Technical Setup: ATOUR LIFESTYLE HOLDINGS-ADR Appears Poised for a Breakout.

By Mill Chart

Last update: Nov 15, 2024

ATOUR LIFESTYLE HOLDINGS-ADR (NASDAQ:ATAT) was identified as a Technical Breakout Setup Pattern by our stockscreener. Such a pattern occurs when we see a pause in a strong uptrend: after a strong rise the stock is consolidating a bit and at some point the trend may be continued. Whether this actually happens can not be predicted of course, but it may be a good idea to keep and eye on NASDAQ:ATAT.

Zooming in on the technicals.

ChartMill assigns a Technical Rating to every stock. This score, ranging from 0 to 10, is updated daily and is determined by evaluating multiple technical indicators and properties.

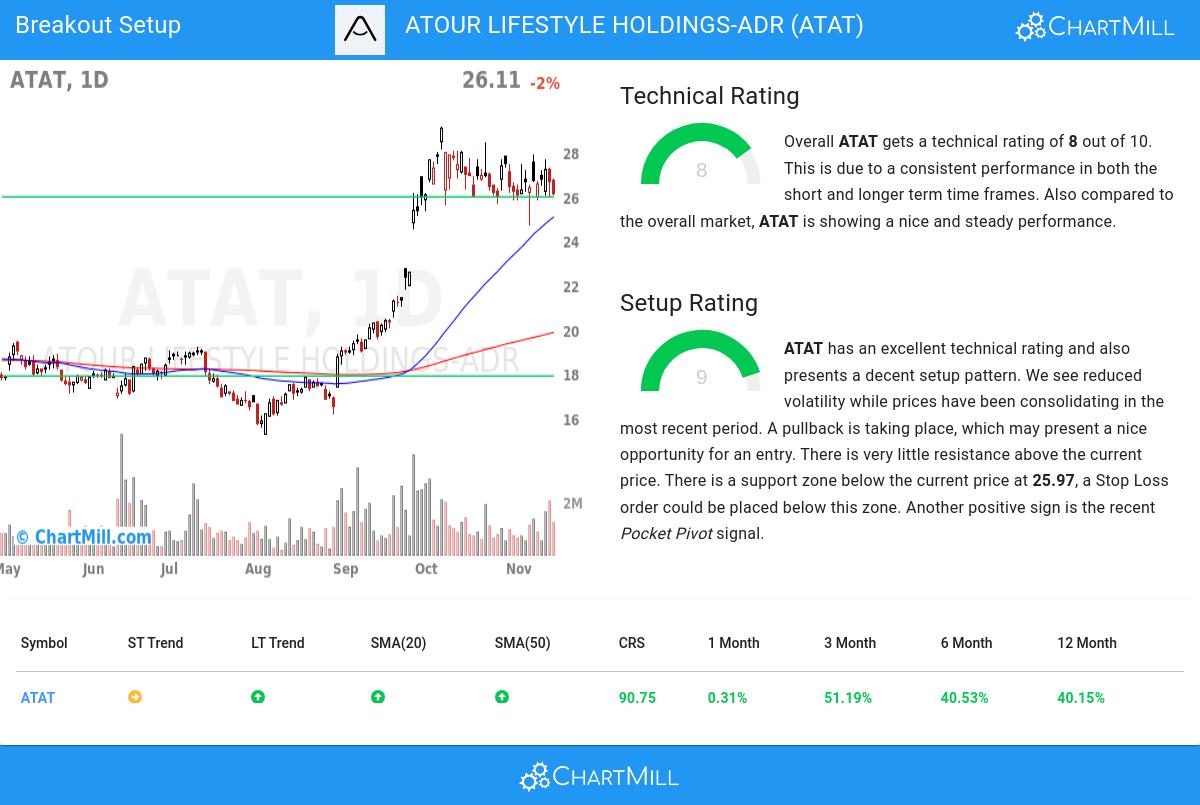

Overall ATAT gets a technical rating of 8 out of 10. This is due to a consistent performance in both the short and longer term time frames. Also compared to the overall market, ATAT is showing a nice and steady performance.

- The long term trend is positive and the short term trend is neutral. The long term trend may just continue or reversal may be around the corner!

- ATAT is part of the Hotels, Restaurants & Leisure industry. There are 135 other stocks in this industry. ATAT outperforms 83% of them.

- ATAT is currently trading in the upper part of its 52 week range. The S&P500 Index however is currently trading near a new high, so ATAT is lagging the market slightly.

- When comparing the yearly performance of all stocks, we notice that ATAT is one of the better performing stocks in the market, outperforming 90% of all stocks. However, this overall good ranking is mostly due to the recent strong move.

- In the last month ATAT has a been trading in the 24.69 - 28.42 range, which is quite wide. It is currently trading in the middle of this range, so some resistance may be found above.

Check the latest full technical report of ATAT for a complete technical analysis.

Looking at the Setup

Besides the Technical Rating, ChartMill also assign a Setup Rating to every stock. This setup score also ranges from 0 to 10 and determines to which extend the stock is consolidating. This is achieved by evaluating multiple short term technical indicators. NASDAQ:ATAT currently has a 9 as setup rating:

Besides having an excellent technical rating, ATAT also presents a decent setup pattern. Prices have been consolidating lately and the volatility has been reduced. A pullback is taking place, which may present a nice opportunity for an entry. There is very little resistance above the current price. There is a support zone below the current price at 25.97, a Stop Loss order could be placed below this zone. Very recently a Pocket Pivot signal was observed. This is another positive sign.

How can NASDAQ:ATAT be traded?

For a potential trade one would typically wait until the stock breaks out of the consolidation zone to enter the stock and it could be sold again for a loss when it would fall back below the zone.

This article should in no way be interpreted as trading advice. You should always make your own analysis and trade or not trade based on your own observations and style. The article is based purely on some technical observations.

Our Breakout screener lists more breakout setups and is updated daily.

Keep in mind

This is not investing advice! The article highlights some of the observations at the time of writing, but you should always make your own analysis and invest based on your own insights.