an ongoing drive to reduce costs. The combination of rising transaction volumes and global supply chain complexity is driving demand for cloud-based spend management platforms able to integrate the two.

Sales Growth

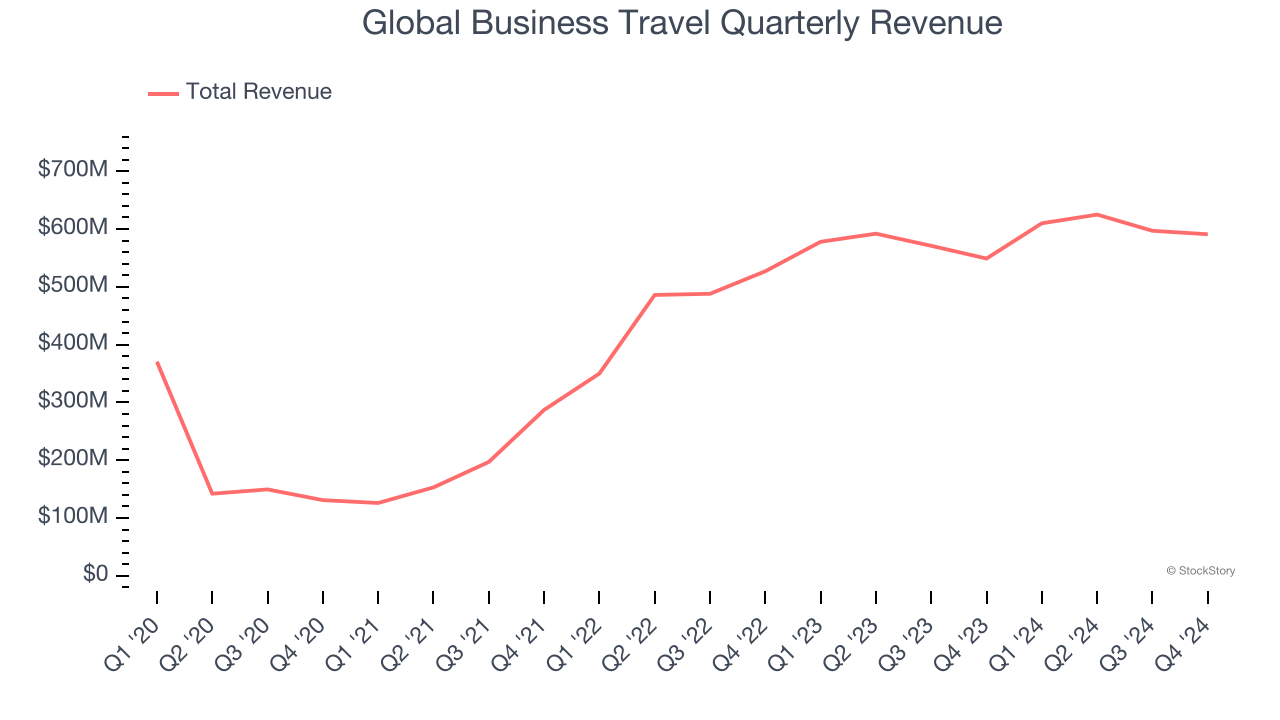

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Global Business Travel’s 47% annualized revenue growth over the last three years was incredible. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Global Business Travel reported year-on-year revenue growth of 7.7%, and its $591 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

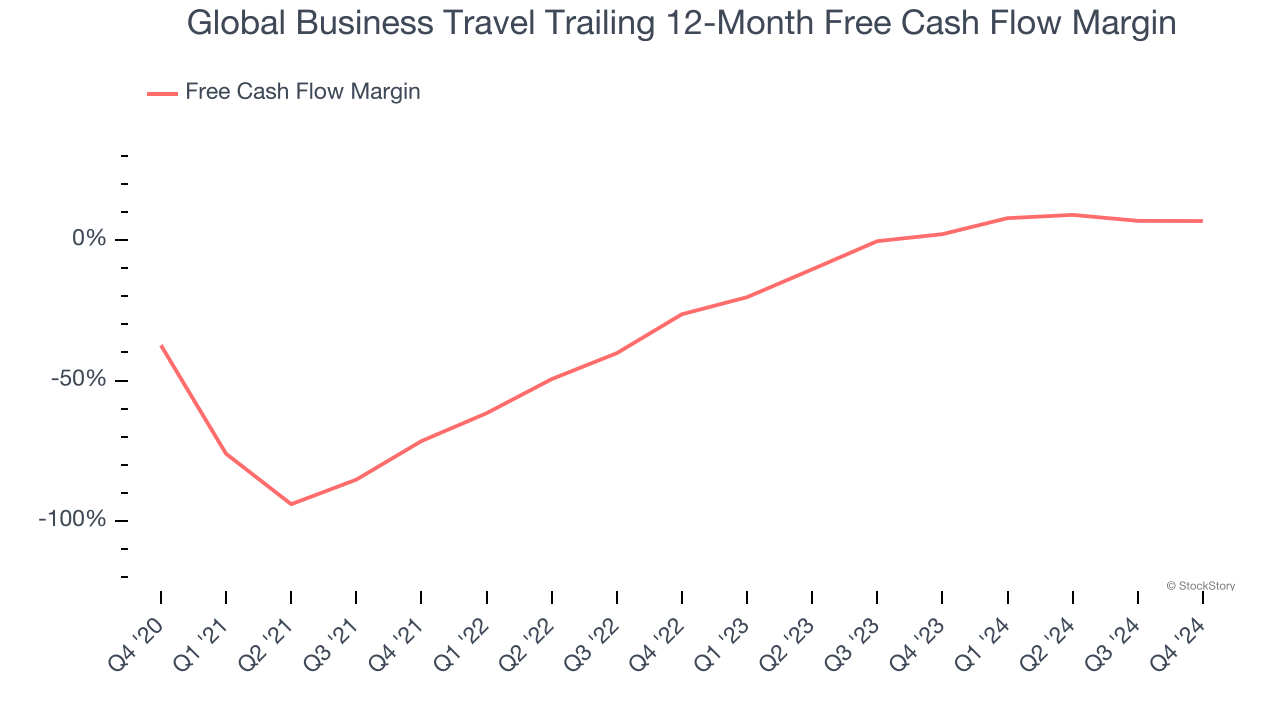

Global Business Travel has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.8%, subpar for a software business.

Global Business Travel’s free cash flow clocked in at $33 million in Q4, equivalent to a 5.6% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Global Business Travel’s Q4 Results

It was good to see Global Business Travel provide full-year EBITDA guidance that slightly beat analysts’ expectations. We were also happy its revenue, EPS, and EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed significantly and suggests a slowdown in demand. Overall, this quarter could have been better. The stock traded down 1.9% to $8.45 immediately following the results.

Is Global Business Travel an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

8.07

+0.09 (+1.13%)

273.21

-2.43 (-0.88%)

Find more stocks in the Stock Screener