Analyzing NYSE:FLO's Dividend Potential.

By Mill Chart

Last update: Oct 15, 2024

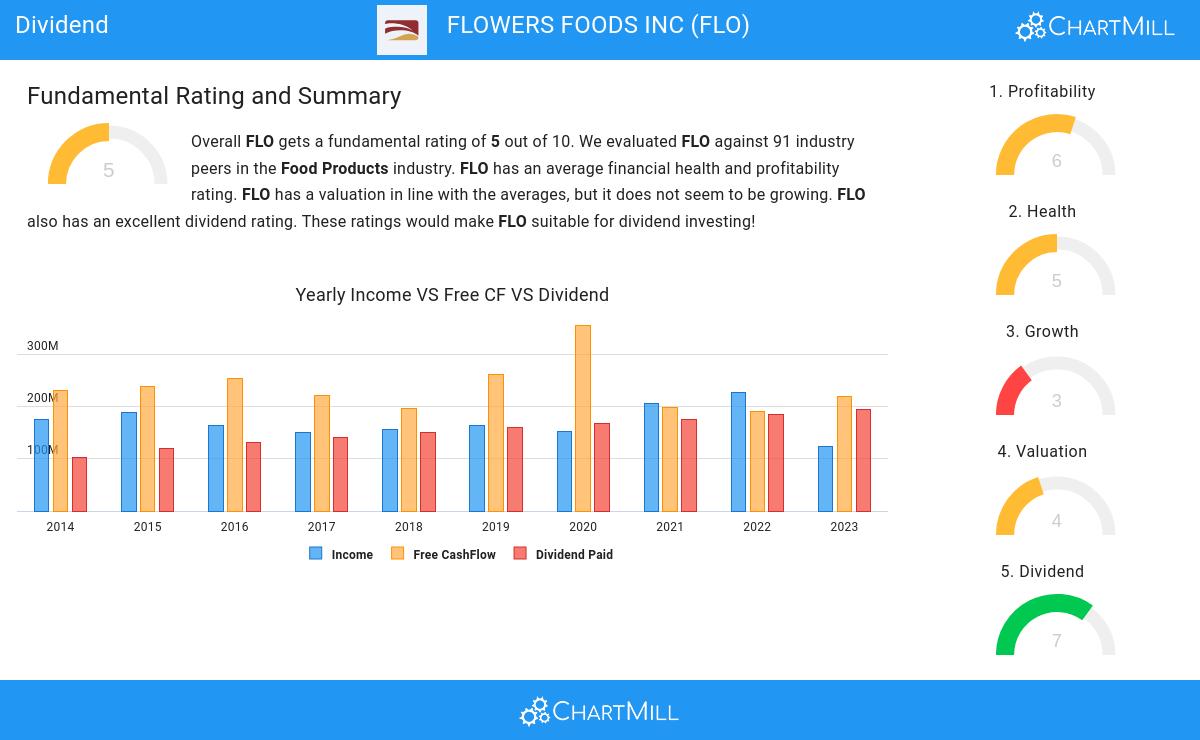

Unearth the potential of FLOWERS FOODS INC (NYSE:FLO) as a dividend stock recommended by our stock screening tool. NYSE:FLO maintains a robust financial footing and delivers a sustainable dividend. We'll delve into the details below.

A Closer Look at Dividend for NYSE:FLO

An integral part of ChartMill's stock analysis is the Dividend Rating, which spans from 0 to 10. This rating evaluates diverse dividend factors, including yield, historical data, growth, and sustainability. NYSE:FLO has received a 7 out of 10:

- With a Yearly Dividend Yield of 4.27%, FLO is a good candidate for dividend investing.

- FLO's Dividend Yield is rather good when compared to the industry average which is at 3.57. FLO pays more dividend than 87.91% of the companies in the same industry.

- Compared to an average S&P500 Dividend Yield of 2.22, FLO pays a better dividend.

- On average, the dividend of FLO grows each year by 10.15%, which is quite nice.

- FLO has been paying a dividend for at least 10 years, so it has a reliable track record.

- FLO has not decreased their dividend for at least 10 years, which is a reliable track record.

Looking at the Health

A critical element of ChartMill's stock evaluation is the Health Rating, which spans from 0 to 10. This rating considers multiple health factors, including liquidity and solvency, both in absolute terms and relative to industry peers. NYSE:FLO has received a 5 out of 10:

- An Altman-Z score of 3.68 indicates that FLO is not in any danger for bankruptcy at the moment.

- With a decent Altman-Z score value of 3.68, FLO is doing good in the industry, outperforming 78.02% of the companies in the same industry.

- FLO has a better Debt to FCF ratio (4.06) than 72.53% of its industry peers.

Evaluating Profitability: NYSE:FLO

ChartMill assigns a Profitability Rating to every stock. This score ranges from 0 to 10 and evaluates the different profitability ratios and margins, both absolutely, but also relative to the industry peers. NYSE:FLO scores a 6 out of 10:

- The Return On Equity of FLO (9.31%) is better than 61.54% of its industry peers.

- Looking at the Return On Invested Capital, with a value of 9.66%, FLO belongs to the top of the industry, outperforming 82.42% of the companies in the same industry.

- FLO has a better Operating Margin (6.94%) than 68.13% of its industry peers.

- FLO's Operating Margin has improved in the last couple of years.

- With an excellent Gross Margin value of 49.01%, FLO belongs to the best of the industry, outperforming 100.00% of the companies in the same industry.

More Best Dividend stocks can be found in our Best Dividend screener.

Check the latest full fundamental report of FLO for a complete fundamental analysis.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.