Understanding Economic Cycles: Key Insights for Investors and Traders

By Kristoff De Turck - reviewed by Aldwin Keppens

~ 4 minutes read - Last update: Sep 19, 2024

Economic cycles, also known as business cycles, are fluctuations in economic activity over time, typically measured by changes in GDP, employment, and other key economic indicators.

These cycles are crucial for investors and traders because they influence market conditions, asset prices, and investment opportunities. Understanding these cycles can help in making informed decisions about when to buy or sell assets.

Economic Cycles

1. Expansion (Growth)

Description: The economy is growing, with rising GDP, increasing employment, and improving consumer confidence. Businesses invest in production, and consumers spend more, leading to higher corporate profits.

Market Impact: Stock markets tend to perform well during expansions as corporate earnings rise. Interest rates are generally low, encouraging borrowing and investment. Sectors like technology, consumer discretionary, and financials often perform well.

Investment Strategy: During expansion, investors typically favor equities over bonds, as stocks usually offer better returns. Growth stocks, which are expected to deliver above-average earnings, are often attractive.

Explore High Growth (Momentum) Trading Ideas in ChartMill

2. Peak

Description: The economy reaches the height of its expansion. Growth rates slow down, and signs of overheating, such as high inflation and labor shortages, may appear. Central banks may start raising interest rates to control inflation.

Market Impact: Stock markets may begin to show volatility as investors anticipate the end of the expansion. Bonds might become more attractive if interest rates rise. Inflation-resistant assets like commodities might gain favor.

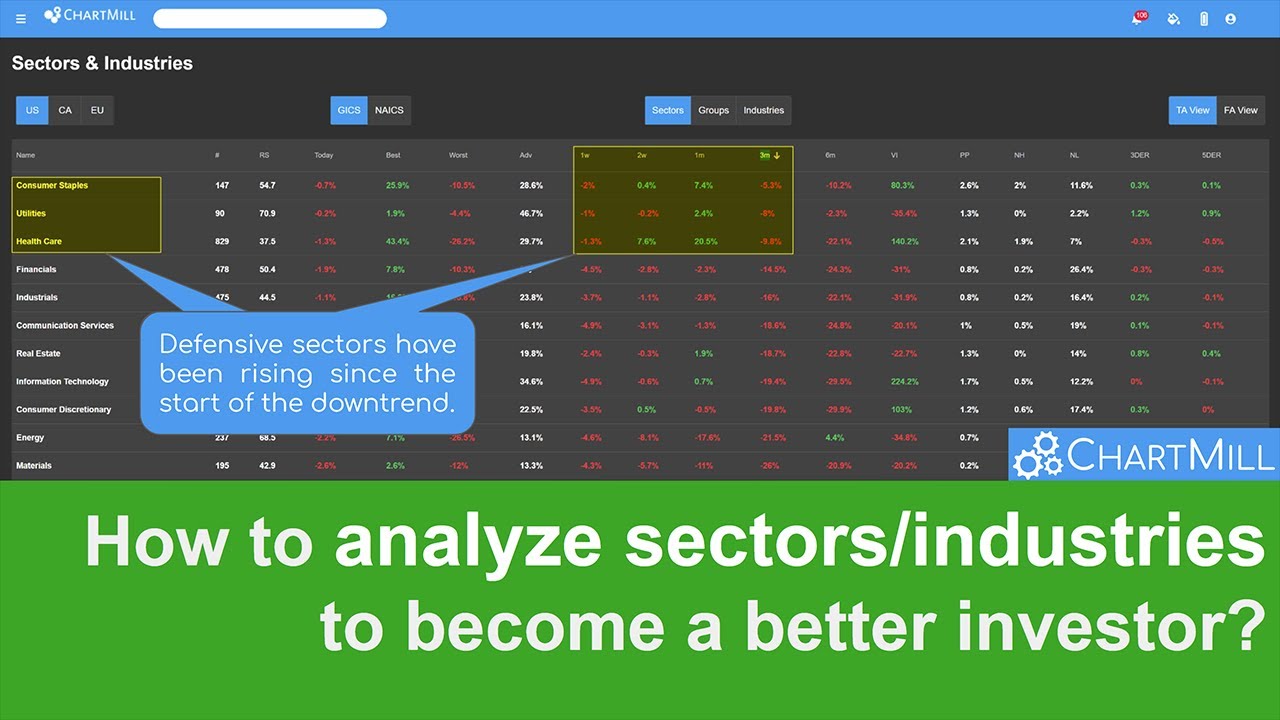

Investment Strategy: This is often a good time to rebalance portfolios, taking profits from high-performing assets and possibly increasing exposure to defensive sectors like utilities, healthcare, and consumer staples.

Utilities, Healthcare and Consumer Staples stocks in ChartMill (Market Cap at least $300M)

3. Contraction (Recession)

Description: Economic activity slows down, GDP contracts, unemployment rises, and consumer spending declines. This phase can be triggered by high interest rates, reduced consumer confidence, or external shocks like financial crises.

Market Impact: Stock markets typically decline during recessions, while bonds, especially government bonds, often perform well as investors seek safety. Defensive sectors may outperform, while cyclical sectors (e.g., industrials, consumer discretionary) tend to underperform.

Investment Strategy: During a recession, preserving capital becomes more important. Investors might shift to bonds, especially high-quality government or corporate bonds. Safe-haven assets like gold can also be attractive.

4. Trough

Description: The economy reaches its lowest point, marking the end of the recession. Economic indicators stabilize but remain weak. Central banks may lower interest rates and governments might introduce stimulus measures to kick-start growth.

Market Impact: This phase can offer some of the best buying opportunities, as asset prices are generally low. However, markets can be volatile, and it's challenging to predict the exact timing of a recovery.

Investment Strategy: Investors often start to accumulate assets with strong recovery potential, such as undervalued stocks or high-yield bonds. Risk tolerance should be carefully considered, as the timing of a recovery is uncertain.

Value Investing Trading Ideas in ChartMill

Causes of different stages in economic cycles

The different stages of economic cycles are driven by a complex interplay of factors. During expansion, the main driver is an increase in consumer and business confidence, leading to higher spending and investment. This phase is often fueled by low interest rates, which encourage borrowing and investment.

At its peak, economic growth reaches its limit, often due to rising inflation and labor market tightness, which can lead to higher costs for businesses. Central banks may respond by raising interest rates to cool the economy, inadvertently triggering the next phase.

Contraction or recession usually occurs when high interest rates, reduced consumer spending, or external shocks (such as financial crises or geopolitical events) lead to a decline in economic activity.

Business investment as well as consumer confidence decline, unemployment rises, creating a downward spiral. Finally, the trough marks the low point of the cycle, when the economy stabilizes but remains weak.

This phase is often driven by lower inflation, lower interest rates and government stimulus measures, which eventually lead to a recovery when businesses and consumers regain confidence, paving the way for a new expansion cycle.

Key Takeaways for Investors and Traders

Market Timing:

Understanding where the economy is in the cycle can help with timing investments. However, timing the market perfectly is challenging, and many investors prefer a long-term approach that smooths out these cycles.

Diversification:

A diversified portfolio can help manage risks associated with different stages of the cycle. For example, holding a mix of equities, bonds, and alternative assets can provide stability through economic fluctuations.

Sector Rotation:

Different sectors perform better at different stages of the cycle. Sector rotation strategies involve adjusting sector allocations to take advantage of these performance patterns. Economic cycles are a natural part of economic growth and contraction. While they can be unpredictable, understanding the typical characteristics of each phase can help investors and traders make more informed decisions.