Market Monitor February 6th

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Feb 7, 2025

Market Recap: Wall Street Gains, Amazon Slips, and U.S. Job Growth Slows

Wall Street: The U.S. stock markets closed mostly higher, except for the Dow Jones (-0.3%). Ford dropped more than 7% after issuing a disappointing 2025 outlook, despite solid quarterly results. Salesforce declined 4.9% following the announced departure of COO Brian Millham. Eli Lilly gained 3.4% on strong earnings, while Honeywell lost 5.6% after announcing plans to split its business.

Amazon: The company is investing over $100 billion in AI and cloud, but disappointed investors with a weak revenue forecast for the current quarter. The stock fell 5% in after-hours trading. CEO Andy Jassy called AI the biggest technological shift since the internet and stressed the need for massive investments.

U.S. Job Market: The U.S. economy added 143,000 jobs in January, fewer than expected, but wages grew by 4.1%, exceeding forecasts. Unemployment fell to 4%. Markets initially reacted negatively but seems to recover.

Market Overview

Major Indices:

- The S&P 500 (SPY) is in an uptrend, gaining 0.35% on the day.

- The Nasdaq 100 (QQQ) also shows strength, rising 0.52%.

- The Russell 2000 (IWM), representing small caps, declined 0.33%, indicating some weakness in smaller stocks.

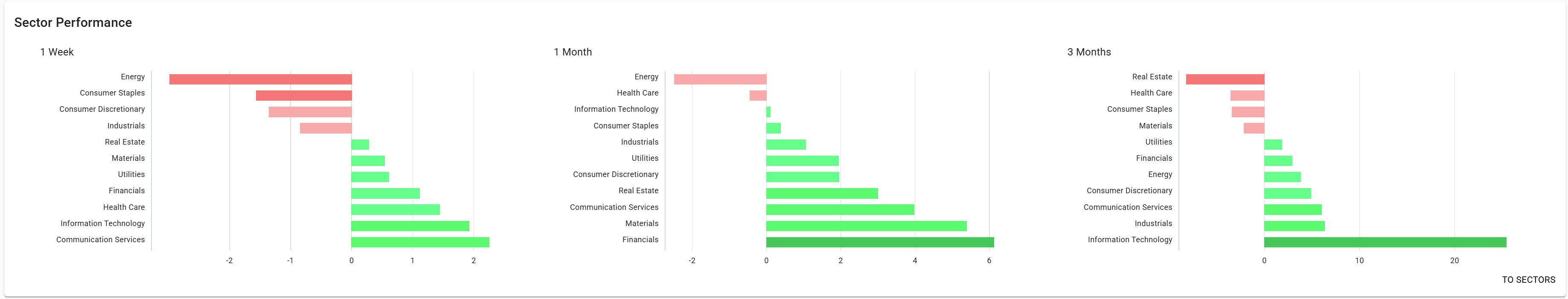

Sector Performance:

-

Over the past week, Energy, Consumer Staples, and Consumer Discretionary sectors showed weakness.

-

Industrials and Real Estate also underperformed.

-

Technology, Communication Services, and Health Care led the market.

-

Over three months, Real Estate and Health Care struggled, while Information Technology and Industrials performed well.

Market Breadth Indicators:

- Advancing vs. Declining stocks show mixed momentum.

- A higher percentage of stocks remain above key moving averages, indicating overall market strength.

- New highs outnumber new lows, confirming bullish momentum.

Key Takeaways

- Large caps (SPY, QQQ) remain strong, but small caps (IWM) are lagging.

- Technology continues to lead, while defensive sectors (Consumer Staples, Health Care) face pressure.

- Market breadth remains constructive, suggesting bullish conditions overall.

AMAZON.COM INC

NASDAQ:AMZN (2/7/2025, 9:56:10 AM)

233.69

-5.14 (-2.15%)

AMZN Latest News and Analysis

2 hours ago - ChartmillMarket Monitor February 6th

2 hours ago - ChartmillMarket Monitor February 6thMarket Recap: Wall Street Gains, Amazon Slips, and U.S. Job Growth Slows

20 hours ago - ChartmillMost active S&P500 stocks in Thursday's session

20 hours ago - ChartmillMost active S&P500 stocks in Thursday's sessionLet's have a look at what is happening on the US markets on Thursday. Below you can find the most active S&P500 stocks in today's session.

2 days ago - ChartmillMarket Monitor February 4th

2 days ago - ChartmillMarket Monitor February 4thWall Street: Spotify and Palantir Surge Higher, Alphabet’s Capital Spending Concerns Investors

3 days ago - ChartmillShould you consider NASDAQ:AMZN for high growth investing?

3 days ago - ChartmillShould you consider NASDAQ:AMZN for high growth investing?A fundamental and technical analysis of (NASDAQ:AMZN): Why AMAZON.COM INC (NASDAQ:AMZN) qualifies as a high growth stock.