3 Reasons ZBRA is Risky and 1 Stock to Buy Instead

Provided By StockStory

Last update: Apr 4, 2025

The past six months haven’t been great for Zebra. It just made a new 52-week low of $237, and shareholders have lost 35.4% of their capital. This might have investors contemplating their next move.

Is now the time to buy Zebra, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Zebra. Here are three reasons why you should be careful with ZBRA and a stock we'd rather own.

Why Do We Think Zebra Will Underperform?

Taking its name from the black and white stripes of barcodes, Zebra Technologies (NASDAQ:ZBRA) provides barcode scanners, mobile computers, RFID systems, and other data capture technologies that help businesses track assets and optimize operations.

1. Core Business Falling Behind as Demand Declines

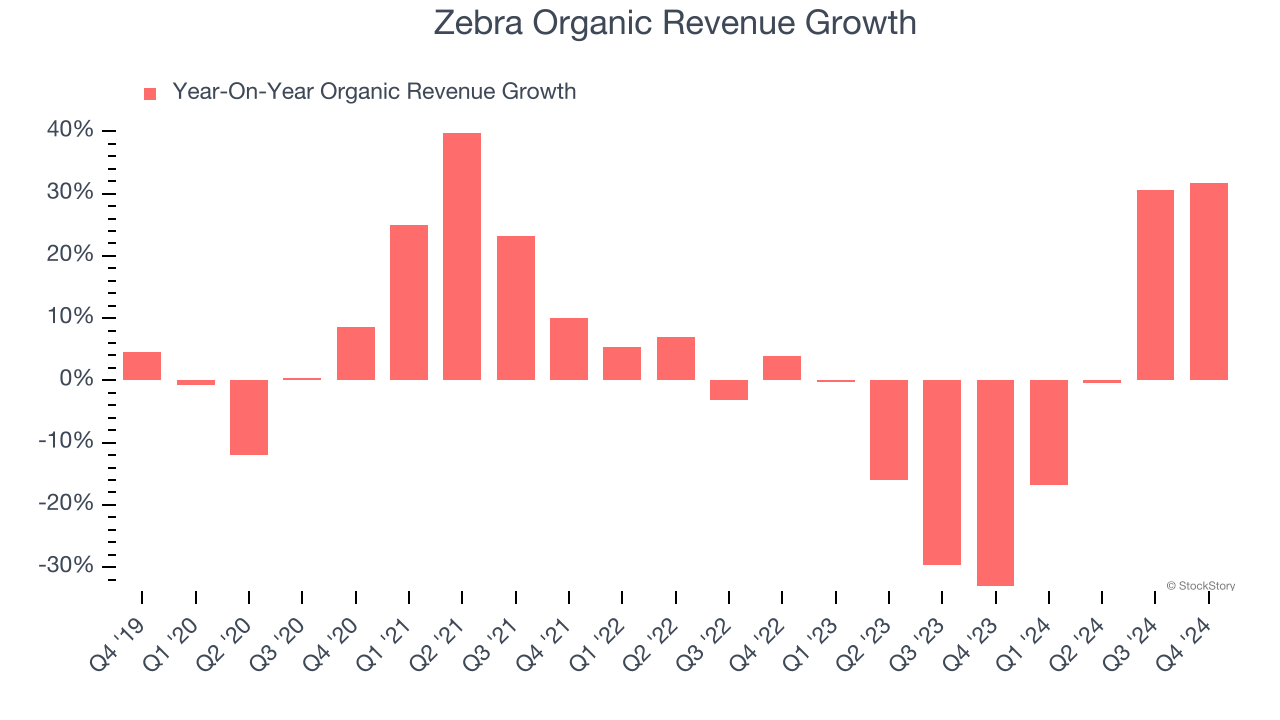

In addition to reported revenue, organic revenue is a useful data point for analyzing Specialized Technology companies. This metric gives visibility into Zebra’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Zebra’s organic revenue averaged 4.2% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Zebra might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Growth Has Stalled

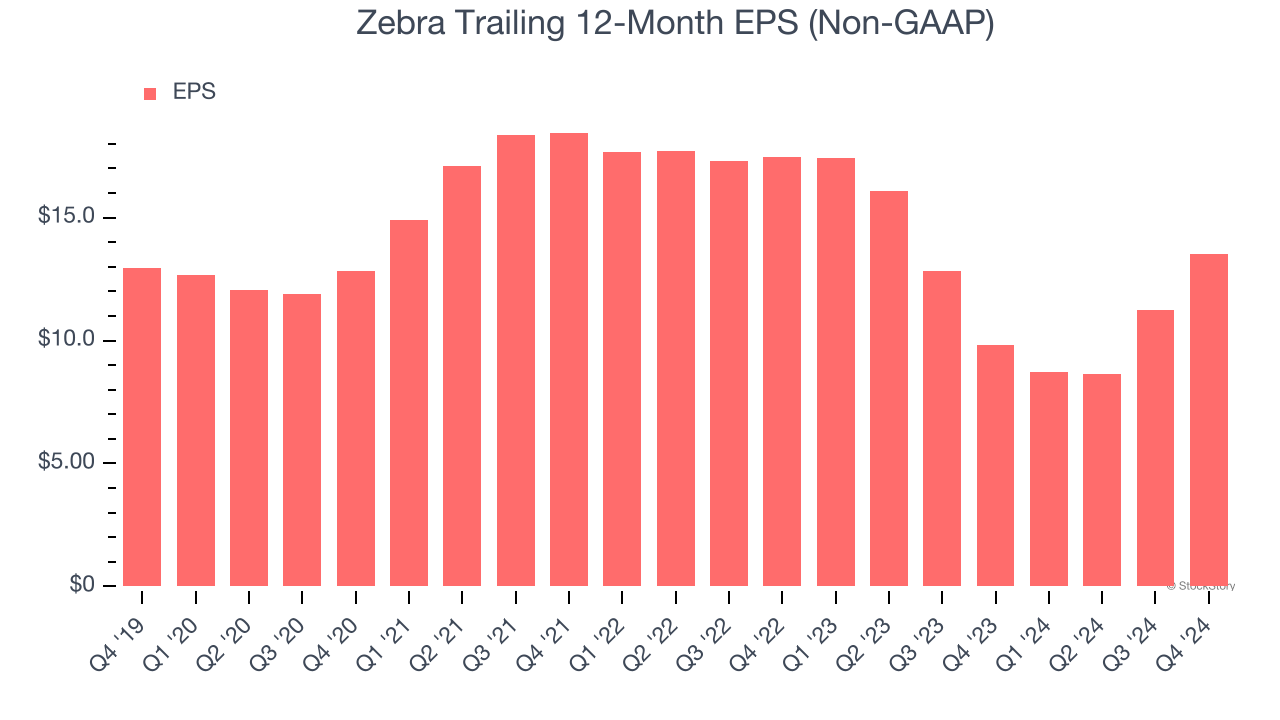

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Zebra’s flat EPS over the last five years was below its 2.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

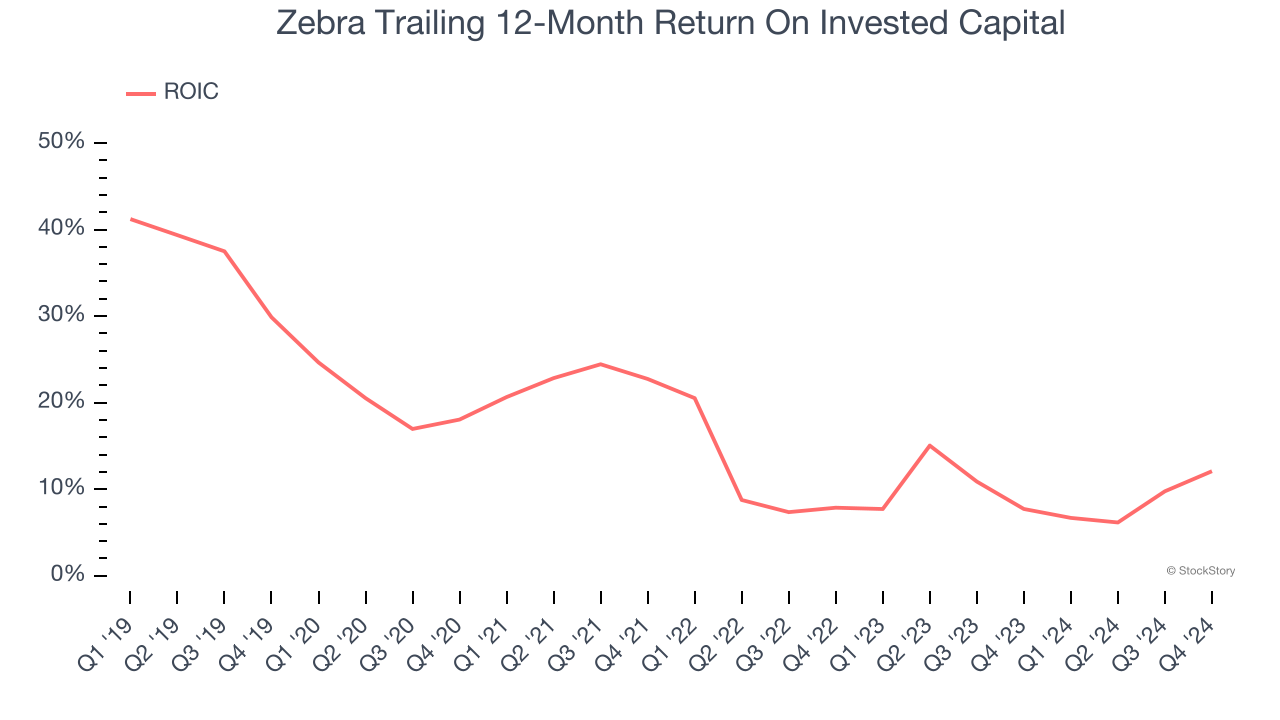

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Zebra’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of Zebra, we’re out. After the recent drawdown, the stock trades at 14.9× forward price-to-earnings (or $237 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Zebra

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

227.2

+5.15 (+2.32%)

368.45

+5.76 (+1.59%)

Find more stocks in the Stock Screener

ZBRA Latest News and Analysis

16 days ago - ChartmillGet insights into the top movers in the S&P500 index of Monday's pre-market session.

16 days ago - ChartmillGet insights into the top movers in the S&P500 index of Monday's pre-market session.Let's have a look at what is happening on the US markets before the opening bell on Monday. Below you can find the top S&P500 gainers and losers in today's pre-market session.

20 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.

20 days ago - ChartmillUncover the latest developments among S&P500 stocks in today's session.Stay updated with the movement of S&P500 stocks in today's session. Discover which S&P500 stocks are making waves on Thursday.

20 days ago - ChartmillThursday's session: top gainers and losers in the S&P500 index

20 days ago - ChartmillThursday's session: top gainers and losers in the S&P500 indexStay informed about the performance of the S&P500 index in the middle of the day on Thursday. Uncover the top gainers and losers in today's session for valuable insights.