The Bearish Harami Pattern | Definition

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Apr 19, 2024

Bearish Harami Candlestick Pattern Definition

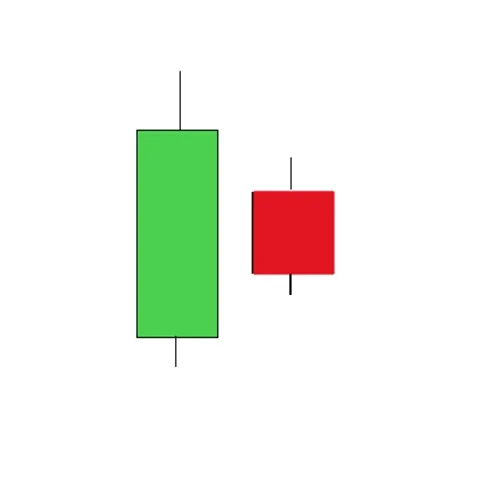

A Bearish Harami Candlestick Pattern is a pattern that indicates a top when it is preceded by a price increase. It is a two-candle bearish reversal pattern. The first candle has a relatively large green body (bullish) and the second one has a smaller red body (bearish) that’s contained within the body of the first candle. This is also known as an 'inside day' pattern. The upper and lower shadow lines of the second candle are short and should also fall within the body of the first candle.

This combination tells us a number of things :

- The opening price of the second candle is lower than the closing price of the first bullish candle, so the day starts with a gap down and sellers are gaining control.

- The rest of the trading session, buyers and sellers more or less keep each other in balance. A slightly negative closing price is a sign that sellers, after the initial gap down, have maintained control. However, there was not yet enough momentum to lower the price below the opening price of the previous day. As a result we see an 'inside candle'.

Just like the Bullish Harami pattern, a Bearish Harami pattern is a reversal pattern. It is an indication that the current existing upward trend (short or long term) is coming to an end and a negative trend reversal is imminent.

Please keep in mind that the pattern in itself is only an indication of a change of direction, but is by no means sufficient on its own to be used arbitrarily as an entry setup.

Bearish Harami Example

The chart above shows two nice bearish harami setups (red circles) but at least as important is the observation that there are other elements that support a short setup:

- The price may be up in the short term, the long term trend of the share remains bearish as the price is still beneath the 200-day moving average. A shortsetup therefore means that we will act in the direction of the long-term trend.

- The bearish harami patterns are at the level of the important 200SMA that serves as resistance.

These are two additional elements that support the pattern. I repeat, it's important to remember that just the specific candlestick pattern alone is never sufficient to base a trade decision on.